What Is Overdraft Protection And How Does It Impact Your Credit

What Is Overdraft Protection And How Does It Impact Your Credit How an overdraft may impact your credit . there is one instance in which an overdraft can hurt your credit: if it's sent to collections. if you pay the fees and negative balance after an overdraft, you'll be fine. but if you don't pay back what you owe, the financial institution can send that debt to collections. Overdraft lines of credit. an overdraft line of credit functions like a credit card — but without the card. if you don’t have enough money in your account to cover a transaction, your bank.

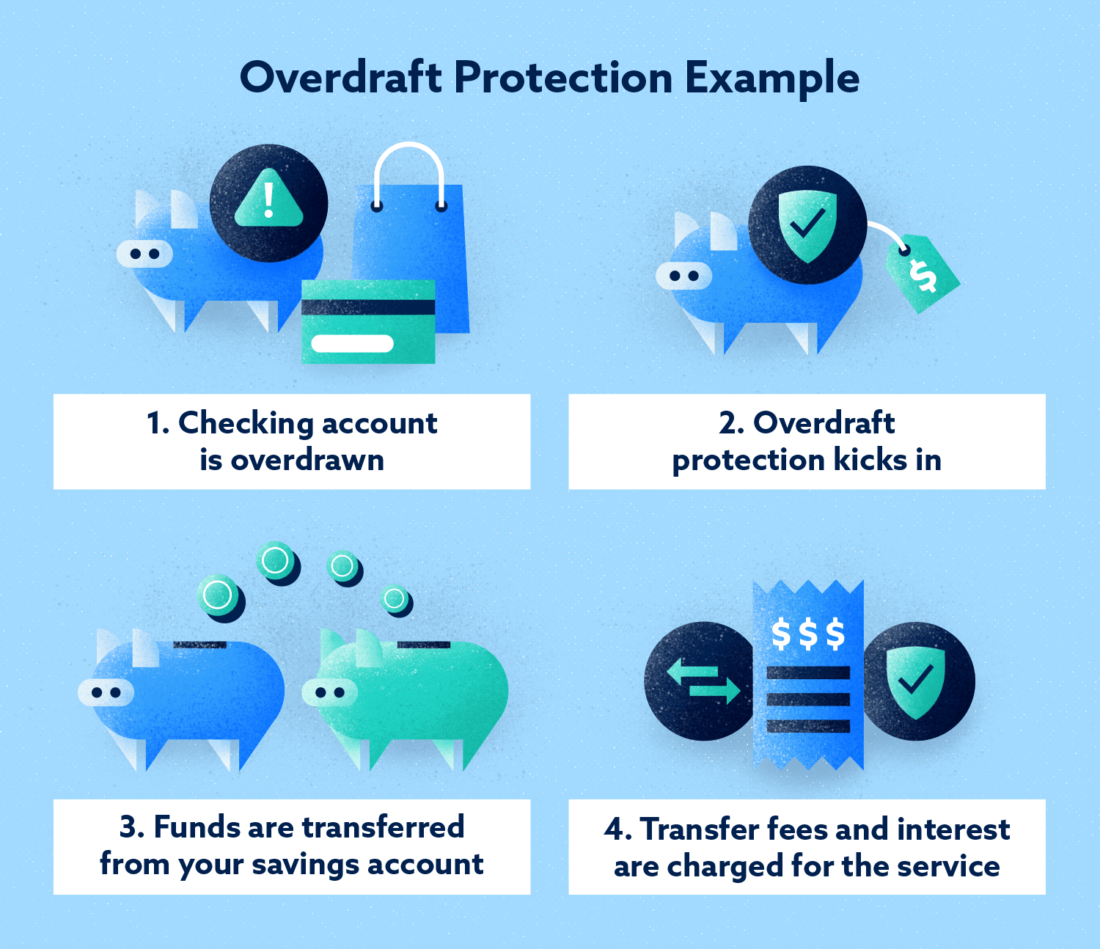

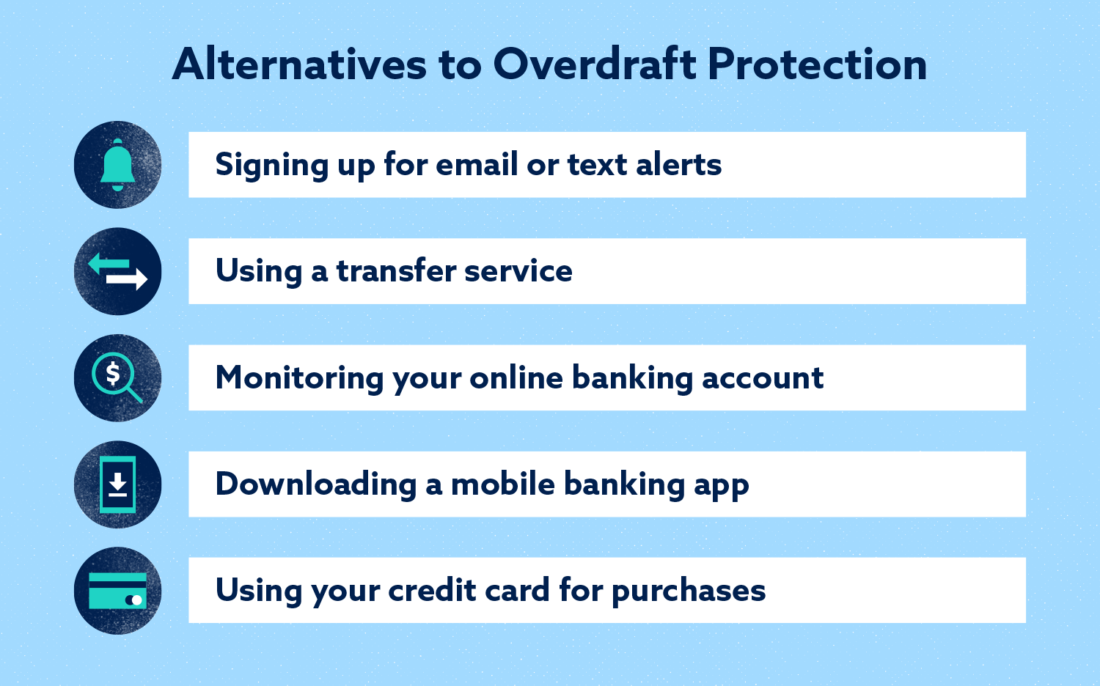

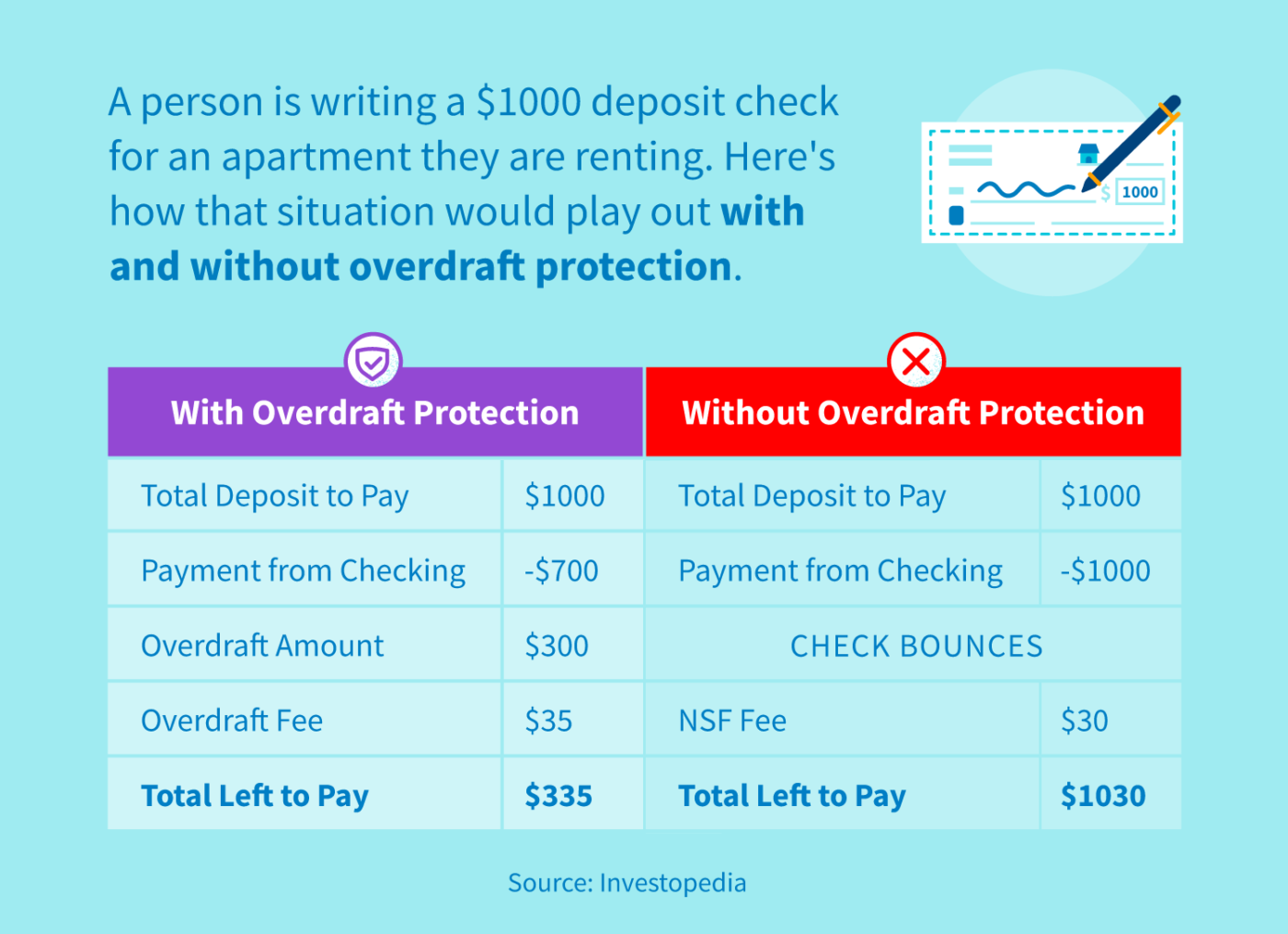

What Is Overdraft Protection And How Does It Impact Your Credit Overdrafts don’t usually affect your credit scores unless you don’t resolve them quickly and the account goes into collections. checking accounts aren’t included in your credit reports from the three major credit bureaus, but they could be included in your chexsystems report. if your bank offers overdraft protection and you opt for it. Overdraft protection is an optional service that prevents charges to a bank account (primarily checks, atm transactions, debit card charges) from being rejected when they