The Fair Credit Billing Act Explained Ccbill Blog

The Fair Credit Billing Act Explained Ccbill Blog The fair credit billing act is designed to protect consumers from unfair billing practices. the act provides a path for consumers to dispute billing errors or unauthorized charges and requires. The fair credit billing act (fcba) is a federal law enacted in 1974 that limits consumers' liability and protects them from unfair billing practices in several ways. it amended the truth in lending act (tila), which was enacted six years prior. the fcba applies to open end credit accounts, including credit cards, charge cards and home equity.

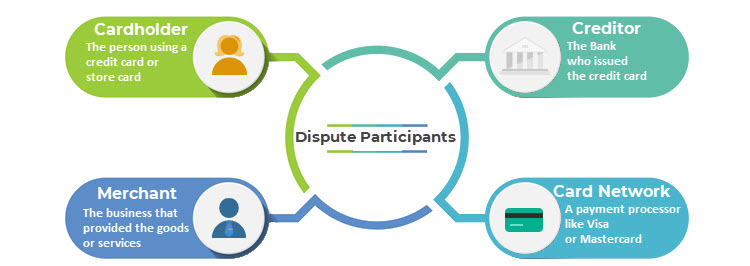

The Fair Credit Billing Act Explained Ccbill Blog The fcba gives cardholders the right to dispute charges that fall under the “billing error” categories described above. the law says that they must do so in writing within sixty days of receiving a statement of the charge. the issuer is then required to respond to the cardholder within 30 days of receiving the dispute. Related reading: why a credit card is a smarter choice than a debit card. the fair credit billing act was created before the internet boom, and it specifically requires consumers to mail a written notice to dispute a transaction within 60 days of the charge in order to be covered by the law. withholding payment while disputes are being investigated. The fair credit billing act (fcba) is a federal law that mandates the protection of consumers from exploitation by creditors through billing errors. enacted in 1974, the fcba was introduced as an amendment to the truth in lending act (1968). the fair credit billing act provides a mechanism whereby disputed billing amounts can be addressed. In 1974, congress passed the fair credit billing act (fcba), designed to protect consumers from unfair billing practices and limit their liability. the fcba gives you the legal right to address.

The Fair Credit Billing Act Explained Ccbill Blog The fair credit billing act (fcba) is a federal law that mandates the protection of consumers from exploitation by creditors through billing errors. enacted in 1974, the fcba was introduced as an amendment to the truth in lending act (1968). the fair credit billing act provides a mechanism whereby disputed billing amounts can be addressed. In 1974, congress passed the fair credit billing act (fcba), designed to protect consumers from unfair billing practices and limit their liability. the fcba gives you the legal right to address. This act, amending the truth in lending act, requires prompt written acknowledgment of consumer billing complaints and investigation of billing errors by creditors. the amendment prohibits creditors from taking actions that adversely affect the consumer's credit standing until an investigation is completed, and affords other protection during. The fair credit billing act explained in less than 4 minutes. the balance is part of the dotdash meredith publishing family. the fair credit billing act (fcba) is a federal law that limits consumer liability and protects individuals from unfair billing practices. find out how it works.

Know Your Rights The Fair Credit Billing Act Explained Youtube This act, amending the truth in lending act, requires prompt written acknowledgment of consumer billing complaints and investigation of billing errors by creditors. the amendment prohibits creditors from taking actions that adversely affect the consumer's credit standing until an investigation is completed, and affords other protection during. The fair credit billing act explained in less than 4 minutes. the balance is part of the dotdash meredith publishing family. the fair credit billing act (fcba) is a federal law that limits consumer liability and protects individuals from unfair billing practices. find out how it works.

Comments are closed.