Pin On I

How To Turn Sim Pin On And Off On Iphone Using an ip pin to file. enter the six digit ip pin when prompted by your tax software product or provide it to your trusted tax professional preparing your tax return. the ip pin is used only on forms 1040, 1040 nr, 1040 pr, 1040 sr, and 1040 ss. correct ip pins must be entered on electronic and paper tax returns to avoid rejections and delays. Step 2: find the location where you want to drop a pin. navigate to the location on the map where you wish to drop the pin. you can do this by scrolling and zooming on the map until you find the exact spot. alternatively, you can type an address or a place’s name in the search bar at the bottom of the screen.

How To Require A Pin Number To Unlock Iphone 5 Live2tech An identity protection pin (ip pin) is a unique six digit number known only to the taxpayer and the irs; it helps prevent the misuse of the taxpayer’s social security number (ssn) or individual taxpayer identification number (itin) on fraudulent federal income tax returns. in calendar year 2022, about 525,000 taxpayers opted in to the irs’s. 2. use the online tool to get an ip pin. after you create an online account, use the “get an ip pin” button on the irs website to register for a pin. you can access the ip pin tool from mid. If an ip pin isn't entered correctly, we'll reject the return and you'll need to enter the correct ip pin to e file it again. paper return: if you have an ip pin, you're the primary and or secondary taxpayer, and you fail to enter your ip pin correctly, your return will take longer to process while we validate the information. Change or reset your pin. windows 11 windows 10. a pin is a user defined set of numbers, or a combination of numbers and letters, that allows you to sign in to your windows device instead of a password. your pin is securely stored on your device, it isn’t transmitted anywhere, and it isn’t stored on a server. this makes it more secure than.

If You Like It Then You Shoulda Put A юааpinюаб On It таф Ned Martinтащs Amused If an ip pin isn't entered correctly, we'll reject the return and you'll need to enter the correct ip pin to e file it again. paper return: if you have an ip pin, you're the primary and or secondary taxpayer, and you fail to enter your ip pin correctly, your return will take longer to process while we validate the information. Change or reset your pin. windows 11 windows 10. a pin is a user defined set of numbers, or a combination of numbers and letters, that allows you to sign in to your windows device instead of a password. your pin is securely stored on your device, it isn’t transmitted anywhere, and it isn’t stored on a server. this makes it more secure than. Welcome to pinterest. discover recipes, home ideas, style inspiration and other ideas to try. An assistor will verify your identity and mail your ip pin to your address of record within 21 days. international users can call us at 1 267 941 1000 (not toll free) between 6 a.m. 11 p.m. eastern time. exception: it’s after october 14 and you haven’t filed your current or prior year forms 1040 or 1040 pr ss.

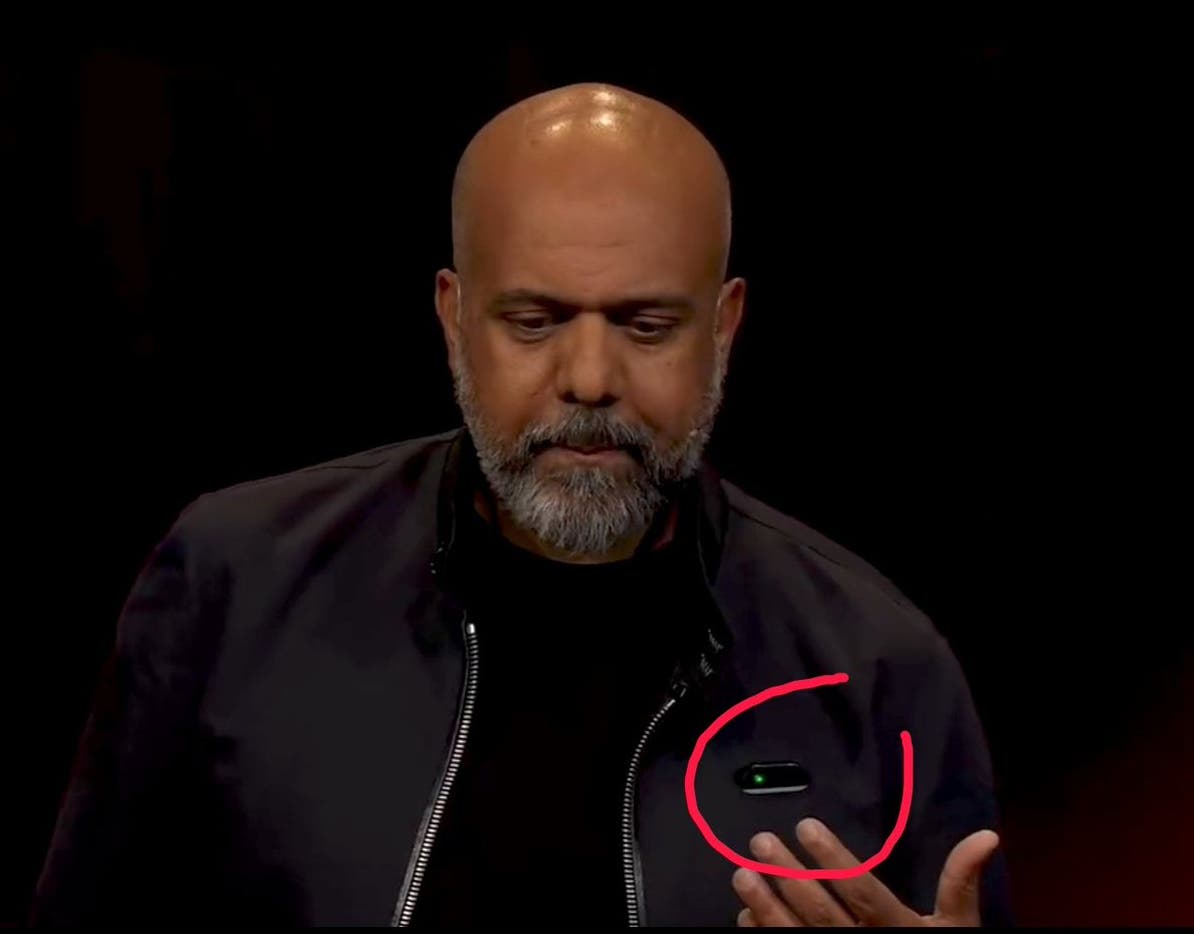

Humane Ai Pin Krok K Budoucnosti Bez Mobilnг Ch Telefonеї Nebo Pouhгў Sci Welcome to pinterest. discover recipes, home ideas, style inspiration and other ideas to try. An assistor will verify your identity and mail your ip pin to your address of record within 21 days. international users can call us at 1 267 941 1000 (not toll free) between 6 a.m. 11 p.m. eastern time. exception: it’s after october 14 and you haven’t filed your current or prior year forms 1040 or 1040 pr ss.

Comments are closed.