exceed the available. An overdraft is when you don’t have enough money in your checking account to pay for a purchase, but your bank or credit union covers the payment anyway. when that happens, the bank often charges you a fee and makes you pay back the overdrafted amount — this is overdraft protection. let’s face it — anyone can make an honest mistake. Overdraft protection is a service offered by banks and credit unions that allows customers to avoid declined transactions and other penalties when they try to spend more money than they have in their checking accounts. with overdraft protection, if you try to make a purchase or withdraw cash that exceeds your available balance, the bank will.

Overdraft Protection Creditrepair An overdraft is when you don’t have enough money in your checking account to pay for a purchase, but your bank or credit union covers the payment anyway. when that happens, the bank often charges you a fee and makes you pay back the overdrafted amount — this is overdraft protection. let’s face it — anyone can make an honest mistake. Overdraft protection is a service offered by banks and credit unions that allows customers to avoid declined transactions and other penalties when they try to spend more money than they have in their checking accounts. with overdraft protection, if you try to make a purchase or withdraw cash that exceeds your available balance, the bank will. Fortunately, an overdraft typically won’t have a direct impact on your credit score. if you overspend and face an overdraft, it won’t show up on your credit report. however, if you don’t repay what you owe and the overdraft ends up getting sent to collections, then this could show up on your credit report, and may negatively impact your. Using an unarranged overdraft can hurt your credit score. if you go over an arranged overdraft limit or stay in an unarranged overdraft for a long period of time, your bank may report it to the.

/what-does-overdraft-protection-mean-for-your-credit-960738-final-b393f72c0de549e89fd867ee40b1a46c.jpg)

What Does Overdraft Protection Mean For Your Credit Fortunately, an overdraft typically won’t have a direct impact on your credit score. if you overspend and face an overdraft, it won’t show up on your credit report. however, if you don’t repay what you owe and the overdraft ends up getting sent to collections, then this could show up on your credit report, and may negatively impact your. Using an unarranged overdraft can hurt your credit score. if you go over an arranged overdraft limit or stay in an unarranged overdraft for a long period of time, your bank may report it to the.

Comments are closed.