The Impact of Economic Events on Currency Exchange Rates

The Intertwined Dance: How Economic Events Sway Currency Exchange Rates

Currency exchange rates, seemingly volatile and constantly fluctuating, are in reality a delicate reflection of the economic landscape. They are not merely arbitrary numbers; they are the result of a complex interplay between a multitude of economic forces, each pulling and pushing the value of a currency in its own distinct way.

Understanding how economic events impact exchange rates is crucial for businesses engaged in international trade, investors seeking global diversification, and even everyday travelers planning their vacations.

The Fundamentals at Play

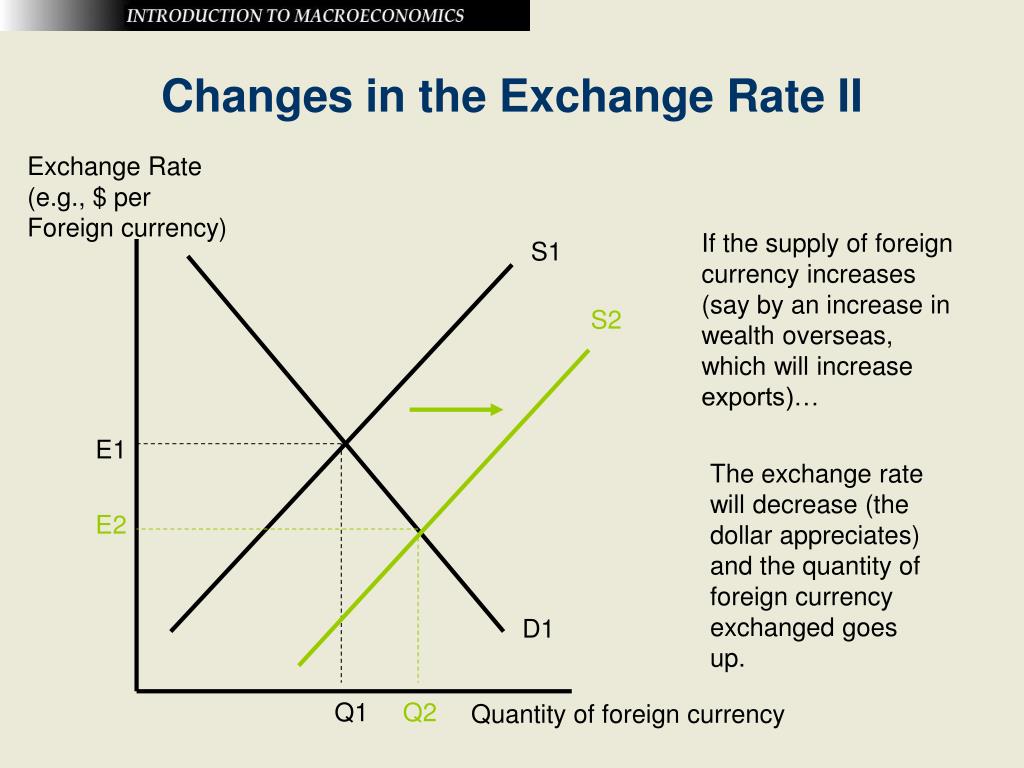

At its core, the exchange rate of a currency is determined by the forces of supply and demand. When demand for a currency is higher than its supply, its value appreciates, making it more expensive to buy. Conversely, when supply exceeds demand, the currency depreciates, becoming cheaper to buy.

However, these forces are not isolated. Economic events, both domestic and global, play a significant role in influencing supply and demand, ultimately impacting exchange rates.

Economic Events and their Influence

Let’s delve into some of the key economic events that can drastically impact currency exchange rates:

- Interest Rates: Higher interest rates attract foreign investors seeking higher returns on their investments. This increased demand for the currency leads to its appreciation. Conversely, lower interest rates make the currency less attractive, leading to depreciation.

- Inflation: High inflation erodes the purchasing power of a currency, making it less attractive to foreign investors. This, in turn, leads to a depreciation in its value.

- Government Policies: Fiscal and monetary policies implemented by governments can significantly influence exchange rates. Expansionary fiscal policies, for example, can lead to increased demand and a currency appreciation, while restrictive monetary policies can lead to a depreciation.

- Economic Growth: Strong economic growth, characterized by increased GDP and job creation, makes a currency more attractive, leading to its appreciation. Conversely, weak economic growth can lead to a depreciation.

- Terms of Trade: The ratio of a country’s export prices to its import prices, known as terms of trade, can also influence exchange rates. Favorable terms of trade (higher export prices relative to import prices) can lead to a currency appreciation.

- Political Stability: Political turmoil or instability can scare investors away, leading to a depreciation of the currency. Conversely, a stable and predictable political environment can attract investors and lead to appreciation.

- Global Events: Major global events like wars, recessions, and natural disasters can also impact exchange rates. Such events can lead to increased risk aversion, causing investors to seek safer currencies like the US dollar, leading to its appreciation.

The Complex Dance Continues

It is crucial to remember that these are just some of the factors that influence exchange rates. The interplay between these forces is complex and often dynamic, making it challenging to predict future movements with absolute certainty.

Understanding the impact of economic events on currency exchange rates is essential for navigating the global economy effectively. By staying informed about key economic indicators and global events, individuals and businesses can make informed decisions and manage their financial risks effectively.