The Fed Cut Rates What Does It Mean For Your Credit Card

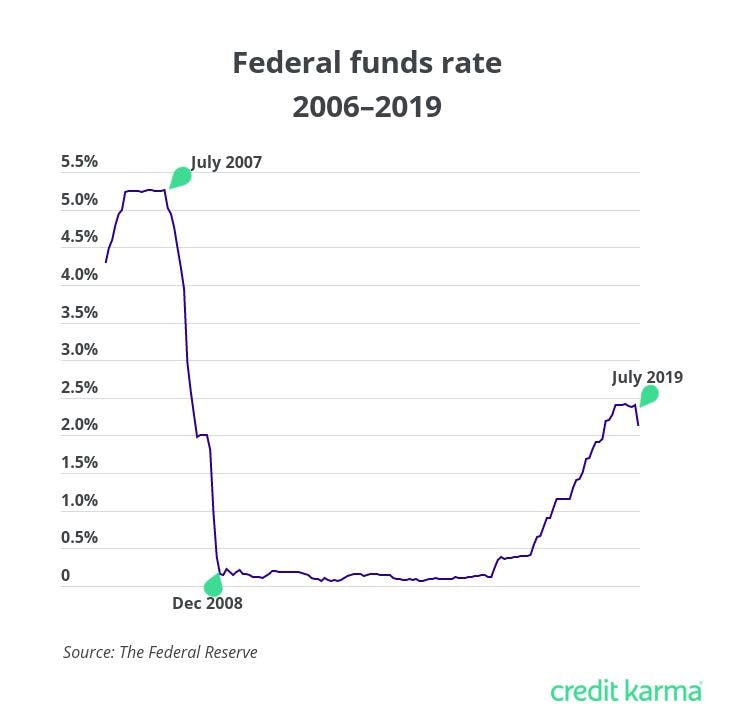

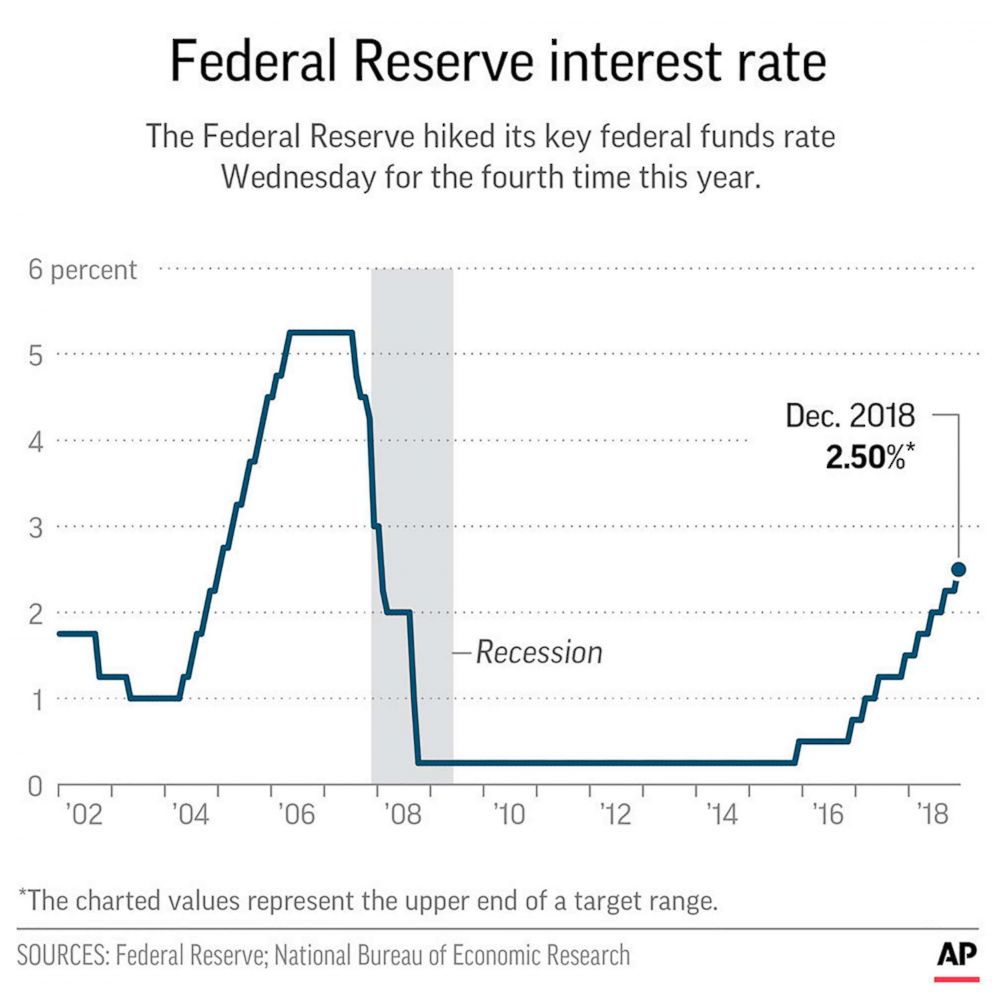

Fed Cuts Interest Rate For Second Time In 2019 What This Means The fed cut interest rates by 50 basis points at this month’s meeting, which means the benchmark interest rate is now 4.75% to 5.00%. experts expect more rate cuts to come in both november and. A single federal reserve funds rate cut will likely only move the needle by 25 basis points. even if, as some experts predict, the fed makes a 50 basis point cut, the federal funds rate will only.

Will Fed Cut Rates In 2024 Quinn Carmelia That said, the fed’s declining benchmark rate will eventually mean better rates for borrowers, many of whom are facing some of the highest credit card interest rates in decades. the average interest rate is 23.18% for new offers and 21.51% for existing accounts, according to wallethub’s august credit card landscape report. On top of stubborn food and energy costs, credit card debt is at a record $1.14 trillion, with the average balance per consumer standing at $6,329, up 4.8% year over year. last quarter, the u.s. The federal reserve cut its benchmark rate by a half percentage point, or 50 basis points, at the end of its two day meeting wednesday. for consumers, this means relief from high borrowing costs. Feds cut interest rate for first time since 2020. here’s what that could mean for your wallet. 02:45 it's been a long and bumpy road to the federal reserve's first interest rate cut in more than.

When Will The Fed Cut Interest Rates In 2024 Uk Diann Florina The federal reserve cut its benchmark rate by a half percentage point, or 50 basis points, at the end of its two day meeting wednesday. for consumers, this means relief from high borrowing costs. Feds cut interest rate for first time since 2020. here’s what that could mean for your wallet. 02:45 it's been a long and bumpy road to the federal reserve's first interest rate cut in more than. The current average interest rate for store branded retail credit cards is even higher, at a record peak of 30.45%. credit card delinquencies have also been on the rise. how fed rate cut will affect credit card apr: the fed's short term interest rates are closely tied to credit card interest rates. If you have $5,000 of credit card debt at a 24.92% apr and pay $250 per month, it’ll take you 27 months and $1,528 in interest to pay the balance off. if the apr drops a quarter point to 24.67%.

Interest Rates Fed Cut To Trim Credit Card Mortgage Savings Ratesођ The current average interest rate for store branded retail credit cards is even higher, at a record peak of 30.45%. credit card delinquencies have also been on the rise. how fed rate cut will affect credit card apr: the fed's short term interest rates are closely tied to credit card interest rates. If you have $5,000 of credit card debt at a 24.92% apr and pay $250 per month, it’ll take you 27 months and $1,528 in interest to pay the balance off. if the apr drops a quarter point to 24.67%.

Comments are closed.