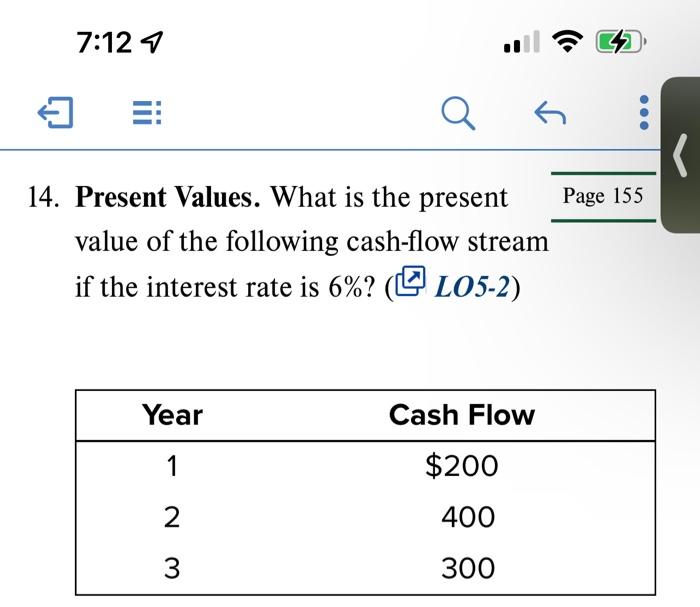

Solved 4 Present Values What Is The Present Value Of The Chegg

Solved 4 Present Values What Is The Present Value Of The Chegg Annuity present values what is the value today of $ 5, 1 0 0 per year, at a discount rate of 7. 9 percent, if the first payment is received 6 years from today and the last payment is received 2 0 years from today? there are 2 steps to solve this one. solution. Finance questions and answers. problem 5 10 spreadsheet problem: present values of an ordinary annuity andannuity due (lg5 6)what is the present value of a $105 annual payment over 10 years if interest rates are 5 percent using bothend of year and beginning of year payments?note: round your final answers to 2 decimal places.

