Prevent Pin Fraud Scams

Prevent Pin Fraud Scams Contact your bank and other organizations immediately to let them know. 4. you find transactions you don’t remember making. if you’re checking your online credit card statement and you notice several transactions that you don’t remember making, you might be the victim of a sim swap scam. Protect the physical device. this means using facial recognition or fingerprint scanning options common in smartphones, velasquez says, along with a pin. protect the physical sim. you can lock your sim with a numerical pin you'll have to enter every time you restart a device or remove a sim. you can create such a pin inside the settings on your.

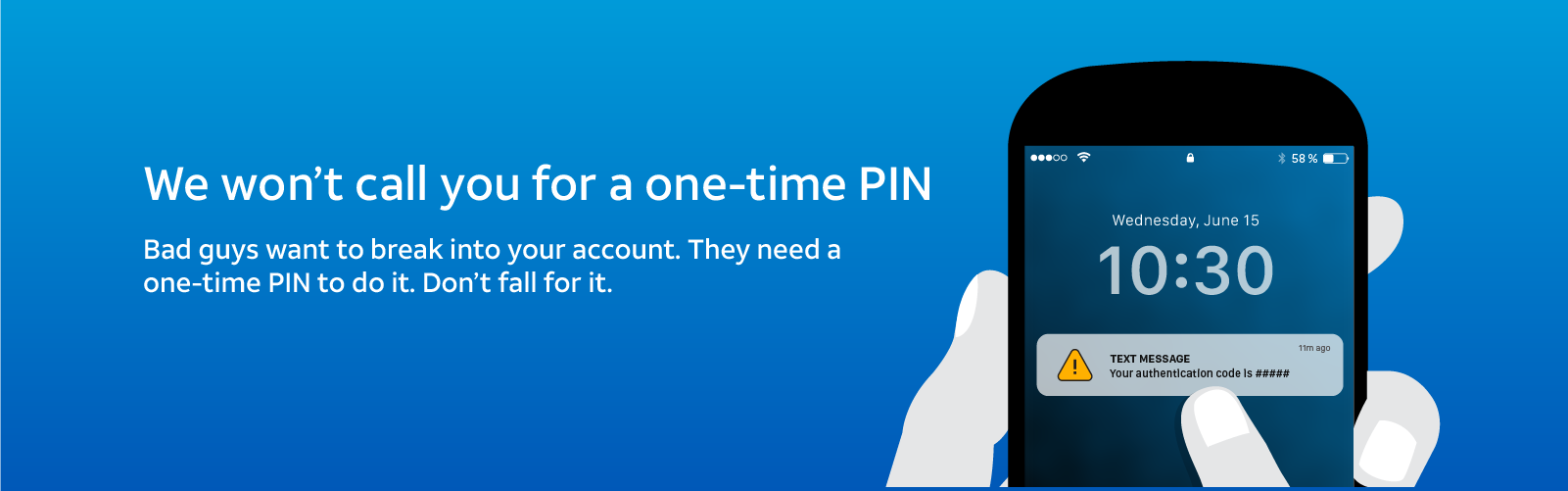

Prevent Pin Fraud Scams Sim swapping, sometimes called a sim hijacking attack, occurs when the device tied to a customer’s phone number is fraudulently manipulated. fraudsters usually employ sim swapping as a way to receive one time security codes from banks, cryptocurrency exchanges, and other financial institutions. Contact one of the three credit bureaus (equifax, experian, or transunion) and request a fraud alert. you can do this online in under 30 minutes. file a report on the bbb scam tracker. this tool collects and presents scam data to prevent others from falling prey to similar attacks. don’t engage with the attacker. attackers may attempt to. Typically, loss of service on your device – your phone going dark or only allowing 911 calls – is the first sign this has happened. if you suspect you have been a victim of a porting out scam, take immediate action: contact your phone company. contact your bank and other financial institutions. file a police report. What is a sim swap. a sim swap is when cybercriminals trick a cellular service provider into switching a victim’s service to a sim card that they control — essentially hijacking the victim’s phone number. the main aim of sim swapping is usually to exploit two factor authentication to gain fraudulent access to bank accounts.

Snap Benefits California Change Your Ebt Card Pin Now To Avoid Food Typically, loss of service on your device – your phone going dark or only allowing 911 calls – is the first sign this has happened. if you suspect you have been a victim of a porting out scam, take immediate action: contact your phone company. contact your bank and other financial institutions. file a police report. What is a sim swap. a sim swap is when cybercriminals trick a cellular service provider into switching a victim’s service to a sim card that they control — essentially hijacking the victim’s phone number. the main aim of sim swapping is usually to exploit two factor authentication to gain fraudulent access to bank accounts. Here are a few steps you can take to stay safe. 1. protect your phone and sim. most phones ship with several protection methods, including pins, passwords, patterns, fingerprint scanners, and. If you suspect a sim swapping attack, take immediate action to secure your bank accounts and credit lines, change your passwords, and contact the police to file a report. prevention includes using app based authentication or physical security keys, rather than sms based 2fa. you think you’re making all the right moves.

Comments are closed.