What Are The Rules For Doing A 1031 Exchange Prevail Innovative Wealth Strategies

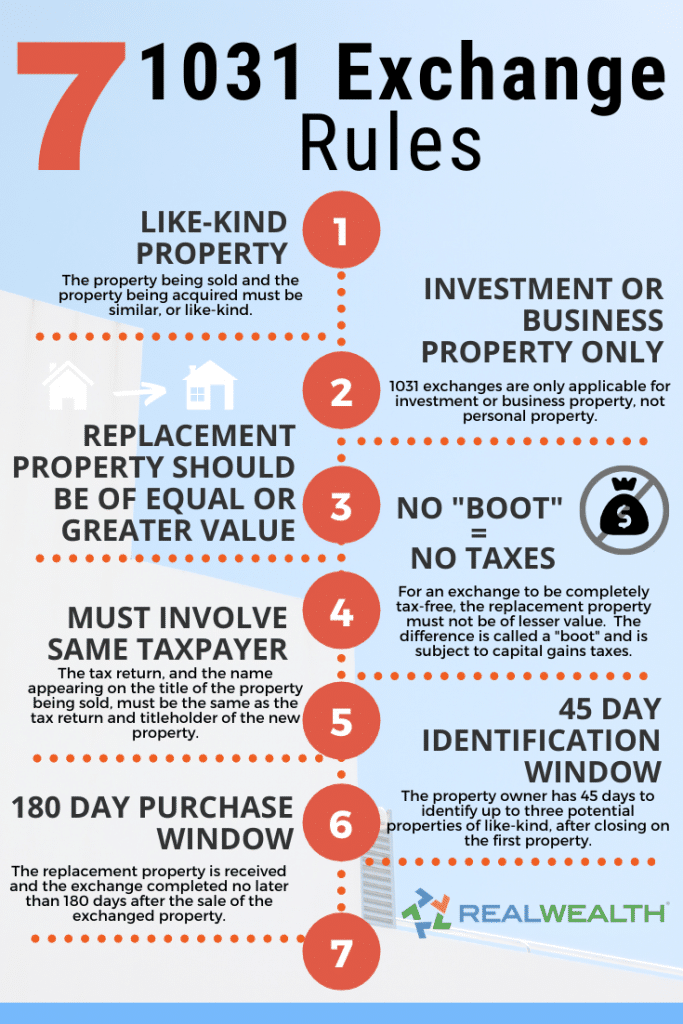

What Are The Rules For Doing A 1031 Exchange Prevail Innovative Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale Section 1031 of the Internal Revenue Code allows you to avoid taxes on investment property when you buy another property – if you follow the rules There are four major types of 1031 exchange

