The Bookkeeping Basics For Beginners

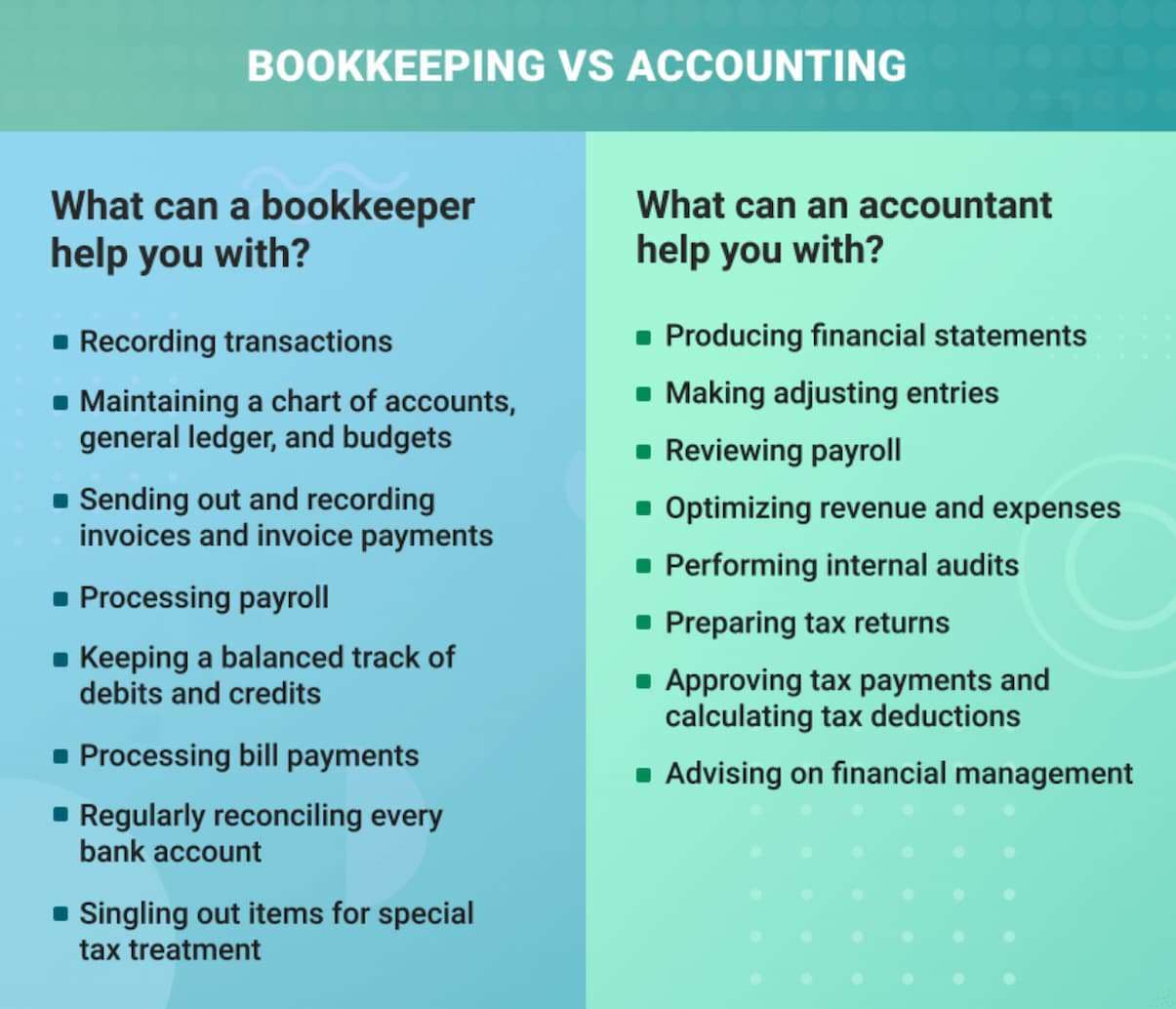

Bookkeeping Tutorial For Beginners Bookstime How to guides for basic bookkeeping including banking, petty cash care, accounts receivable and payable, filing systems, and more day to day tips. financial reports. which pull all the information together so you know what the result is of all your hard work: profit and loss report. balance sheet and cash flow. The beginner's guide to bookkeeping. what is bookkeeping? image by daniel fishel à © the balance 2019. the balance is part of the dotdash meredith publishing family. here is a guide to the basics of bookkeeping, the difference between it and accounting, and how to set up your system.

Bookkeeping An Essential Guide To Bookkeeping For Beginners Along With Bookkeeping is the recording of past financial data to make future business decisions. in this tutorial, you'll learn what bookkeeping is and i'll show you h. Introducing the accounting cycle • 5 minutes. step 1 collect and analyze transactions • 2 minutes. step 2 posting transactions to the general ledger • 1 minute. step 3 preparing an unadjusted trial balance • 3 minutes. step 4 preparing adjusting entries at the end of a period • 2 minutes. 1. set up your bookkeeping system. the first step is choosing a system that works for you. the main options are: manual bookkeeping: pen, paper, and a calculator—the old school approach. while perfectly functional for some micro businesses, manual bookkeeping can be time consuming and prone to errors. Diy: it can be effortless to start bookkeeping, as you only really need to download a bookkeeping app. the more you do it yourself for your business, the easier the process can become. you can essentially take full control and be the bookkeeper for your own business so you don’t lose any visibility. 3.

Free Bookkeeping Guide For Beginners Accounting Accounting And 1. set up your bookkeeping system. the first step is choosing a system that works for you. the main options are: manual bookkeeping: pen, paper, and a calculator—the old school approach. while perfectly functional for some micro businesses, manual bookkeeping can be time consuming and prone to errors. Diy: it can be effortless to start bookkeeping, as you only really need to download a bookkeeping app. the more you do it yourself for your business, the easier the process can become. you can essentially take full control and be the bookkeeper for your own business so you don’t lose any visibility. 3. Bookkeeping is a process that involves recording and organizing your business's financial transactions. learning bookkeeping basics — and applying them — can revolutionize your business. types of bookkeeping accounts for small businesses. here are 1o types of bookkeeping accounts for a small to medium sized business. 1. accounts receivable. Bookkeeping basics 101: 9 bookkeeping basics for beginners. 1. assets. assets are the things the business owns. tangible and intangible assets are part of the balance sheet. intangible assets include royalty and goodwill, while tangible assets include the following: cash account – this is the cash on hand and cash on banks.

Free Bookkeeping Guide For Beginners Bookkeeping is a process that involves recording and organizing your business's financial transactions. learning bookkeeping basics — and applying them — can revolutionize your business. types of bookkeeping accounts for small businesses. here are 1o types of bookkeeping accounts for a small to medium sized business. 1. accounts receivable. Bookkeeping basics 101: 9 bookkeeping basics for beginners. 1. assets. assets are the things the business owns. tangible and intangible assets are part of the balance sheet. intangible assets include royalty and goodwill, while tangible assets include the following: cash account – this is the cash on hand and cash on banks.

Comments are closed.