Why Do Mutual Funds Hold More Cash Shorts

Why Should You Invest In Mutual Funds Shorts Youtube Why do mutual funds hold more cash? #shorts subscribe to groww mutual fund channel : bit.ly 2fx57wjra disclaimer link groww.in p sebi resear. The mutual fund cash level is the total percentage of a mutual fund's assets in cash. most mutual funds keep approximately 5% of the portfolio in cash and equivalents. funds that actively use.

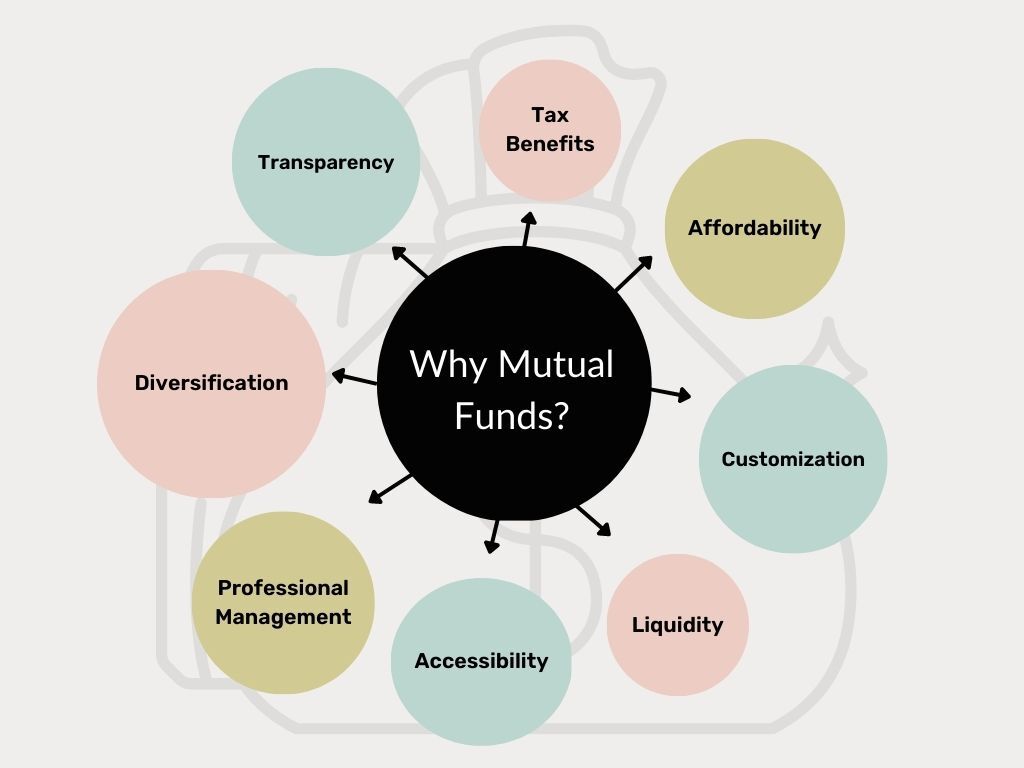

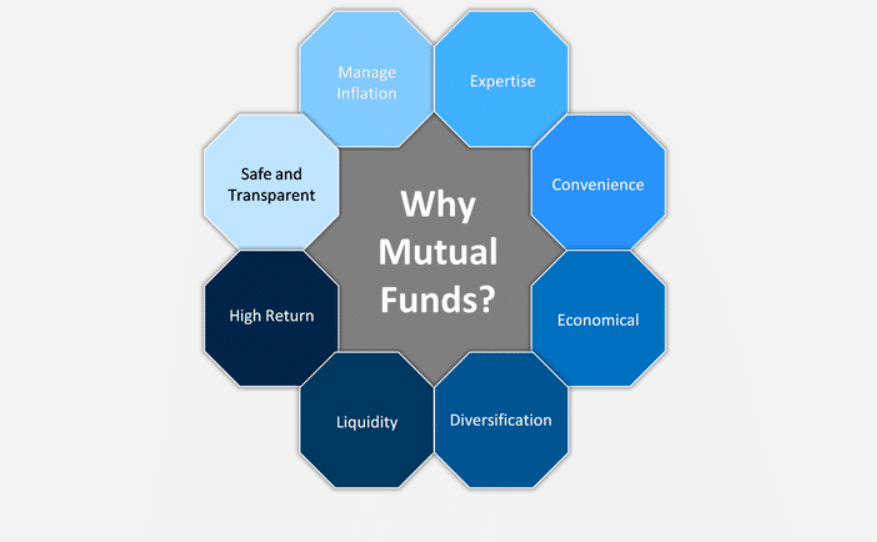

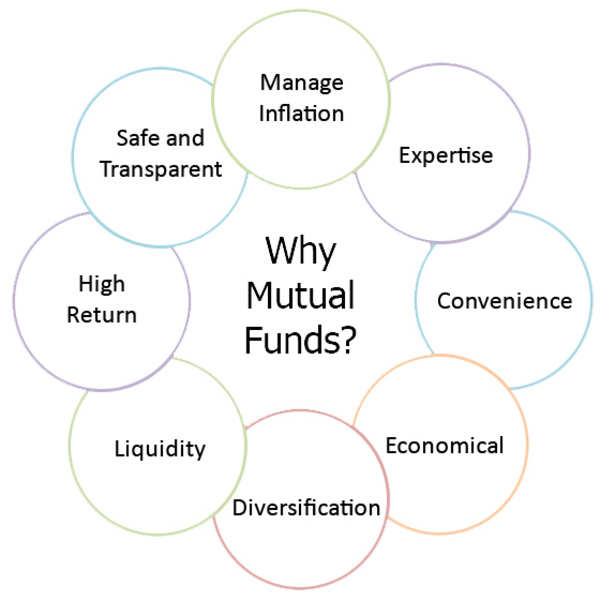

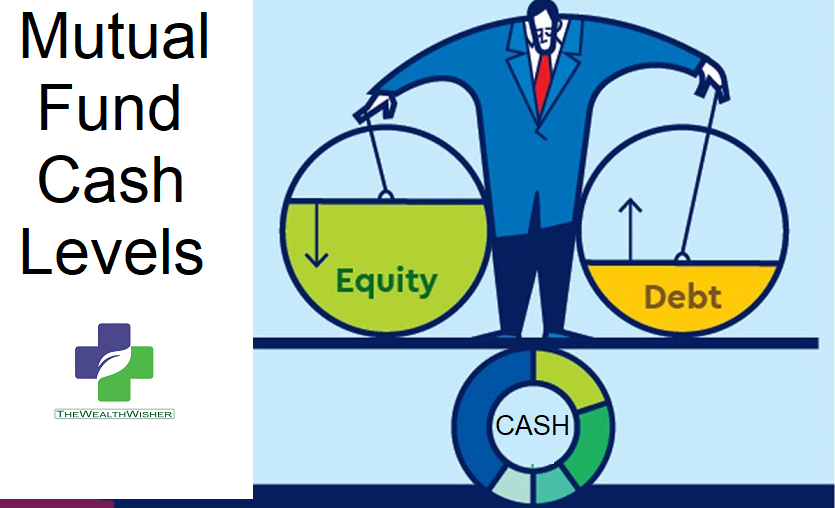

The A Z Of Mutual Funds A Simple Explainer Mprofit Mutual fund cash levels provide insights into fund managers’ market outlook and operational strategies. higher cash levels may indicate caution or bearish sentiment, while lower levels suggest confidence or bullishness. understanding cash levels can help investors assess fund liquidity, risk management practices, and potential investment returns. American mutual’s managers started increasing their cash allocation in 2022. the fund began the year with 4.6% of its portfolio in cash and ended 2022 with nearly 10% in cash. over the past five. So, buying and selling of mutual funds for trading purposes is an investment mistake, which investors need to avoid as much as possible. a mutual fund can never give returns equivalent to a stock. A mutual fund is a convenient and simple way for investors to help diversify their investments at generally low cost, but it takes a fair degree of complexity to deliver such a simple solution. here are six things to know about how mutual funds work, including how they make money, how they're priced, and what they cost. 1. how mutual funds invest.

