Your Complete Guide To Municipal Bonds Credit Appraisals

Your Complete Guide To Municipal Bonds Credit Appraisals Municipal bonds are securities issued by local governments or by other governments to finance capital projects such as constructing highways or sewers. due to this reason, the investor does not have to pay tax on interest payments. according to statistics, the municipal bond market is worth $3.8 trillion. this makes municipal bonds attractive. A municipal bond is a debt security issued by a state or municipality to fund public works. the first official municipal bond on record was issued by new york city in 1812 to pay for the digging.

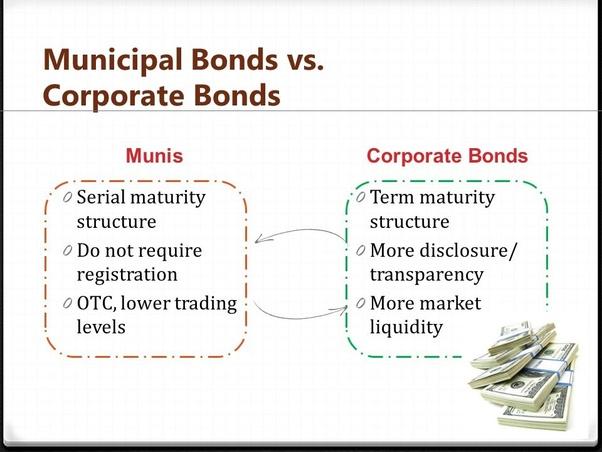

Your Complete Guide To Municipal Bonds Credit Appraisals For example, if you invest $5,000 in a 10 year municipal bond paying 5% interest, you've loaned $5,000 for 10 years. in return, the municipality will pay you $250 annually in interest typically. When you purchase and hold an individual bond, you get your principal back when the bond matures. some muni bonds mature in one to three years, while others mature in 20 or 30. Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds. nevertheless, municipal. Municipal bonds, also known as munis, are debt securities usually issued by state and local governments to fund public projects. investors purchase these bonds, effectively lending money to the government, and receive interest payments and the bonds face value at maturity. munis are generally favored by investors for their potential tax.

Comments are closed.