The Average Investor From R Wallstreetbets Vs R Investing R Agedlikewine

The Average Investor From R Wallstreetbets Vs R Investing R Agedlikewine In this video let's look through some of the nuanced differences between r investing and r wallstreetbets.i have tried to draw a picture of the average inves. 200k subscribers in the agedlikewine community. a subreddit for things that have stood the test of time.

R Wallstreetbets Vs R Investing R Wallstreetbets This paper studies the influence of reddit social media attention on investor risk taking and welfare using individual trading data from a large trading platform. we show that attention generated on the subreddit r wallstreetbets (wsb) spurs uninformed trading, also in short positions. This banding together of individuals on a forum like r wallstreetbets captured media attention and even that of congress and the sec. this research paper explores if the content posted on r wallstreetbets actually had any predictive power on whether a stock goes up or down the following day. The wallstreetbets subreddit is a prime example of the social investing phenomenon, where average people with brokerage accounts — called retail investors — meet online to discuss stock trading strategies. Really, as cliche and arrogant as it may sound, i'd be as bold to say that almost all socialists i've met are at least above average intelligence. it's usually our enemies, the reactionaries, the liberals, the bourgeoisie, the fascists, those are often the most ignorant and backwards of humanity.

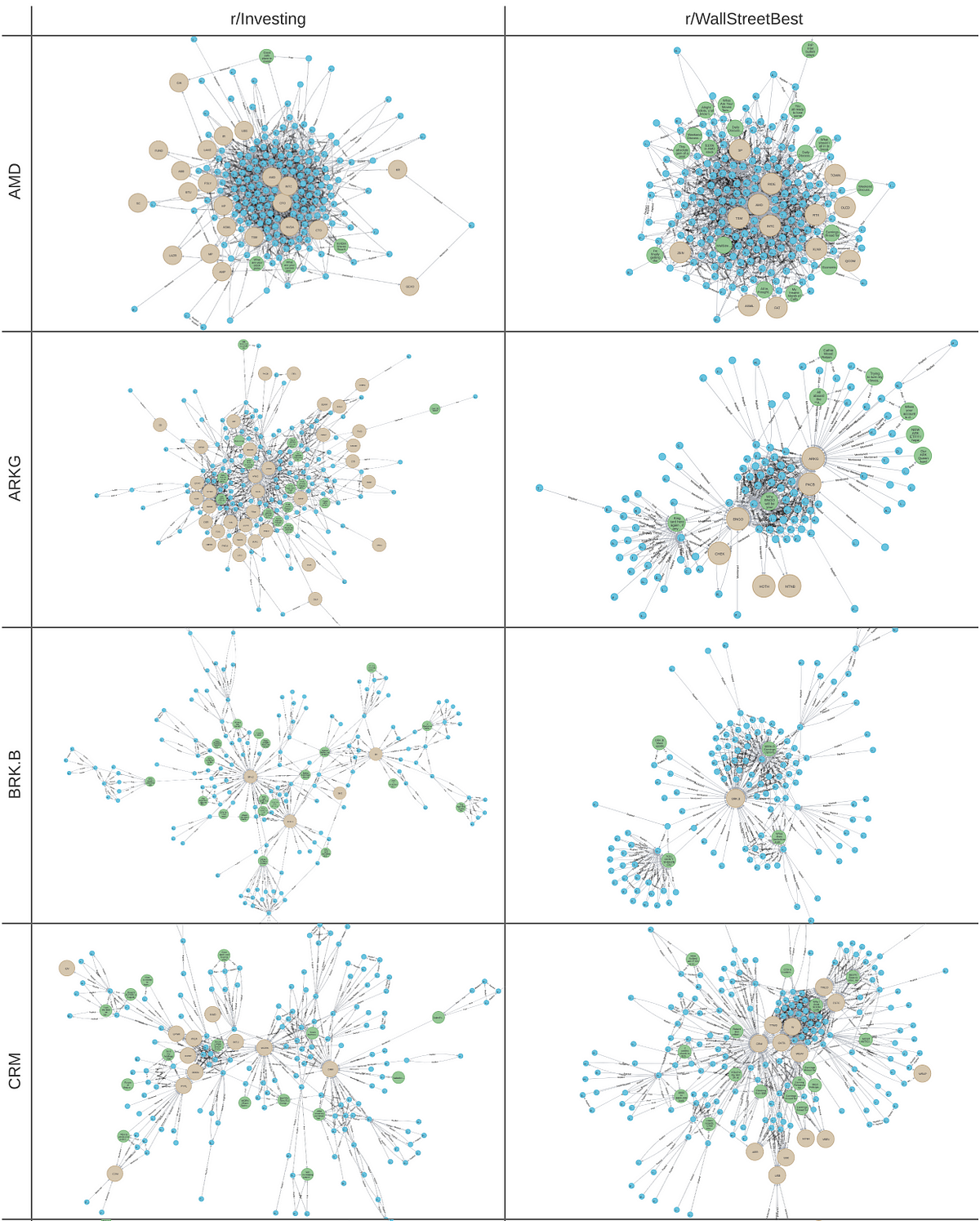

Graphing R Investing And R Wallstreetbets By Zuye Zheng Geek Culture Medium The wallstreetbets subreddit is a prime example of the social investing phenomenon, where average people with brokerage accounts — called retail investors — meet online to discuss stock trading strategies. Really, as cliche and arrogant as it may sound, i'd be as bold to say that almost all socialists i've met are at least above average intelligence. it's usually our enemies, the reactionaries, the liberals, the bourgeoisie, the fascists, those are often the most ignorant and backwards of humanity. The discussion led to comparing the average annual return on investment for a wallstreetbets user compared to an average investor. the accepted statistic for average investors is a 10% annual return on investment for their portfolio. The average retail investor is in high growth so of course their percentage is down more compared to an etf. eventually, like history, growth will run past etf returns and then crash again. The average stock market return is about 10% per year for nearly the last century. the s&p 500 is often considered the benchmark measure for annual stock market returns. though 10% is the average stock market return, returns in any year are far from average. Finance lecturer nick vlisides, who teaches um dearborn’s investment fund management course, weighs in on the r wallstreetbets story and what it says about hedge funds, buyer behavior and the stock market.

Comments are closed.