Municipal Bonds Vs Corporate Bonds Overview Factors Tips

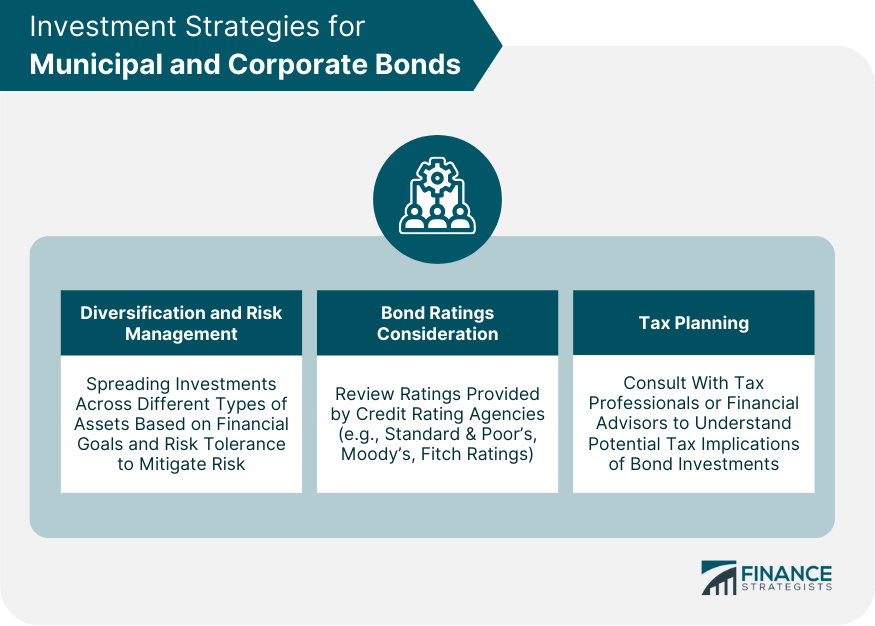

Municipal Bonds Vs Corporate Bonds Overview Factors Tips Several factors influence municipal and corporate bonds, including economic conditions, issuer credit quality, tax laws, and market demand. diversification is crucial in bond investments, as it allows investors to balance stability, tax advantages, and higher yields by including a mix of municipal and corporate bonds with different characteristics. That is, until you account for taxes. for example, a high income earner may find that investing in municipal bonds is a better fit because they are exempt from state and federal taxes. by contrast, much of the returns on corporate bonds would be erased by taxes for an investor in the highest tax bracket. 4. liquidity.

