What The Fed Rate Cut Means For Auto Loans

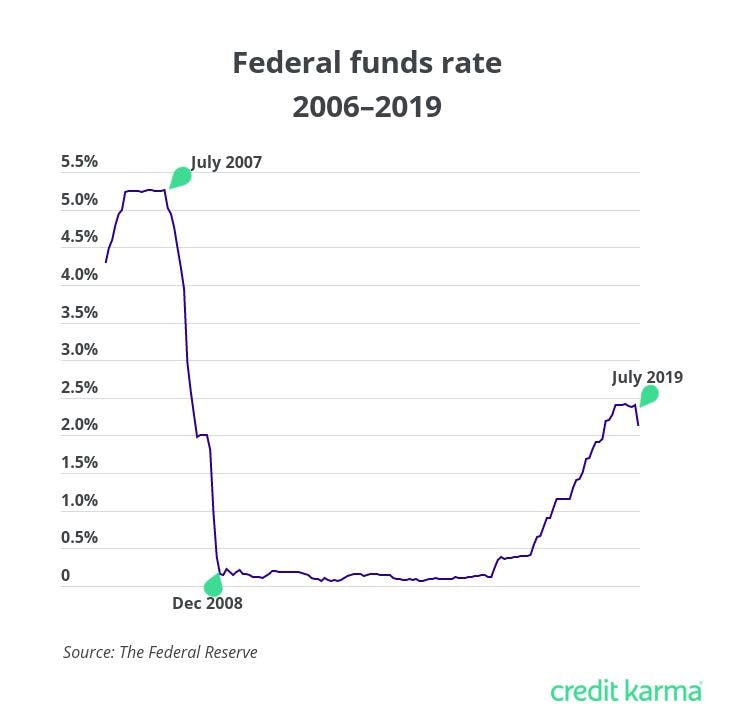

Fed Cuts Interest Rate For Second Time In 2019 What This Means The fed is also likely to make further cuts. with yesterday’s decision, the board issued “dot plots” – non binding predictions of its plans – that show 2.5 points worth of cuts in total. The average auto loan interest rate in the second quarter of 2024 was 6.84% for a new car, according to experian's state of the automotive finance market report, and 12.01% for a used car. that's.

юааwhat The Fedюабтащs Near Zero юааratesюаб юааmeansюаб For You Wsj Updated 11:12 am pdt, september 18, 2024. new york (ap) — the federal reserve has cut its benchmark interest rate from its 23 year high, with consequences for debt, savings, auto loans, mortgages and other forms of borrowing by consumers and businesses. on wednesday, the fed announced that it reduced its key rate by an unusually large half. More: some auto lease deals give consumers a way to save $200 or so on monthly car payments. the short term federal funds rate is currently in the 5.25% to 5.5% range — and a series of rate cuts. The average rate on new car loans was 7.1 percent in august, according to edmunds, a car shopping website, down slightly from 7.4 percent in the same month in 2023 and up from 5.7 percent in 2022. The average rate on a new car loan last month was 7.1 percent, down from 7.4 a year ago but up from 5.7 in 2022, according to edmunds, an auto shopping website. auto loans rates are not tied.

