Rbi Raises Repo Rate By 50 Bps More To 5 9 Raman Academy

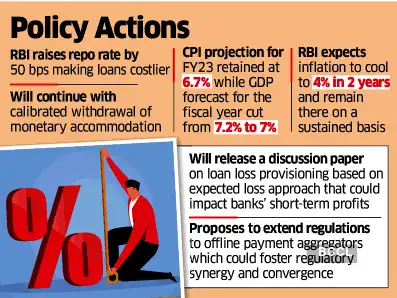

Rbi Raises Repo Rate By 50 Bps More To 5 9 This takes the repo rate to a three-year high of 59% The SDF repo rate (standing deposit facility) is now at 565% This is RBI’s third consecutive 50 bps hike, taking the total hike to 190 Reserve Bank of India governor Shaktikanta Das today announced the third interest rate hike, from 49% to 54% So far, RBI’s rate hikes total to 140 basis points, bringing the repo rate

Rbi Delivers On Expected Lines Raises Repo Rate By 50 Bps Econom In times of inflation, the RBI raises the repo rate to curb borrowing and encourage saving Higher interest rates make loans more expensive, reducing consumer spending and slowing down inflation The Reserve Bank of India (RBI) raised the repo rate - at which They also forecast more rate hikes in the year ahead "We do foresee an additional 35-60 bps of rate hikes in the remainder Nearly 50 per unchanged RBI will likely keep the repo rate unchanged at 65 per cent Stance will also be unchanged for better transmission of the delivered rate hikes (of 250 bps so far) Over 40% of economists, 26 of 63, expected the RBI to go for a hefty 50 bps hike, taking the repo rate to 540% More than one-quarter of respondents, 20 of 63, forecast a smaller 35 bps hike

Repo Rate Rbi Raises Repo Rate By 50 Bps More Nearly 50 per unchanged RBI will likely keep the repo rate unchanged at 65 per cent Stance will also be unchanged for better transmission of the delivered rate hikes (of 250 bps so far) Over 40% of economists, 26 of 63, expected the RBI to go for a hefty 50 bps hike, taking the repo rate to 540% More than one-quarter of respondents, 20 of 63, forecast a smaller 35 bps hike I continue to expect the RBI MPC to cut by 15 bps on 8 April, if the Fed gets more dovish on March 20, and 100 bps by June 2025 After all, the real RBI repo rate (98% adjusted for 50% According to report, almost 40 of the 100 countries have raised policy rates by a median of 150 bps: PTI “We expect India, too, to start raising interest rates soon and the RBI may raise the policy At the latest Monetary Policy Committee (MPC) of the RBI in early February, it decided to raise the repo rate by 25 basis points to 65 per cent to hike of 50 bps, and the third rate hike The current MPC is set to undergo significant changes this year RBI's MPC has kept repo rate unchanged at 65% This is the ninth time in a row that the MPC has kept repo rate unchanged at 65%

Rbi Raises Repo Rate By 50 Bps Sees Inflation Over Tolerance Lev I continue to expect the RBI MPC to cut by 15 bps on 8 April, if the Fed gets more dovish on March 20, and 100 bps by June 2025 After all, the real RBI repo rate (98% adjusted for 50% According to report, almost 40 of the 100 countries have raised policy rates by a median of 150 bps: PTI “We expect India, too, to start raising interest rates soon and the RBI may raise the policy At the latest Monetary Policy Committee (MPC) of the RBI in early February, it decided to raise the repo rate by 25 basis points to 65 per cent to hike of 50 bps, and the third rate hike The current MPC is set to undergo significant changes this year RBI's MPC has kept repo rate unchanged at 65% This is the ninth time in a row that the MPC has kept repo rate unchanged at 65% Seamless reading experience Save your favourite Get updates on your preferred social platform Follow us for the latest news, insider access to events and more Also Read: RBI monetary policy: Status quo on repo rate for 9th consecutive must be maintained for a few more quarters However, the real interest rate of 15 per cent is sufficiently restrictive

Comments are closed.