What Is Equity Release Or A Lifetime Mortgage

Equity Release вђ Lifetime Mortgage Article 3 Confused The Key The most common type of equity release is a lifetime mortgage. as with a traditional mortgage, a lifetime mortgage is a loan against the value of the property. the older the homeowner is and the greater the value of the property, the larger the sum that can be borrowed. Defined as a type of equity release, a lifetime mortgage enables homeowners aged 55 and above to access a portion of the equity tied up in their property, without the need to sell or vacate their.

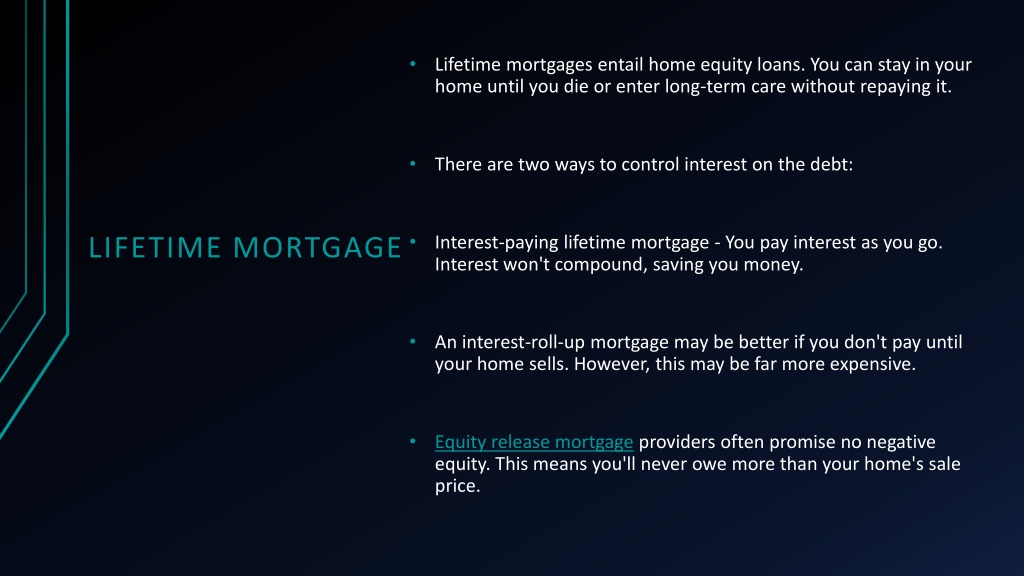

What Is A Lifetime Mortgage Equity Release Explained Youtube A lifetime mortgage is an "equity release" arrangement, primarily in the u.k., that allows homeowners to withdraw equity from their home while continuing to live in it. the borrowed amount must be. Equity release. home reversion, or equity release, is when you sell a part of your home to a provider in return for a lump sum or regular payments. typically you can receive 30 60% of the value of your home. you may want the money for renovations, a holiday or to pay off debts. there is often a minimum age for these plans which is usually 65. Most people using an equity release scheme choose a lifetime mortgage. a lifetime mortgage allows you to access money that is locked in to the value of your property. a lifetime mortgage can be useful for people who need access to the wealth stored in their property immediately and is an alternative to selling a family home to access funds. Lifetime mortgages are the most popular type of equity release plan. they work by giving homeowners access to some of the value, or ‘equity’, tied up in their property. unlike a conventional mortgage, which runs for a fixed term, a lifetime mortgage is designed to run for the rest of your life. during this period, the property remains 100.

What Is Equity Release How Lifetime Mortgages Work Aviva Most people using an equity release scheme choose a lifetime mortgage. a lifetime mortgage allows you to access money that is locked in to the value of your property. a lifetime mortgage can be useful for people who need access to the wealth stored in their property immediately and is an alternative to selling a family home to access funds. Lifetime mortgages are the most popular type of equity release plan. they work by giving homeowners access to some of the value, or ‘equity’, tied up in their property. unlike a conventional mortgage, which runs for a fixed term, a lifetime mortgage is designed to run for the rest of your life. during this period, the property remains 100. Equity release is a type of loan that allows older borrowers to access some of the money tied up in their property. there are different types, like a lifetime mortgage or a home reversion plan. Before applying for a lifetime mortgage or home reversion plan, you'll first need to seek advice from a qualified equity release adviser. this is a requirement of the financial conduct authority. a qualified advisor will be able to compare equity release deals from across the market.

Ppt What Is Equity Release Powerpoint Presentation Free Download Equity release is a type of loan that allows older borrowers to access some of the money tied up in their property. there are different types, like a lifetime mortgage or a home reversion plan. Before applying for a lifetime mortgage or home reversion plan, you'll first need to seek advice from a qualified equity release adviser. this is a requirement of the financial conduct authority. a qualified advisor will be able to compare equity release deals from across the market.

Comments are closed.