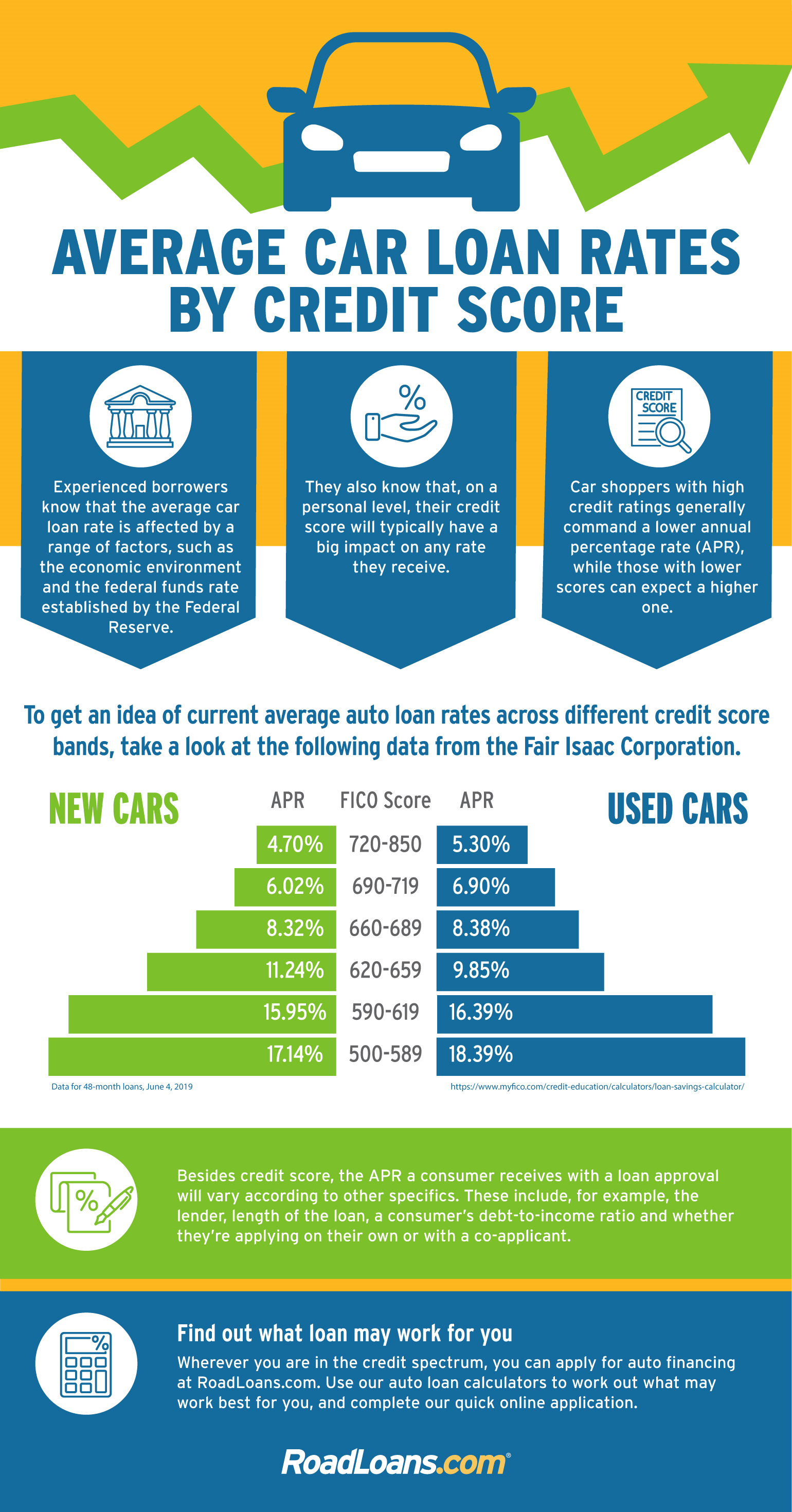

Check Out Average Auto Loan Rates According To Credit Score Roadloans The average rate on new car loans was 7.1 percent in august, according to edmunds, a car shopping website, down slightly from 7.4 percent in the same month in 2023 and up from 5.7 percent in 2022. The average rate on a new car loan last month was 7.1 percent, down from 7.4 a year ago but up from 5.7 in 2022, according to edmunds, an auto shopping website. auto loans rates are not tied. Consumer loans will get cheaper with lower fed rates, including auto loans, which sit now at their most expensive rate since 2001, up from 2021’s sub 5% rate for new car loans to about 8.7%. The first rate cut in years will affect many types of consumer products. here's what it means for credit cards, mortgage rates, auto loans and savings accounts.

Comments are closed.