Pros Cons Of Accredited Debt Relief

Pros Cons Of Accredited Debt Relief There are two ways to contact accredited debt relief customer support if you run into issues. email customerservice@acrelief . call 877 201 2548 on weekdays from 5 a.m. to 9 p.m. pt and on. Pros. reduced debt by up to 40%, minus fees. debt consolidation without a loan or bankruptcy. tailored debt relief programs. cons. fees of up to 25% of your enrolled balance. minimum $15,000 in.

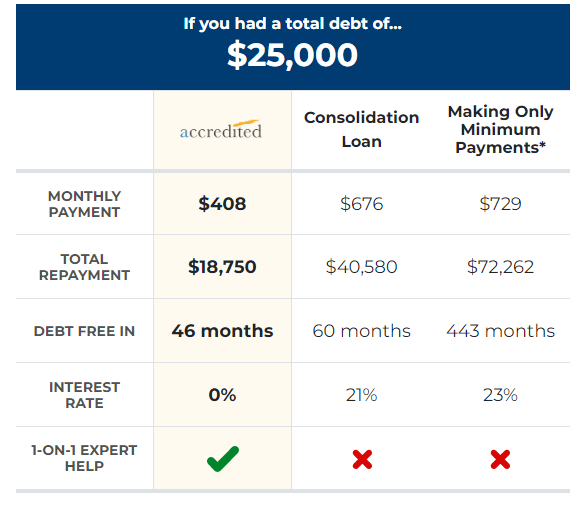

Accredited Debt Relief Review вђ Features Pros And Cons Updated thu, jul 25 2024. liz knueven. one of the top debt settlement companies in the u.s., accredited debt relief claims it can cut clients' payments and get them debt free in as little as two. Debt consolidation loans can offer lower fixed interest rates, a fixed monthly payment plan and a set repayment schedule. a balance transfer credit card can get you 0 percent apr for up to 18. Accredited debt relief has a score of 4.9 on trustpilot, with over 3,700 excellent customer reviews. users often speak of the company's professionalism, thoroughness, and responsiveness to customers. they also have an a bbb rating, with many customer reviews praising their customer service and efficient resolutions. It’s also important to understand the pros and cons of debt consolidation. 2. credit counseling accredited debt relief weighs in by forbes advisor brand group. more resources. sep 17, 2024.

Comments are closed.