Solved Straight Line Depreciation Method Assume That Sam Chegg

Solved Assume Straight Line Depreciation Method Is Used Chegg Accounting questions and answers. straight line depreciation method assume that sam company purchased factory equipment on january 1, 2018, for $80,000. the equipment has an estimated life of five years and an estimated residual salvage value of $6,000. 1 complete the depreciation schedule using the straight line method. 2 record the first year. Accounting questions and answers. assume straight line depreciation method is used. required: 1. calculate the project's net present value. (future value of $1. present value of $1. future value annuity of $1. present value annulty of $1.) note: use appropriate factor (s) from the tables provided.

Solved Assume Straight Line Depreciation Method Is Used Chegg Assume straight line depreciation method is used. required: help bbs evaluate this project by calculating each of the following: 1. accounting rate of return. note: round your answer to 2 decimal places. 2. payback period. note: round your answer to 2 decimal places. 3. net present value (npv). note: do not round intermediate calculations. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period. rate of depreciation can be calculated as follows: rate of depreciation =. 1. x 100%. useful life. e.g. rate of depreciation of an asset having a useful life of 8 years is 12.5% p.a. (1 ÷ 8) x 100% = 12.5% per year. The company would be able to take an additional $10,000 in depreciation over the extended two year period, or $5,000 a year, using the straight line method. as with the straight line example, the asset could be used for more than five years, with depreciation recalculated at the end of year five using the double declining balance method. The straight line method of depreciation gradually reduces the value of fixed or tangible assets by a set amount over a specific period of time. only tangible assets, or assets you can touch, can.

Solved Assume Straight Line Depreciation Method Is Used Chegg The company would be able to take an additional $10,000 in depreciation over the extended two year period, or $5,000 a year, using the straight line method. as with the straight line example, the asset could be used for more than five years, with depreciation recalculated at the end of year five using the double declining balance method. The straight line method of depreciation gradually reduces the value of fixed or tangible assets by a set amount over a specific period of time. only tangible assets, or assets you can touch, can. The most common method of depreciation used on a company’s financial statements is the straight line method. when the straight line method is used each full year’s depreciation expense will be the same amount. we will illustrate the details of depreciation, and specifically the straight line depreciation method, with the following example. The straight line calculation steps are: determine the cost of the asset. subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. determine the useful life of the asset. divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

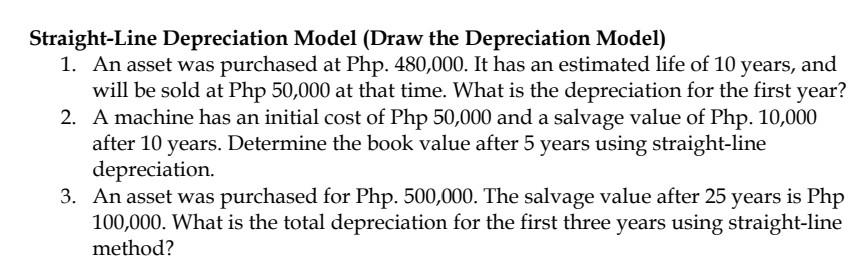

Solved Straight Line Depreciation Model Draw The Chegg The most common method of depreciation used on a company’s financial statements is the straight line method. when the straight line method is used each full year’s depreciation expense will be the same amount. we will illustrate the details of depreciation, and specifically the straight line depreciation method, with the following example. The straight line calculation steps are: determine the cost of the asset. subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable amount. determine the useful life of the asset. divide the sum of step (2) by the number arrived at in step (3) to get the annual depreciation amount.

Comments are closed.