Rbi Repo Rate India Central Bank Hikes Interest Rates Afte

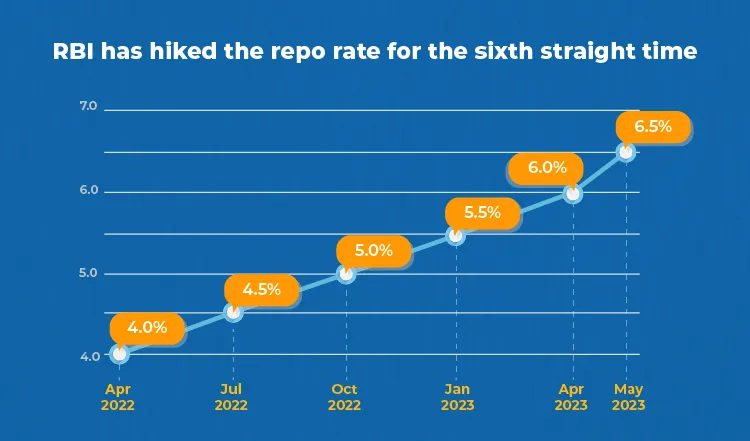

Rbi Repo Rate 2023 History Graph Chart And Potential Impact Of High The reserve bank of india (rbi) raised the repo rate at which it lends money to commercial banks by 40 basis points to 4.4%. the rate had been reduced to a record low of 4% during the covid 19. In an effort to battle inflation, the reserve bank of india (rbi) raised the repo rate once more. the central bank raised the repo rate by 25 basis points (bps; 100 bps = 1%) to 6.50% in its most recent monetary policy statement on february 8, 2023. following the rbi hike, the following banks increased their lending rates. rbi rate hike.

Rbi Repo Rate India Central Bank Hikes Interest R The reserve bank of india (rbi) surprised markets by holding its key repo rate steady on thursday after six consecutive hikes, saying it was closely monitoring the impact of recent global. The reserve bank of india (rbi) increased the repo rate once more in an effort to combat inflation. in its latest monetary policy announcement on september 30, 2022, the central bank raised the repo rate by 50 basis points (bps; 100 basis points = 1%) to 5.90%. To reduce continuing inflation challenges, the reserve bank of india (rbi) lifted its key repo rate, or the key lending rate, by 35 basis points on wednesday, to 6.25% from 5.90%. Punjab national bank: the state owned bank has increased the repo linked lending rate from 6.5 per cent to 6.9 per cent with effect from june 1 for existing customers, according to an official.

Repo Rate And Reverse Repo Rate 2023 By Rbi To reduce continuing inflation challenges, the reserve bank of india (rbi) lifted its key repo rate, or the key lending rate, by 35 basis points on wednesday, to 6.25% from 5.90%. Punjab national bank: the state owned bank has increased the repo linked lending rate from 6.5 per cent to 6.9 per cent with effect from june 1 for existing customers, according to an official. While the current repo rate of 4.9% is still not as high as the pre pandemic level of 5.15%, the common man will feel the pinch because of higher consumer inflation. on wednesday, the rbi raised. Bank credit rose (y o y) by 11.1 per cent as on april 22, 2022. india’s foreign exchange reserves declined by us$ 6.9 billion in 2022 23 (up to april 22) to us$ 600.4 billion. 5. in march 2022, headline cpi inflation surged to 7.0 per cent from 6.1 per cent in february, largely reflecting the impact of geopolitical spillovers.

Repo Rate Current Repo Rate In India 18 Aug 2024 While the current repo rate of 4.9% is still not as high as the pre pandemic level of 5.15%, the common man will feel the pinch because of higher consumer inflation. on wednesday, the rbi raised. Bank credit rose (y o y) by 11.1 per cent as on april 22, 2022. india’s foreign exchange reserves declined by us$ 6.9 billion in 2022 23 (up to april 22) to us$ 600.4 billion. 5. in march 2022, headline cpi inflation surged to 7.0 per cent from 6.1 per cent in february, largely reflecting the impact of geopolitical spillovers.

Comments are closed.