Things You Should Know About Investing In Mutual Funds

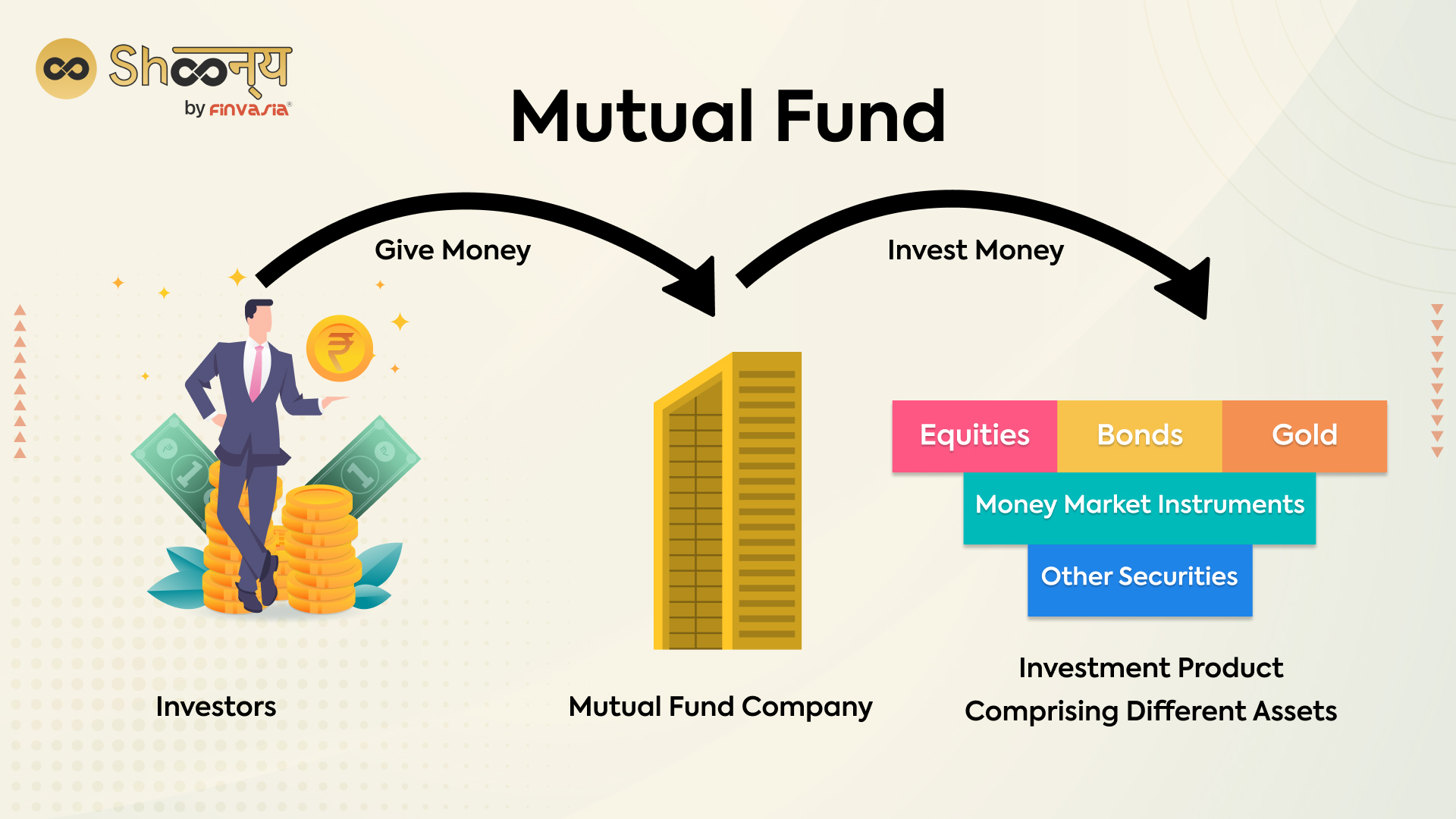

6 Things You Should Know Before Investing In Mutual Funds A mutual fund is an investment that pools together a large amount of money from investors to purchase a basket of securities like stocks or bonds. by purchasing shares of a mutual fund you are. Mutual funds 101. it is first important to understand what mutual funds are. mutual funds are a pot of money contributed by different investors and are managed by an individual or group. funds and other investment instruments are divided into shares. shares are a portion of the fund itself.

