Tracking Error And Why We Believe Other Metrics Better Highlight The Relative Riskiness Of An

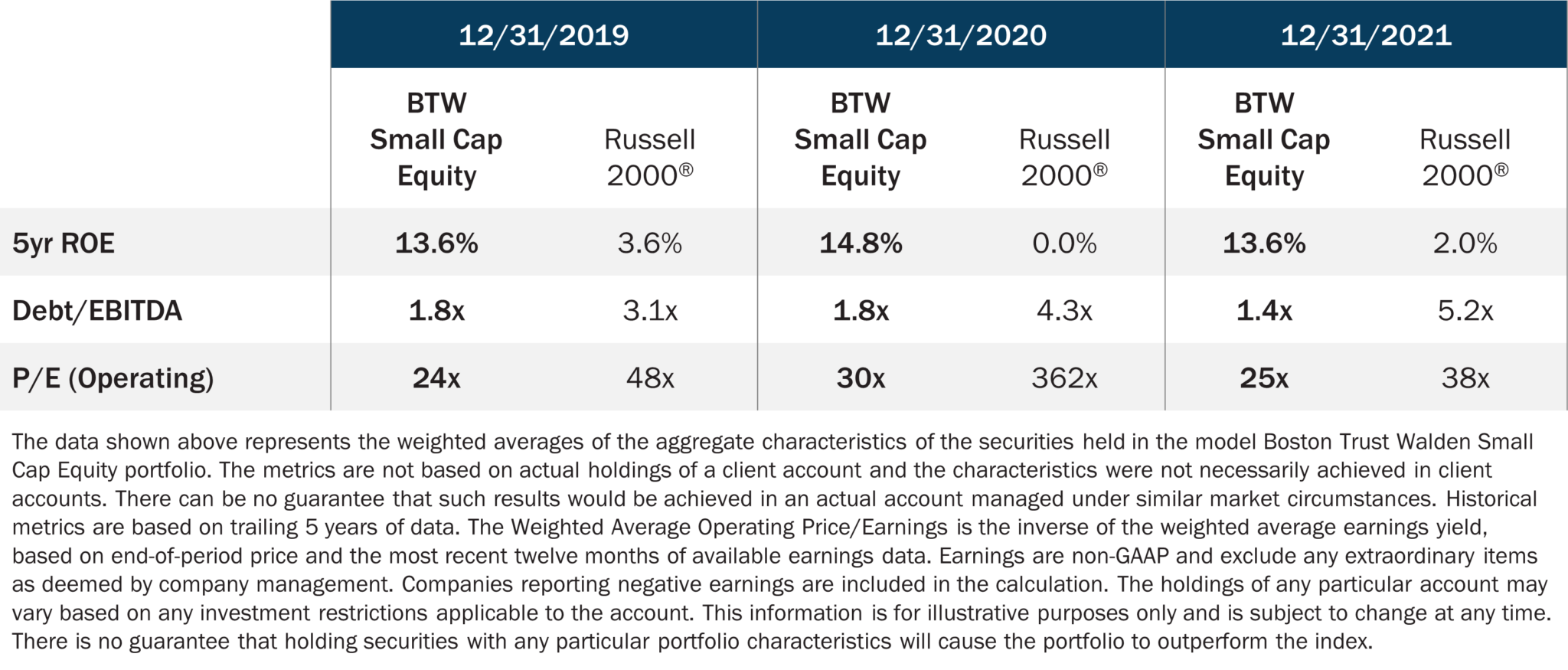

7 Risk Management Metrics You Should Be Tracking Risk Management Management Risk Analysis In this blog post, we seek to define tracking error and elucidate why we believe other metrics may better highlight how we think about the “riskiness” of a strategy relative to the index. Empirical research shows there is a positive relationship between market volatility and tracking error. when market volatility rises, tracking error increases and conversely, when market volatility falls, tracking error decreases.

Tracking Error Explained Uncovering The Power Of Precise Portfolio Analytics Money Masterpiece While tracking error measures the deviation of a portfolio's returns from its benchmark, risk adjusted returns measure the performance of a portfolio relative to its risk. therefore, a portfolio manager should consider both measures when evaluating the performance of a portfolio. Tracking error measures the discrepancy between a portfolio's returns and those of a benchmark index, helping investors and fund managers assess the risk associated with their investment strategies and evaluate their performance relative to the benchmark. When it comes to evaluating investment strategies, information ratio and tracking error are two performance metrics that can provide valuable insights. as an investor, it is crucial to assess the performance of your portfolio and understand how it compares to its benchmark or peers. Tracking error (te) – the humble statistic that serves as a measure of this risk – is having its day in the sun again due to its use in passive sustainable investing. it has become so prevalent, however, that its meaning can often be obscured.

Risk Management Metrics Key Performance Indicators When it comes to evaluating investment strategies, information ratio and tracking error are two performance metrics that can provide valuable insights. as an investor, it is crucial to assess the performance of your portfolio and understand how it compares to its benchmark or peers. Tracking error (te) – the humble statistic that serves as a measure of this risk – is having its day in the sun again due to its use in passive sustainable investing. it has become so prevalent, however, that its meaning can often be obscured. It serves as both a measure of risk and an indicator of a manager's investment style. whether striving for precise replication or seeking to outperform the market, understanding and managing tracking error is essential for maintaining portfolio stability and achieving investment objectives. There are many ways for portfolio managers to quantify and report on the riskiness of a given portfolio. perhaps the most common measures of risk include standard deviation and its close relation, variance. Tracking error serves as an important standalone measure in helping to determine whether a strategy’s overall risk exposure is excessive, in line with our guidelines, or too low to support the potential for meaningful excess returns. The goal of this research brief is to provide a deeper understanding of one particular dimension of portfolio risk: tracking error. one way to measure the risk of a portfolio is on an absolute basis – in other words, not in comparison to a benchmark.

Tracking Error And Why We Believe Other Metrics Better Highlight The Relative Riskiness Of An It serves as both a measure of risk and an indicator of a manager's investment style. whether striving for precise replication or seeking to outperform the market, understanding and managing tracking error is essential for maintaining portfolio stability and achieving investment objectives. There are many ways for portfolio managers to quantify and report on the riskiness of a given portfolio. perhaps the most common measures of risk include standard deviation and its close relation, variance. Tracking error serves as an important standalone measure in helping to determine whether a strategy’s overall risk exposure is excessive, in line with our guidelines, or too low to support the potential for meaningful excess returns. The goal of this research brief is to provide a deeper understanding of one particular dimension of portfolio risk: tracking error. one way to measure the risk of a portfolio is on an absolute basis – in other words, not in comparison to a benchmark.

Tracking Error And Why We Believe Other Metrics Better Highlight The Relative Riskiness Of An Tracking error serves as an important standalone measure in helping to determine whether a strategy’s overall risk exposure is excessive, in line with our guidelines, or too low to support the potential for meaningful excess returns. The goal of this research brief is to provide a deeper understanding of one particular dimension of portfolio risk: tracking error. one way to measure the risk of a portfolio is on an absolute basis – in other words, not in comparison to a benchmark.

The Metrics Of Accuracy Exploring Error Metrics In Linear Regression By Vivek Palanisamy Medium

Comments are closed.