Self Cheque Filling Example Features Benefits Gst Portal India

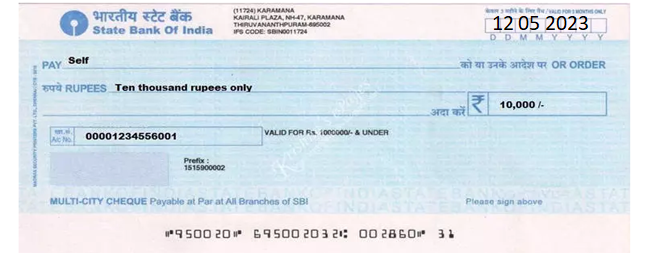

Self Cheque Filling Example Features Benefits Gst Portal India Then, fill in the date field with the current date on which you are writing the self cheque. after that, in the amount section, write the specific amount you wish to withdraw from your bank account in figures. for example, if you want to withdraw rs. 10,000, write “10,000.00” in this space. then, in the amount section, write out the amount. You can identify a cheque as a stale cheque when you will see a date on the cheque is 3 months before the present date. for example let’s suppose in the above cheque image, today is date 15.12.2023 but the cheque has a date of 11.09.2023 then it will be valid for a deposit up to 11.12.2023.

Self Cheque Filling Example Features Benefits Gst Portal India Goods and services tax. help desk number: 1800 103 4786. A self cheque is a cheque that is issued by the drawer to his her self for the purpose of cash withdrawal from his her bank account. the self cheque can be issued by a company, entity, or an individual to withdraw cash from their bank account. this kind of cheque is needed to withdraw cash from the current or say business account. Also, the increased rate of gst in service sector has further increased the payouts by 3% as gst @18% is payable in exception to the old 15% service tax. advantages – the pros of gst, classification has become easier, better compliances and tracking, single window clearances (swc), complete set off of itc, dual gst model. Gst eliminates the cascading effect of tax. gst is a comprehensive indirect tax that was designed to bring indirect taxation under one umbrella. more importantly, it is going to eliminate the cascading effect of tax that was evident earlier. cascading tax effect can be best described as ‘tax on tax’. let us take this example to understand.

Comments are closed.