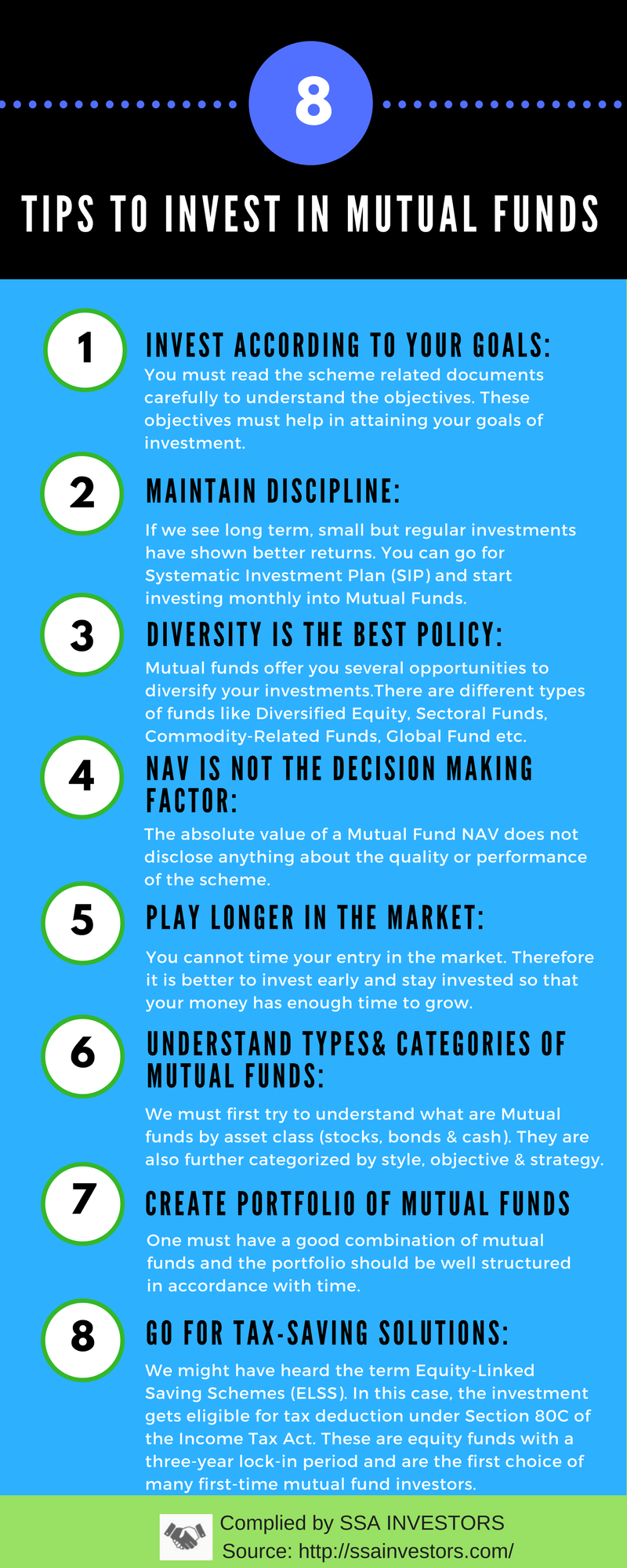

12 Things You Should Know Before Investing In Mutual Fund These funds can hold assets like bonds, stocks, commodities or a combination of several asset classes. you’ll want to do your research before investing in a fund and make sure you understand the. Mutual funds let you pool your money with other investors to purchase stocks, bonds, and other securities. mutual funds act as a basket of securities you buy all at once, which can be easier than. Purchase shares of mutual funds. to start investing in mutual funds, make sure you have enough money deposited in your investment account. keep in mind that mutual funds may have higher investment. A fund may invest outside of its primary asset class to meet its objective. for example, the long term bond fund may invest 80% in long term bonds and 20% in shorter term bonds or other asset classes.

Mutual Funds Everything You Should Know Shoonya Blog Purchase shares of mutual funds. to start investing in mutual funds, make sure you have enough money deposited in your investment account. keep in mind that mutual funds may have higher investment. A fund may invest outside of its primary asset class to meet its objective. for example, the long term bond fund may invest 80% in long term bonds and 20% in shorter term bonds or other asset classes. Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. they're run by professional money managers who decide which securities to buy (stocks, bonds, etc.) and when to sell them. you get exposure to all the investments in the fund and any income they generate. Find a broker. 4. understand mutual fund fees. whether you choose active or passive funds, a company will charge an annual fee for fund management and other costs of running the fund, expressed as.

Why Should You Invest In Mutual Funds Mutual funds let you pool your money with other investors to "mutually" buy stocks, bonds, and other investments. they're run by professional money managers who decide which securities to buy (stocks, bonds, etc.) and when to sell them. you get exposure to all the investments in the fund and any income they generate. Find a broker. 4. understand mutual fund fees. whether you choose active or passive funds, a company will charge an annual fee for fund management and other costs of running the fund, expressed as.

Things You Should Know About Investing In Mutual Funds Know World Now

Comments are closed.