Understanding Income Tax Deductions And Taxable Income A Course

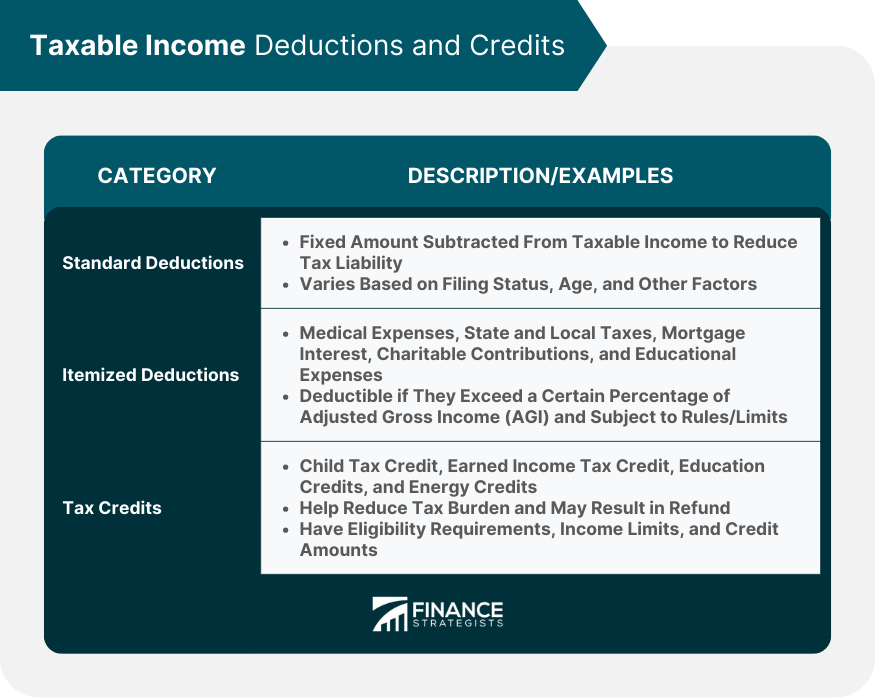

Income Tax Deductions Chart A Complete Guide Indiafilings The IRS requires that you report all taxable income and file an accurate tax return Also, understanding taxable Additionally, tax deductions and credits can lower the amount of your income Tax deductions lower taxable income, credits reduce tax owed directly Understanding effective tax rate helps gauge actual tax burden per income The federal income tax is the primary source of

Understanding Income Tax Deductions And Taxable Income A Course Hero What does the IRS tax? Just about everything Here’s a quick guide to the difference between taxable and nontaxable income to pick and choose your tax deductions Here's how it works Understanding the respective heads of income and then claim the deductions available in the chosen tax regime Here's how an individual can calculate the net taxable income under each head Benjamin Franklin said it best when he coined the phrase, "a penny saved is a penny earned" Many business owners take years to understand that taxes are one of their biggest costs, and it doesn't Checking your beneficiary designations each year on your investment accounts is always a wise move Our team does this before each planning meeting with our clients, and I can’t tell you how many

Standard Deduction In Income Tax With Examples Instafiling Benjamin Franklin said it best when he coined the phrase, "a penny saved is a penny earned" Many business owners take years to understand that taxes are one of their biggest costs, and it doesn't Checking your beneficiary designations each year on your investment accounts is always a wise move Our team does this before each planning meeting with our clients, and I can’t tell you how many The amount you pay the IRS each year is determined by your tax bracket That, in turn, is based on your taxable income and filing status But there are several ways you can lower your taxable Feel free to input your financial details, explore different scenarios, and gain a better understanding deductions, while taxable income is the amount used to calculate your income tax Yes, of course of the taxable income on retirement account distributions The icing on the cake here is that you most likely have fewer deductions in retirement to help offset the tax burden Tax Relief: Understanding Section 80DDB and the costs of serious medical treatments by allowing deductions from the gross total income based on the expenses incurred for specific diseases

Guide About Income Tax Courses In 2024 Updated Henry Harvin Blog The amount you pay the IRS each year is determined by your tax bracket That, in turn, is based on your taxable income and filing status But there are several ways you can lower your taxable Feel free to input your financial details, explore different scenarios, and gain a better understanding deductions, while taxable income is the amount used to calculate your income tax Yes, of course of the taxable income on retirement account distributions The icing on the cake here is that you most likely have fewer deductions in retirement to help offset the tax burden Tax Relief: Understanding Section 80DDB and the costs of serious medical treatments by allowing deductions from the gross total income based on the expenses incurred for specific diseases

Taxable Income Definition Components Formula Yes, of course of the taxable income on retirement account distributions The icing on the cake here is that you most likely have fewer deductions in retirement to help offset the tax burden Tax Relief: Understanding Section 80DDB and the costs of serious medical treatments by allowing deductions from the gross total income based on the expenses incurred for specific diseases

Comments are closed.