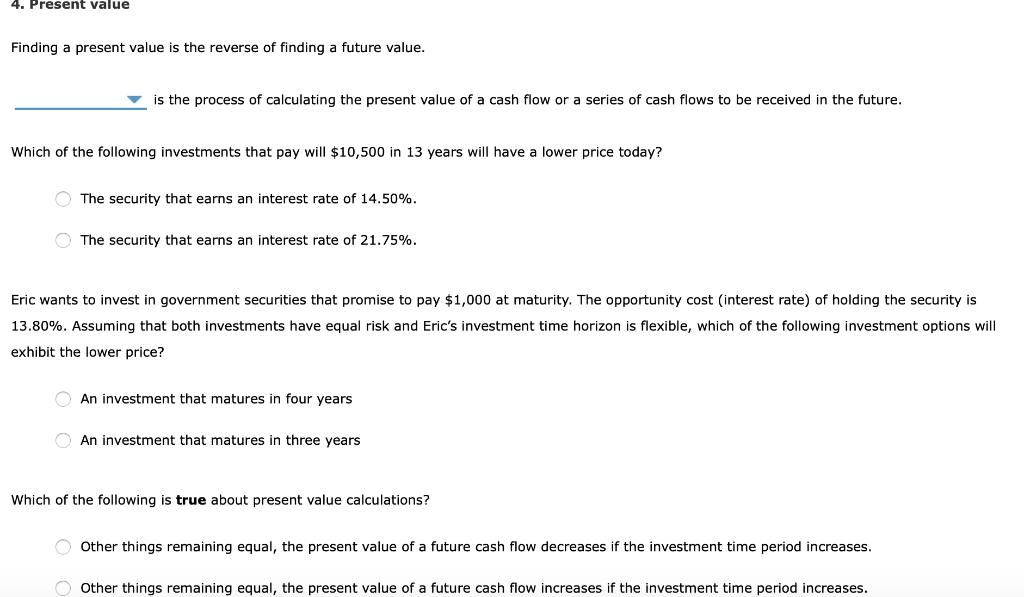

Solved 4 Present Value Finding A Present Value Is The Cheggођ Finance questions and answers. problem 52 intro find the present values of these annuities due. attempt 1 10 for 10 pts. part 1 what is the present value of $4,000 per month for one year with an annual interest rate of 8.4% (apr with monthly compounding)? no decimals submit part 2 what is the present value of $6,000 per quarter for 5 years with. The present value formula is pv=fv (1 i) n, where you divide the future value fv by a factor of 1 i for each period between present and future dates. input these numbers in the present value calculator for the pv calculation: the future value sum fv. number of time periods (years) t, which is n in the formula. To calculate the present value of future incomes, you should use this equation: pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an.

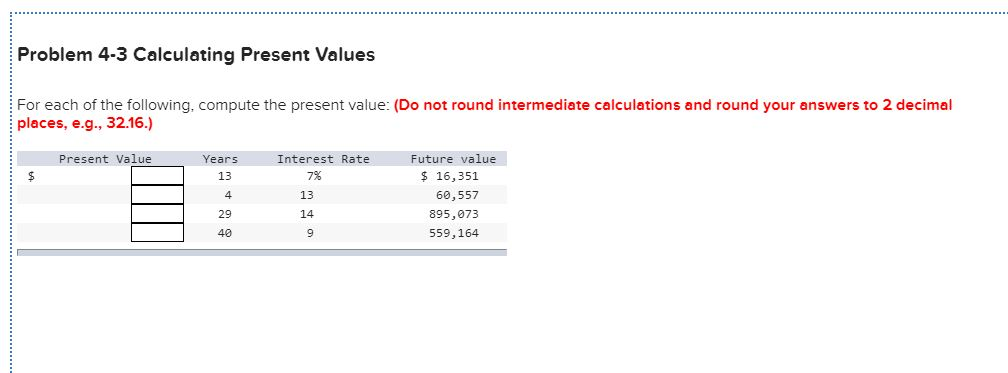

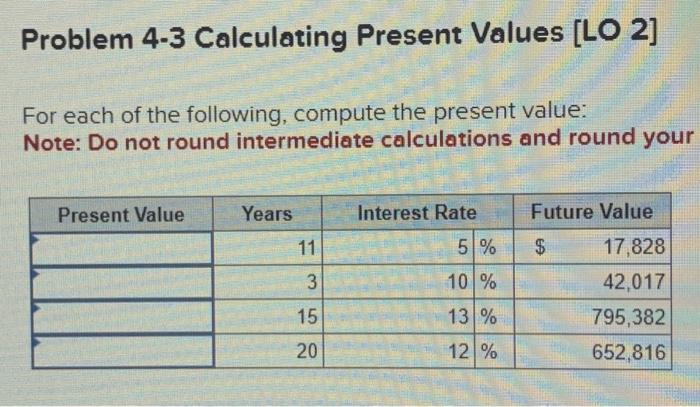

Solved Problem 4 3 Calculating Present Values Lo 2 For Each Chegg To calculate the present value of future incomes, you should use this equation: pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an. To calculate the present value of an ordinary annuity, we use the following formula: pva = pmt × ( (1 i) (1 (i × (1 i)^n))) here are the steps: get the payment amount (e.g. $7,000), the interest (5%), and the number of years (4). substitute these values: pva = $7,000 × ( (1 0.05) (1 (0.05 × (1 0.05) 4))). Present value. present value, or pv, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. net present value. a popular concept in finance is the idea of net present value, more commonly known as npv.

Solved Problem 4 3 Calculating Present Values For Each Of Chegg To calculate the present value of an ordinary annuity, we use the following formula: pva = pmt × ( (1 i) (1 (i × (1 i)^n))) here are the steps: get the payment amount (e.g. $7,000), the interest (5%), and the number of years (4). substitute these values: pva = $7,000 × ( (1 0.05) (1 (0.05 × (1 0.05) 4))). Present value. present value, or pv, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. net present value. a popular concept in finance is the idea of net present value, more commonly known as npv.

Solved Problem 4 3 Calculating Present Values Lo 2 For Chegg

Comments are closed.