Taxes Charged On And Subsidies Provided To Consumers Are

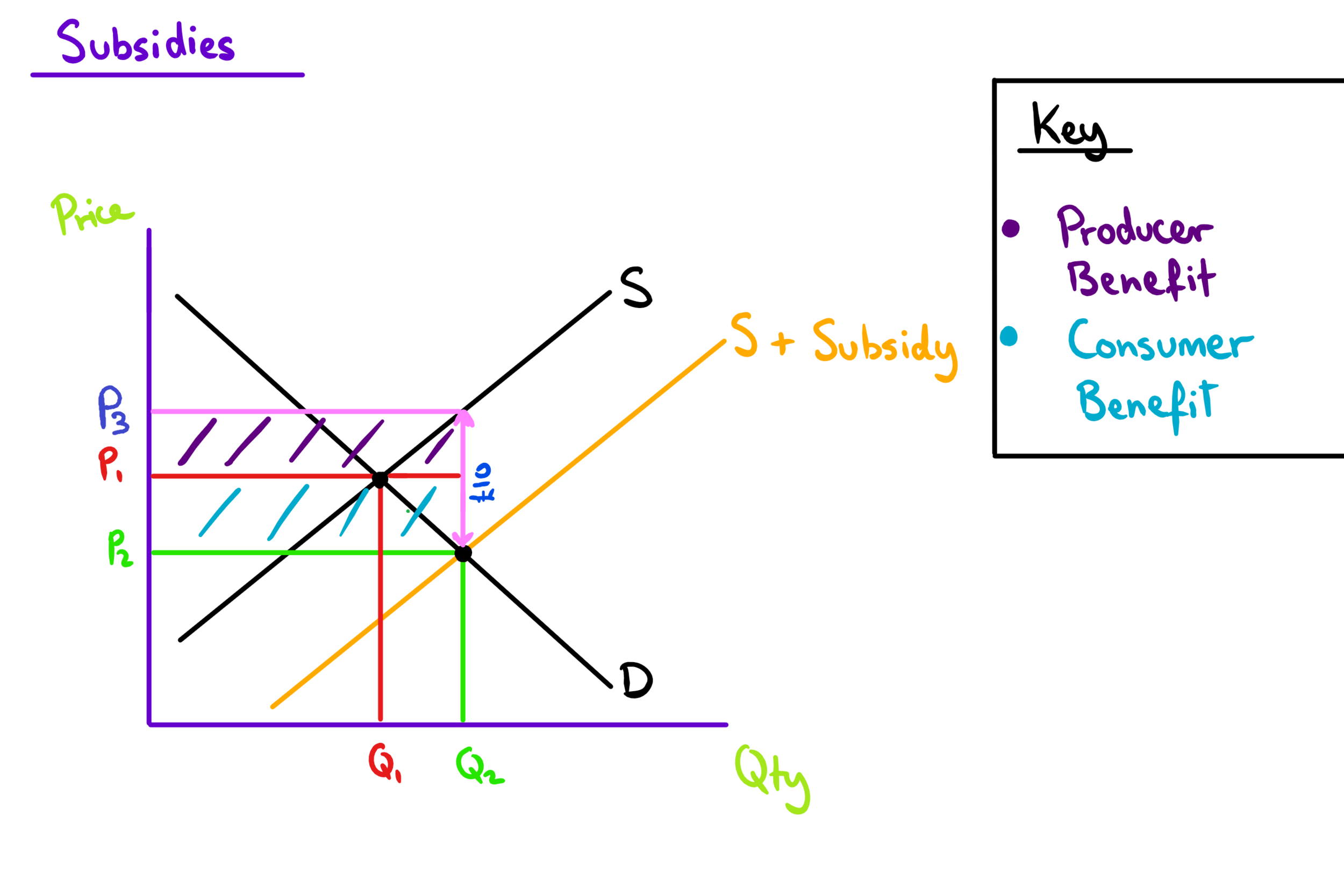

Solved Taxes Charged On And Subsidies Provided To Consumers Chegg Subsidies. a subsidy is just a negative tax: so instead of the price paid by consumers being the price received by firms plus a tax, it’s the price received by firms minus a subsidy. as a result, the quantity is greater than the equilibrium quantity without a subsidy. i’ll add more descriptions of that later. Consumers to government – area a. consumers originally paid $4 gallon for gas. now, they are paying $5 gallon. the $1 increase in price is the portion of the tax that consumers have to bear. despite the fact that the tax is levied on producers, the consumers have to bear a share of the price change.

Taxes Subsidies вђ Mr Banks Economics Hub Resources Tutoring Exam Taxes and subsidies are integral components of a nation's fiscal policy, playing a pivotal role in the economic well being of a country. in the united states, the internal revenue service (irs) oversees tax collection and enforcement, while subsidies are government incentives provided to individuals, businesses, or industries to achieve. Chapter 4 taxes and subsidies. expenditure tax or a tax levied on goods and services (g and s) and it is imposed by the government. imposed on spending to buy goods and services. paid partly by consumers, and partly by producers. ultimately paid to the government by producers. Taxes are levied on goods and services to raise government revenue and discourage consumption, while subsidies are payments made to producers to encourage production and consumption of certain goods and services. both taxes and subsidies can impact consumer choices, market prices, and overall economic efficiency. Fig. 7 a shift in demand due to a tax levied on consumers # if the tax is levied on consumers, this increases the price per unit they must pay, thereby reducing quantity demanded at every price. this shifts the demand curve leftward. effects of subsidies# to account for positive externalities, a popular form of government intervention is a subsidy.

Comments are closed.