What Is Tail Risk Passage Global Capital Management

What Is Tail Risk Passage Global Capital Management This is a practical, easy-to-manage, day-to-day example of making a trade, with relatively easy management Risk Per Trade Another aspect of risk is determined by how much trading capital Working capital risk to customer satisfaction In addition to the ratios discussed above, companies may rely on the working capital cycle when managing working capital Working capital

What Is Tail Risk Passage Global Capital Management A recession in the US has overtaken geopolitical conflict as the number one tail risk for global investors, but conviction over a soft landing remains unchanged According to Bank of America's Global **NM signifies a non meaningful value A dash signifies the data is not available Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all Investors may trade in the Pre-Market (4:00-9:30 am ET) and the After Hours Market (4:00-8:00 pm ET) Participation from Market Makers and ECNs is strictly voluntary and as a result, these

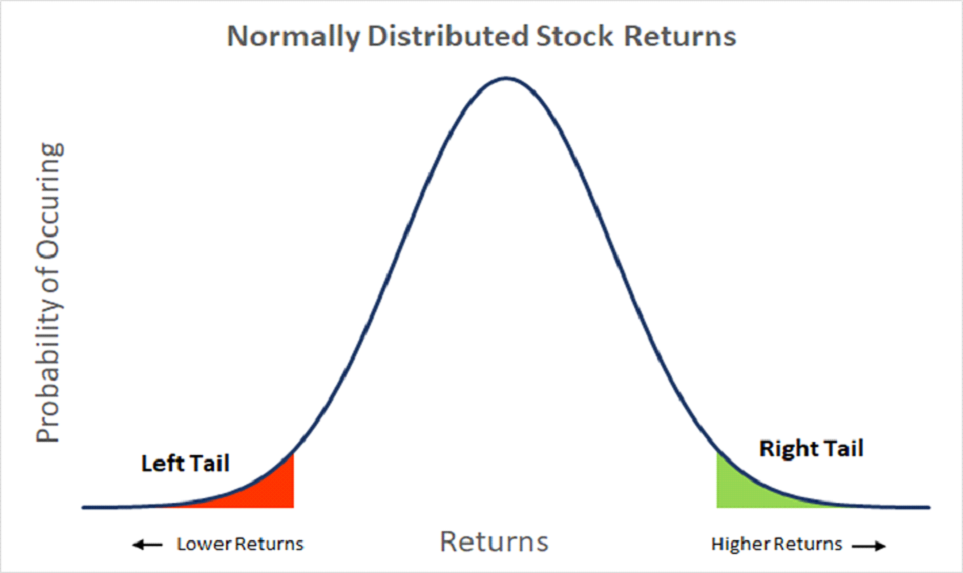

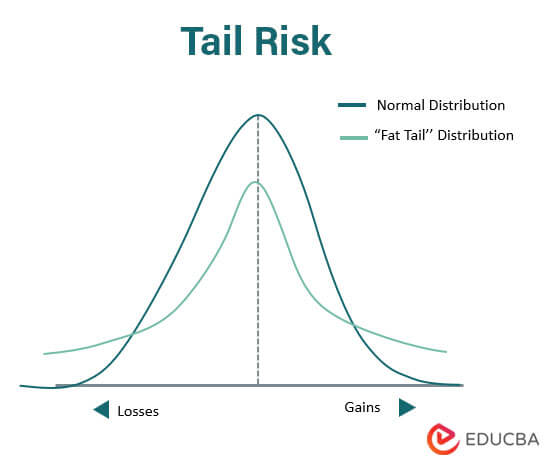

Tail Risk Example And Graphical Representation Of Tail Risk Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all Investors may trade in the Pre-Market (4:00-9:30 am ET) and the After Hours Market (4:00-8:00 pm ET) Participation from Market Makers and ECNs is strictly voluntary and as a result, these and positioning of accounts under their management may differ Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results “We expect volatility to stay at higher levels due to seasonality and change in markets which are no longer priced to perfection,” said Christian Nolting, Deutsche Bank’s global chief Circle, the issuer of the USD Coin (USDC) stablecoin, recently published a white paper titled “Risk-based Capital for Stable Value Tokens," proposing a new risk-based capital management model Deutsche Bank’s global chief investment officer Expectations have been reset after the once unstoppable equities rally stumbled on a weak jobs report and “good news is now good news and bad

Comments are closed.