Trends In Overdraft Non Sufficient Fund Nsf Fee Revenue And Practices

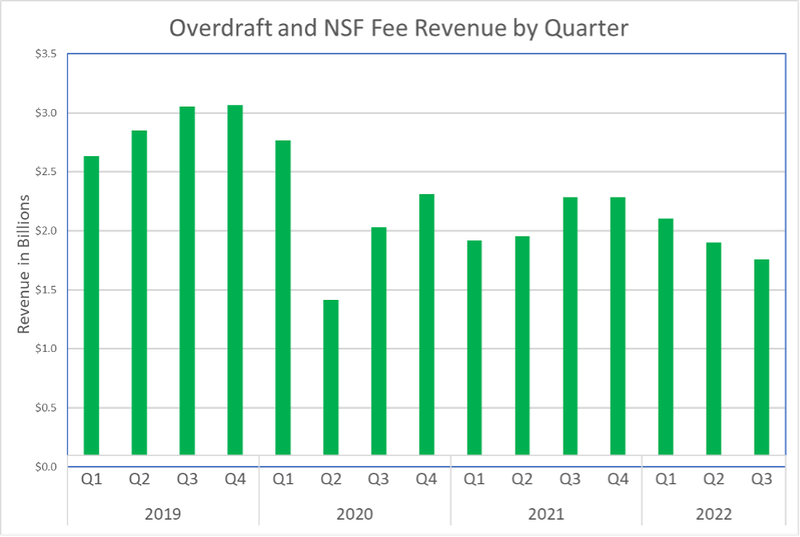

Trends In Overdraft Non Sufficient Fund Nsf Fee Revenue And Practices Since late 2021, cfpb has been closely monitoring trends in overdraft non sufficient fund (nsf) fee revenue and practices. this page provides cfpb's latest data and analysis as well as a record of previous reports and data. The cfpb continues to closely monitor trends in overdraft non sufficient funds (nsf) fee revenue and practices. with 2023 data now available, we can compare overdraft and nsf revenue last year to 2022, when many banks changed their fee policies, and to pre pandemic levels. our most recent analysis finds the following:.

Overdraft Protection Creditrepair For the past year and a half, cfpb has been closely monitoring trends in overdraft non sufficient fund (nsf) fee revenue and practices. with data now available for all four quarters of 2022, we have a fuller picture of reductions in these revenues compared to pre pandemic levels. our most recent analysis finds the following:. Consumers in the occasional overdraft nsf fee group and 41 percent for consumers in the frequent overdraft nsf fee group. the average credit score differs by over 100 points for those in the no overdraft nsf fee group (744) and those in the frequent overdraft nsf fee group (637). o. credit available on a credit card: more than one in six. Although total bank overdraft non sufficient funds (nsf) revenue dropped by an estimated 6% in 2022 compared to 2021, the percentage of households reporting that they paid an overdraft fee held constant. 1. 17% of households with checking accounts reported an overdraft or nsf fee in 2022, unchanged from 2021. Cfpb, non sufficient fund (nsf) fee practices of the 25 banks reporting the most overdraft nsf revenue in 2021, cfpb, cfpb proposes rule to stop new junk fees on bank accounts.

Banksтащ юааoverdraftюаб юааnsfюаб юааfeeюаб юааrevenueюаб Declines Significantly Compared To Pre Although total bank overdraft non sufficient funds (nsf) revenue dropped by an estimated 6% in 2022 compared to 2021, the percentage of households reporting that they paid an overdraft fee held constant. 1. 17% of households with checking accounts reported an overdraft or nsf fee in 2022, unchanged from 2021. Cfpb, non sufficient fund (nsf) fee practices of the 25 banks reporting the most overdraft nsf revenue in 2021, cfpb, cfpb proposes rule to stop new junk fees on bank accounts. 9 there are 454 banks that reported overdraft nsf fee revenues for all six years considered. of these, 29 banks had a year to year change in overdraft nsf fee reliance of over 25 percentage points. upon examining the underlying data, it is likely that these large abrupt changes were due to changes in the categorization under which fees were. Despite these positive trends, the cfpb states in the new report, as it did in its fall 2022 rulemaking agenda, that it is “considering rulemaking activities related to [overdraft nsf] fees.” it also states in the new report that it “will also continue to follow other listed fees to discern to what extent these fees might create barriers to account access.”.

Comments are closed.