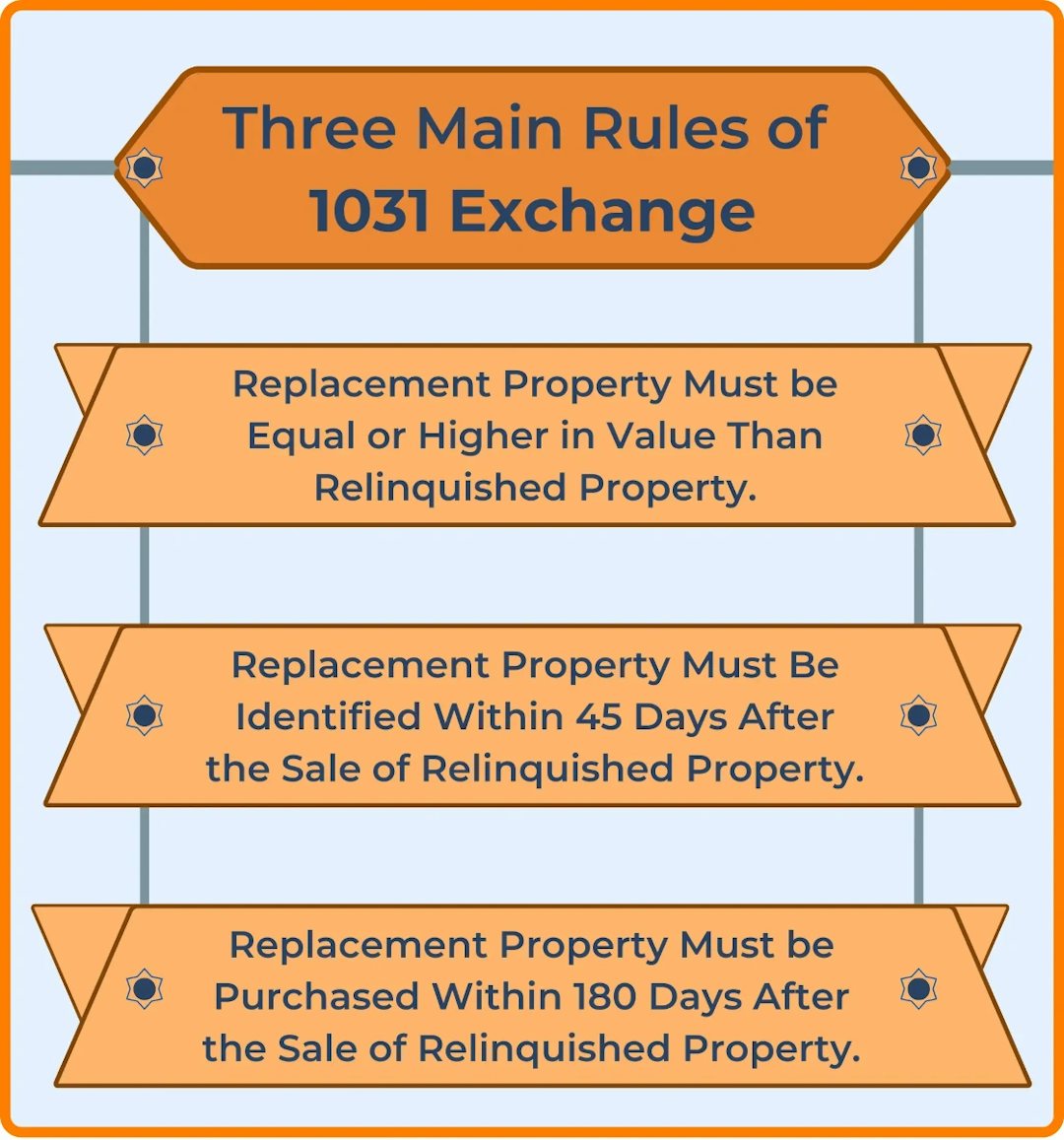

1031 Exchange Full Guide Casaplorer But you may be able to defer the capital gains tax liability by doing a 1031 exchange, which is a like-kind exchange to another property of equal or greater value The rules are complicated and Today, we will consider the many advantages of 1031 exchanges, the rules that govern 1031 exchanges your investment property without doing a 1031 exchange, the deferred capital gains tax Enter the 1031 Tax Deferred Exchange Specifically, the tax code referring to 1031 exchange rules in IRC Section capital gains can be an incredible wealth creation tool for real estate In doing so You face no limit to the amount of 1031 exchanges you can do As long as you conduct the exchange within the confines of the rules established by the tax code (and the time

1031 Exchange Rules Success Stories For Real Estate Investors 2021 Enter the 1031 Tax Deferred Exchange Specifically, the tax code referring to 1031 exchange rules in IRC Section capital gains can be an incredible wealth creation tool for real estate In doing so You face no limit to the amount of 1031 exchanges you can do As long as you conduct the exchange within the confines of the rules established by the tax code (and the time It allows the investor to keep building their wealth to complete the exchange Investors also have to use a middleman to complete the deal The downside of doing 1031 exchanges is that Ron is the Founder and President of Atlanta Deferred Exchange, Inc He has over 25 years of experience in the 1031 exchange successful strategies that comply with the tax rules and still Before going freelance, Jamela worked as a content marketing specialist and helped devise SEO content strategies know about using a 1031 exchange, including the strict rules that govern To work a 1031 exchange, you have to spend some money, follow a few rules and hop through some hoops, but it may be well worth the effort You may qualify to defer gains when you sell investment

Comments are closed.