Mutual Funds How And Why To Invest In Them Investdale So, buying and selling of mutual funds for trading purposes is an investment mistake, which investors need to avoid as much as possible. a mutual fund can never give returns equivalent to a stock. A mutual fund is a convenient and simple way for investors to help diversify their investments at generally low cost, but it takes a fair degree of complexity to deliver such a simple solution. here are six things to know about how mutual funds work, including how they make money, how they're priced, and what they cost. 1. how mutual funds invest. Xuemin (sterling) yan*. in this article, i examine the determinants and implications of equity mutual fund cash holdings. in cross sectional tests, i find evidence generally supportive of a static trade off model developed in this article. in particular, small cap funds and funds with more volatile fund flows hold more cash. Mutual funds are not traded freely on the open market as stocks and etfs are. nevertheless, they are easy to purchase directly from the financial company that manages the fund. they also can be.

Mutual Funds Why Should You Invest In Mutual Funds Mutual Fun Xuemin (sterling) yan*. in this article, i examine the determinants and implications of equity mutual fund cash holdings. in cross sectional tests, i find evidence generally supportive of a static trade off model developed in this article. in particular, small cap funds and funds with more volatile fund flows hold more cash. Mutual funds are not traded freely on the open market as stocks and etfs are. nevertheless, they are easy to purchase directly from the financial company that manages the fund. they also can be.

Why Mutual Funds Have Cash In Portfolio Thewealthwisher Tw2

Comments are closed.