The Difference Between Bonds Vs Stocks Vs Mutual Funds

What Is The Difference Between Stock And Mutual Funds At William Kelly In general, bonds are considered safer investments than stocks. but that’s not always true. it depends on the bond you buy. the riskier the bond — that is, the lower a borrower’s credit. Mutual funds and exchange traded funds (etfs) mutual funds and exchange traded funds are not investments, in the sense that a stock or a bond is. stocks and bonds are asset classes. mutual funds and etfs are pooled investment vehicles, where the money of a number of investors is taken together to buy large blocks or large collections of securities.

/the-difference-between-stocks-and-bonds-417069-final-5bbd17bd46e0fb00268fdc8c.png)

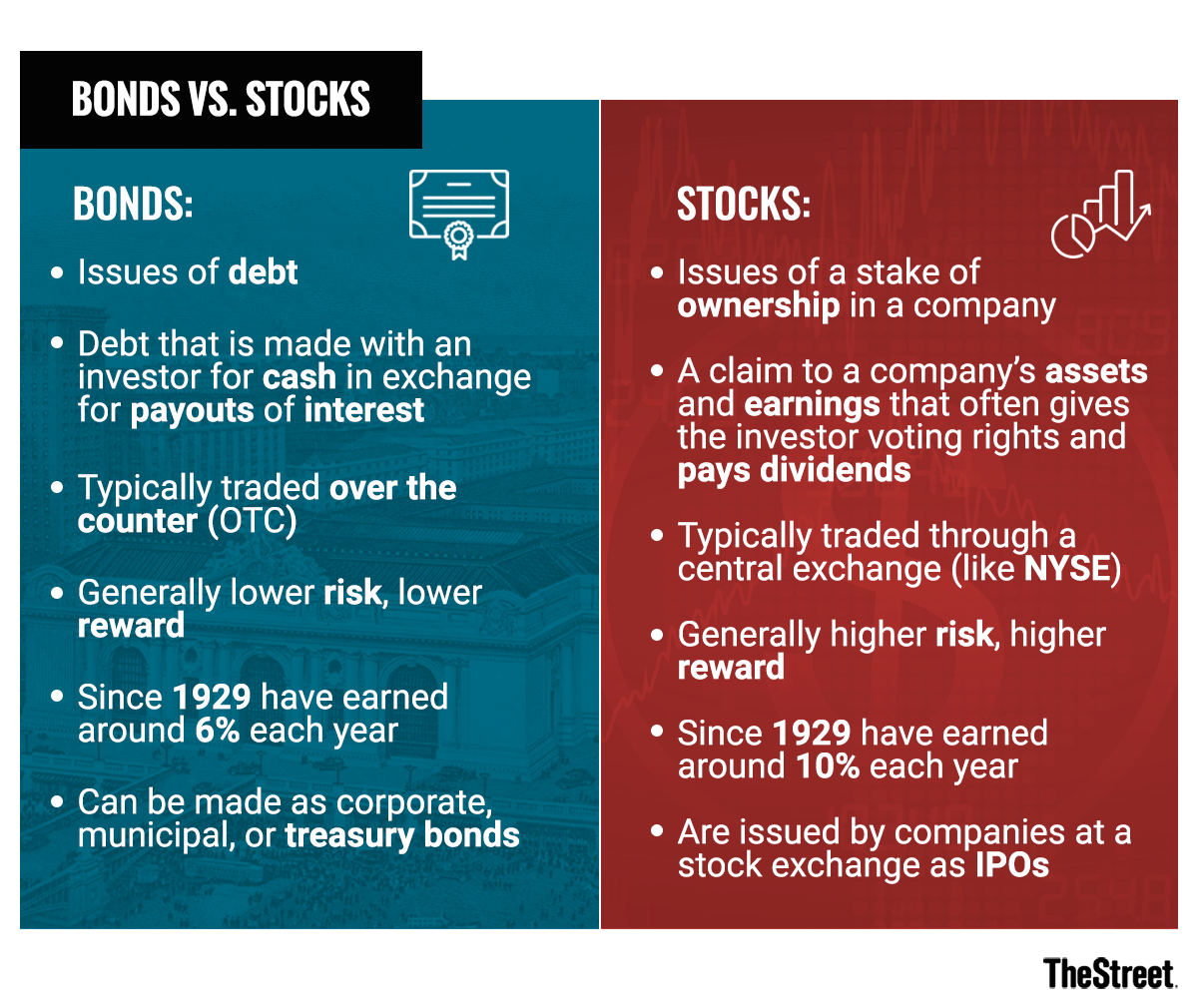

What Are The Differences Between Stocks And Bonds For example, if you invest $1,000 in an etf or a mutual fund with a 0.10% expense ratio, you’ll pay $1 a year in fees. if you invest the same amount in a fund with an expense ratio of 0.60%, you’ll pay $6 a year. commission. a commission is a fee you pay to a broker each time you buy or sell 1 or more shares of an individual stock, bond, or. Some mutual funds even hold a mix of stocks and bonds, offering a diverse portfolio in one fund. these are often called balanced funds. mutual fund managers are responsible for implementing the fund’s investment objective as stated in the prospectus by actively monitoring and trading the portfolio as they seek to maximize returns. for this. How the securities are taxed is another major differentiator between stocks and bonds. with stocks, you pay capital gains taxes when you sell a stock at a profit and on any dividends you receive. Here are the key features, as well as pros and cons, of stocks vs. mutual funds. stocks vs. mutual funds. stocks and mutual funds both offer ways to construct a portfolio, but there are.

Stocks Vs Bonds Vs Etfs Vs Mutual Funds A Beginner Primer How the securities are taxed is another major differentiator between stocks and bonds. with stocks, you pay capital gains taxes when you sell a stock at a profit and on any dividends you receive. Here are the key features, as well as pros and cons, of stocks vs. mutual funds. stocks vs. mutual funds. stocks and mutual funds both offer ways to construct a portfolio, but there are. The difference between mutual funds and stocks. mutual funds and stocks both trade on public exchanges and give you access to the shares of your favorite companies. however, mutual funds require. Mutual funds vs. stocks. the biggest difference between mutual funds and stocks is that stocks are an investment in a single company, whereas mutual funds have many investments — meaning.

7 Points Comparison Of Stocks Vs Bonds Yadnya Investment Academy The difference between mutual funds and stocks. mutual funds and stocks both trade on public exchanges and give you access to the shares of your favorite companies. however, mutual funds require. Mutual funds vs. stocks. the biggest difference between mutual funds and stocks is that stocks are an investment in a single company, whereas mutual funds have many investments — meaning.

Comments are closed.