Sales Tax Chart 8 25 Google Search Sales Tax Chart

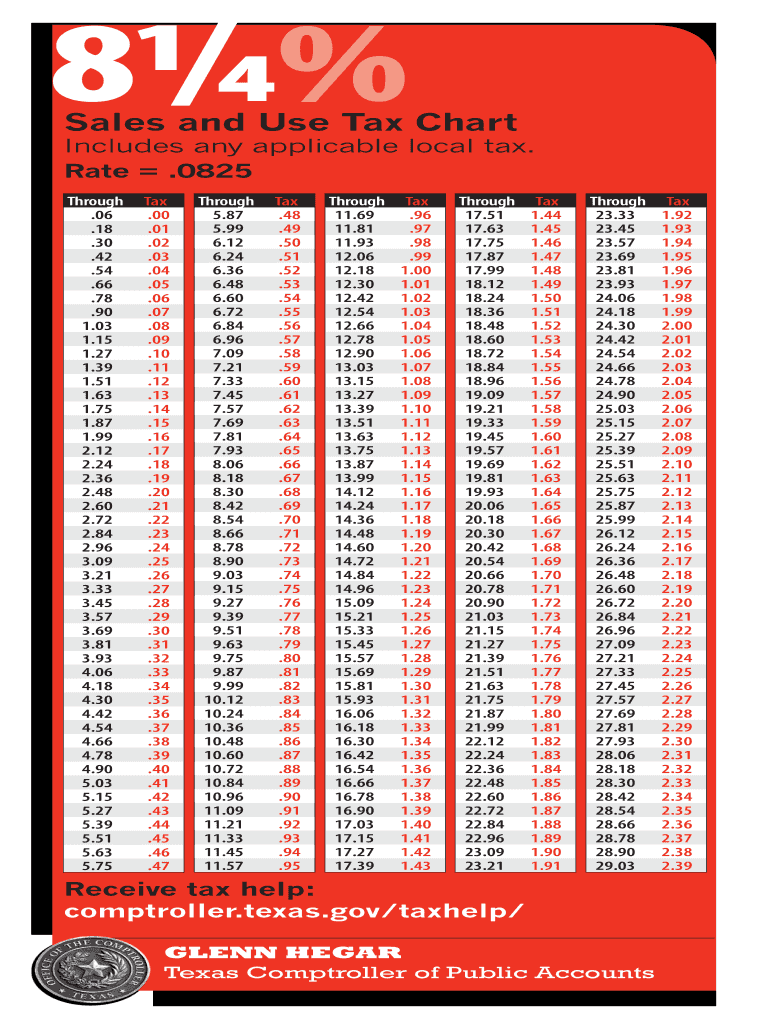

Printable Sales Tax Chart Printable 8.25% sales tax table. a sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price simply round to the nearest $0.20, and find the row in the sales tax chart that shows the applicable tax for that amount. you can fully customize this tax table for any sales tax. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price simply round to the nearest $0.20, and find the row in the sales tax chart that shows the applicable tax for that amount. you can fully customize this tax table for any sales tax rate, price increment, or.

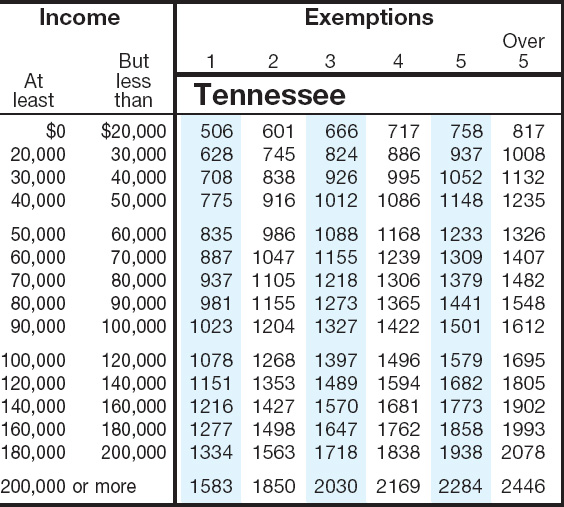

Sales Tax Chart Printable 8.25% sales and use tax chart; price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax price up to tax; 129.03: 10.64: 133.63: 11.02. Some facts about sales tax 8.25%. it is precisely this percentage tax that is levied in texas and nevada; payment of sales tax impoverishes citizens on average by only 2 percent. depending on the state, sales taxes provide between 20% and 60% of state revenue. an alternative to sales tax is value added tax. The countries that define their "sales tax" as a gst are spain, greece, india, canada, singapore, and malaysia. free calculator to find the sales tax amount rate, before tax price, and after tax price. also, check the sales tax rates in different states of the u.s. Sales tax rate = sales tax percent 100. sales tax = list price * sales tax rate. total price with tax = list price sales tax, or. total price with tax = list price (list price * sales tax rate), or. total price with tax = list price * ( 1 sales tax rate) if you need to calculate state sales tax, use tax and local sales tax see the state.

Sales Tax By State Chart The countries that define their "sales tax" as a gst are spain, greece, india, canada, singapore, and malaysia. free calculator to find the sales tax amount rate, before tax price, and after tax price. also, check the sales tax rates in different states of the u.s. Sales tax rate = sales tax percent 100. sales tax = list price * sales tax rate. total price with tax = list price sales tax, or. total price with tax = list price (list price * sales tax rate), or. total price with tax = list price * ( 1 sales tax rate) if you need to calculate state sales tax, use tax and local sales tax see the state. The salestaxhandbook sales tax calculator is a free tool that will let you look up sales tax rates, and calculate the sales tax owed on a taxable purchase, for anywhere in the united states. just enter the zip code of the location in which the purchase is made! keep in mind that sales tax jurisdiction rules can sometimes be too complicated to. Sales tax calculator. amount $ tax inclusive; tax exclusive; tax rate % includes tax. net amount (excluding tax) $100.00. tax (8.875%) $8.88. gross amount (including.

Printable Sales Tax Chart The salestaxhandbook sales tax calculator is a free tool that will let you look up sales tax rates, and calculate the sales tax owed on a taxable purchase, for anywhere in the united states. just enter the zip code of the location in which the purchase is made! keep in mind that sales tax jurisdiction rules can sometimes be too complicated to. Sales tax calculator. amount $ tax inclusive; tax exclusive; tax rate % includes tax. net amount (excluding tax) $100.00. tax (8.875%) $8.88. gross amount (including.

Comments are closed.