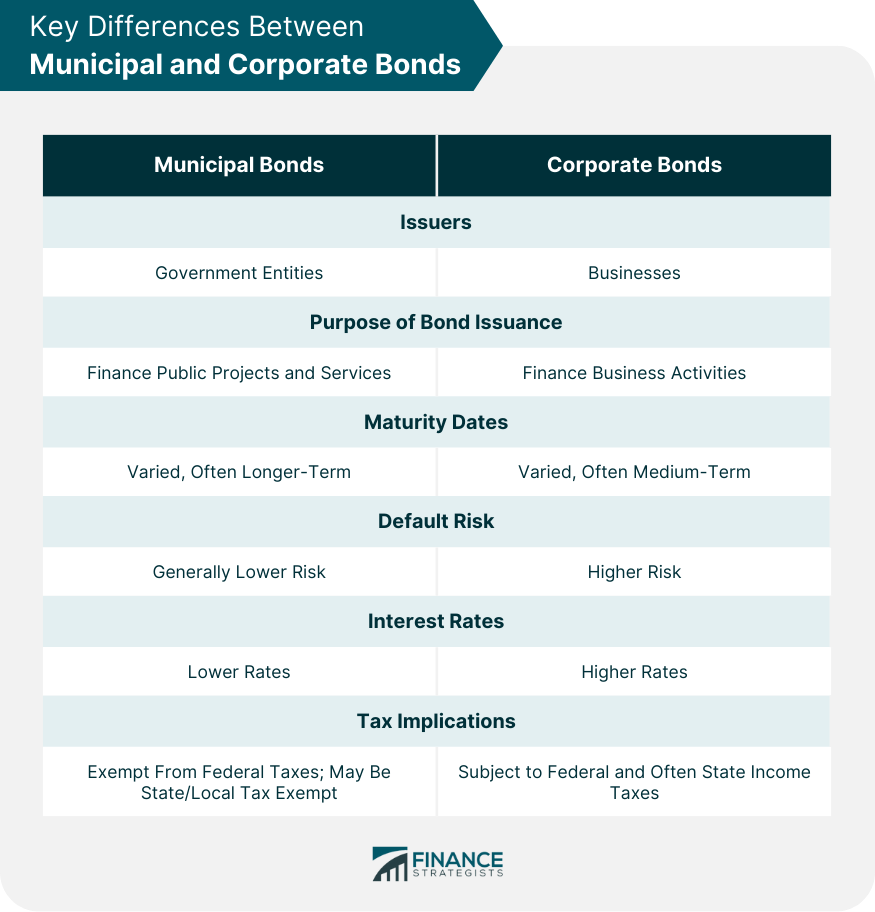

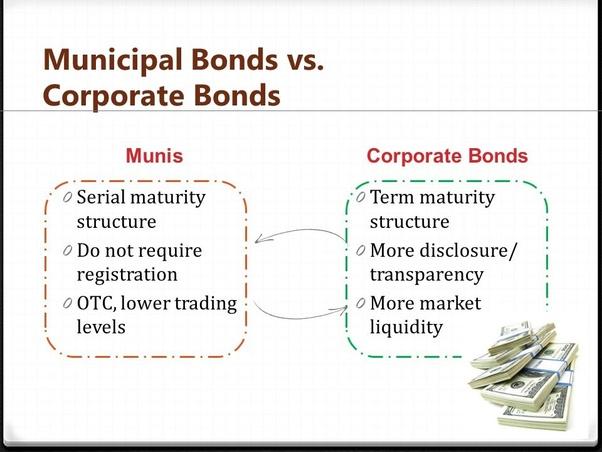

Municipal Bonds Vs Corporate Bonds Overview Factors Tips Municipal bonds vs. corporate bonds. while both municipal and corporate bonds can generate consistent income, they are distinct in several ways that can impact your investment strategy. As noted above, if it’s a tax deferred account, such as an ira or 401 (k), then corporate bonds will likely make more sense than munis. a key benefit of municipal bonds is that their coupon payments are generally exempt from federal and potentially state income taxes, and they aren’t subject to the 3.8% tax on high earners’ investment income. A corporate bond is a debt instrument issued by a company to raise capital, while a municipal bond is a bond issued by a city, town, or state to raise money for public projects. though municipal. Many retirement investors gravitate toward municipal bonds due to their preferential tax treatment. while some municipal bonds may have higher after tax yields than corporate bonds, since bondsavvy focuses on investing in bonds that can appreciate in value, a significant portion of our recommended bonds have achieved higher after tax returns than municipal bonds due to higher coupons and the.

Your Complete Guide To Municipal Bonds Credit Appraisals A corporate bond is a debt instrument issued by a company to raise capital, while a municipal bond is a bond issued by a city, town, or state to raise money for public projects. though municipal. Many retirement investors gravitate toward municipal bonds due to their preferential tax treatment. while some municipal bonds may have higher after tax yields than corporate bonds, since bondsavvy focuses on investing in bonds that can appreciate in value, a significant portion of our recommended bonds have achieved higher after tax returns than municipal bonds due to higher coupons and the. Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds. nevertheless, municipal. Different kinds of municipal bonds. there are two basic types of municipal bonds: revenue and general obligation. both types of bonds can largely eliminate the risk of default by purchasing insurance that guarantees the interest payments to investors if the issuer should become unable to do so for any reason.

Municipal Bonds Vs Corporate Bonds Overview Factors Tips Over the past 10 years, the average default rate for investment grade municipal bonds was 0.10%, compared with a default rate of 2.25% for similarly rated corporate bonds. nevertheless, municipal. Different kinds of municipal bonds. there are two basic types of municipal bonds: revenue and general obligation. both types of bonds can largely eliminate the risk of default by purchasing insurance that guarantees the interest payments to investors if the issuer should become unable to do so for any reason.

Comments are closed.