What Is Derivatives Market Its Functions How To Trade In Derivative

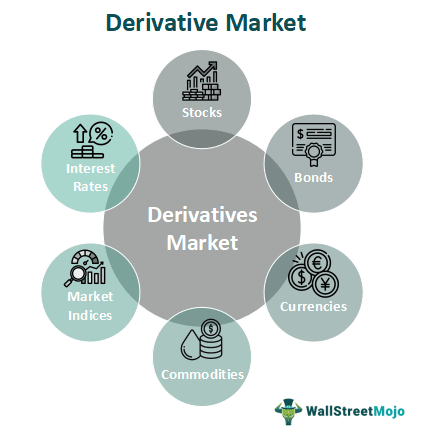

Derivatives Market What Is It Types Importance Advantages A derivative is set between two or more parties that can trade on an exchange or over the counter (otc). these contracts can be used to trade any number of assets and carry their own risks. prices. A derivatives market is a financial marketplace where derivatives like futures and options are traded consists of financial instruments that are used for hedging purposes or for speculation by both individual as well as institutional investors. based on trading motives, the major players in this market are hedgers, arbitrageurs, margin traders.

What Is Derivatives Trading Meaning Types Advantages Century Key highlights. derivatives are powerful financial contracts whose value is linked to the value or performance of an underlying asset or instrument and take the form of simple and more complicated versions of options, futures, forwards and swaps. users of derivatives include hedgers, arbitrageurs, speculators and margin traders. Derivatives can be traded in two distinct ways. the first is over the counter (otc) derivatives, that see the terms of the contract privately negotiated between the parties involved (a non standardised contract) in an unregulated market. the second way to trade derivatives is through a regulated exchange that offers standardised contracts. A derivative is a security whose underlying asset dictates its pricing, risk, and basic term structure. investors use derivatives to hedge a position, increase leverage, or speculate on an asset's. Pros of derivatives trading. risk management: derivatives enable traders to hedge against market fluctuations, reducing potential losses. through strategies like options or futures contracts, traders can protect portfolios from adverse movements in prices, currencies, or interest rates. leverage and amplified returns: derivatives allow traders.

What Is Derivatives Market Its Functions How To Trade In Derivative A derivative is a security whose underlying asset dictates its pricing, risk, and basic term structure. investors use derivatives to hedge a position, increase leverage, or speculate on an asset's. Pros of derivatives trading. risk management: derivatives enable traders to hedge against market fluctuations, reducing potential losses. through strategies like options or futures contracts, traders can protect portfolios from adverse movements in prices, currencies, or interest rates. leverage and amplified returns: derivatives allow traders. A derivatives market is a financial marketplace where financial instruments, such as options and futures, and other derivative instruments are traded. different types of investors take part in this market with varying objectives. for instance, some want to earn a profit, some speculate, while some enter the market to hedge their risk. Pros of derivatives. hoang says that derivatives generally have a lower purchase price than the underlying assets they control. options contracts, for example, are usually cheaper than the stock.

What Is Derivatives How Do They Work A Beginners Guide A derivatives market is a financial marketplace where financial instruments, such as options and futures, and other derivative instruments are traded. different types of investors take part in this market with varying objectives. for instance, some want to earn a profit, some speculate, while some enter the market to hedge their risk. Pros of derivatives. hoang says that derivatives generally have a lower purchase price than the underlying assets they control. options contracts, for example, are usually cheaper than the stock.

Comments are closed.