Why Is Loan Servicing So Bad The Mortgage Professor 1

Why Is Loan Servicing So Bad The Mortgage Professor 1 Youtube The department of housing and urban development (hud) reports that two of every five complaints they receive from borrowers involve loan servicing issues. j . Why mortgage servicing is bad. the problem is that the financial incentives to provide good service, which work in other sectors of our economy, don’t work for loan servicing. a house painter, for example, is constantly under pressure to perform well. if he doesn’t have good references from previous clients, you won’t hire him.

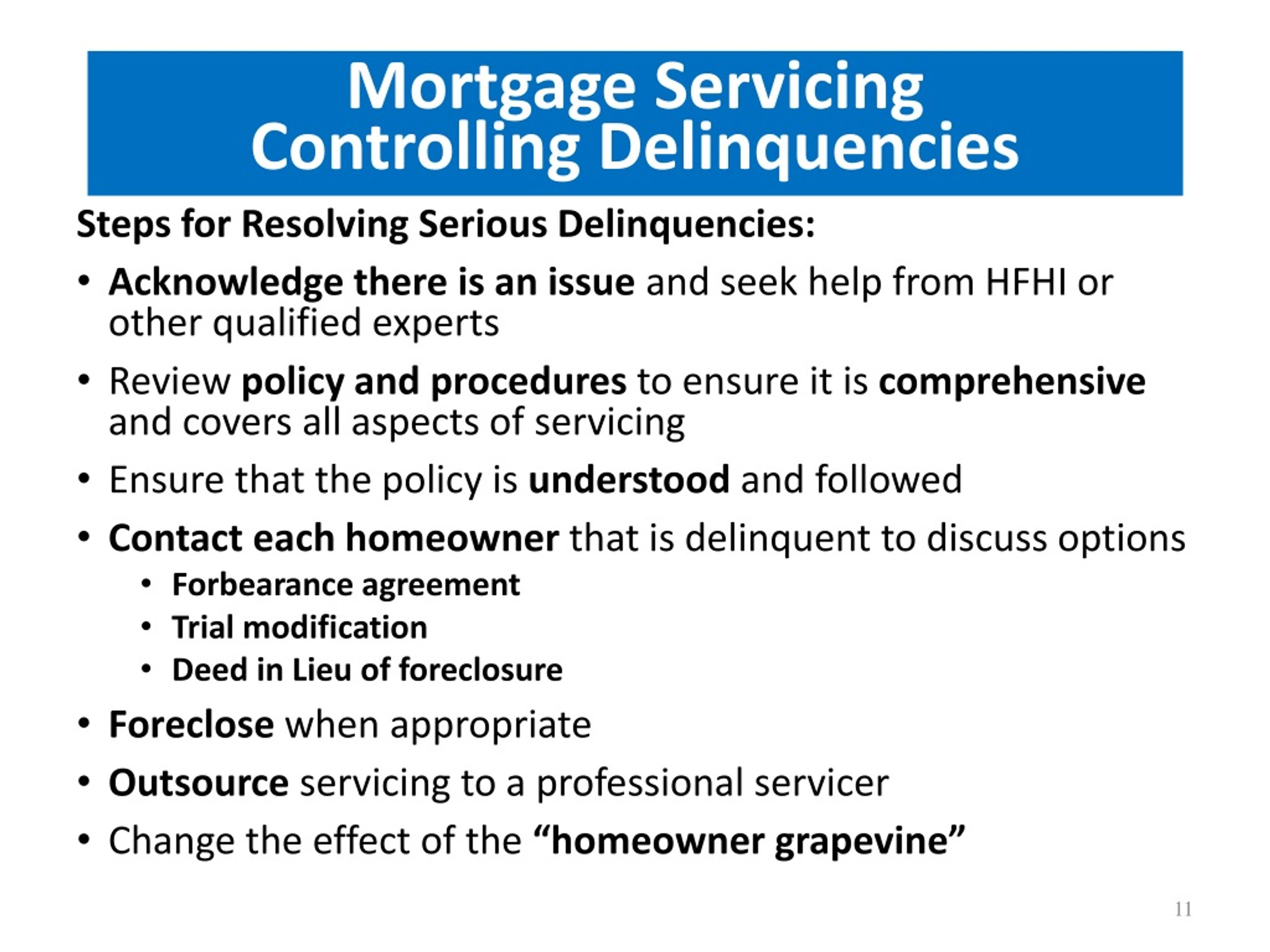

Ppt The Mortgage Process Servicing Powerpoint Presentation Free Loan servicing is when a third party manages your loan on behalf of the lender. it’s common for a lender to transfer servicing rights to a loan servicer to issue statements, collect monthly. So if you want to increase the odds of having a positive experience with a mortgage servicing company, start by getting rate quotes from well known, highly rated lenders. also, don’t be afraid. Sometimes mortgage servicers engage in outright deceptions or abuse. they may improperly charge late fees to a homeowner, tack on inappropriate foreclosure costs, or impose other invalid fees related to a homeowner falling behind on payments or facing foreclosure. even if the fee itself is legitimate, you may have grounds to challenge the. Mortgage servicing is the act of administering your mortgage from the time your loan closes until it’s paid off. it’s the job of the servicer to collect your payment and forward it to the investors in your mortgage. if you have an escrow account for real estate taxes, homeowners’ insurance and (if applicable) mortgage insurance, they also.

Loan Servicing How Does Loan Servicing Work With Example Sometimes mortgage servicers engage in outright deceptions or abuse. they may improperly charge late fees to a homeowner, tack on inappropriate foreclosure costs, or impose other invalid fees related to a homeowner falling behind on payments or facing foreclosure. even if the fee itself is legitimate, you may have grounds to challenge the. Mortgage servicing is the act of administering your mortgage from the time your loan closes until it’s paid off. it’s the job of the servicer to collect your payment and forward it to the investors in your mortgage. if you have an escrow account for real estate taxes, homeowners’ insurance and (if applicable) mortgage insurance, they also. A mortgage servicer can be a major bank, community bank, credit union or other financial institution that specializes in loan servicing: collecting payments and handling customer service on a. As origination profits wane, many lenders are winning the fight with positive revenue due to the increased valuation of their servicing book. the strategy of creating a counter cyclical business model has been a successful plan to smooth the ups and downs of the mortgage market, with the last decade seeing a broad expansion of lenders playing in this space. < p><p>those with a history in.

Comments are closed.