More On Fed Rate Cut Implications Sjk Wealth Management

More On Fed Rate Cut Implications Sjk Wealth Management More on fed rate cut implications. july 31, 2019 in weekly commentary by sjk. sjk wealth management. 182 west court street. doylestown, pennsylvania 18901. local. Fed meeting, we expect a 0.25% rate cut (although it’s currently a coin flip that the fed cuts by 0.50%) to take the fed funds rate back down to 5.25% (upper bound). despite the recent soft payroll report, it likely wasn’t weak enough to prompt the fed, in our view, to cut more aggressively at this meeting. along with a.

More On Fed Rate Cut Implications Sjk Wealth Management After its meeting next week, the fed will deliver two more 25 basis point rate cuts this year in november and december according to 65 of 95 economists. that was up from 55 of 101 last month. Economic data that was released before the fed meeting stole the show (more on that later). nonetheless, the fed held the policy rate unchanged in a range of 5.255.50%, where it has – remained since july 2023. further highlights from lpl’s chief economist, jeffrey roach, include:. At the latest u.s. federal reserve meeting on july 30 31, the central bank held its federal funds rate steady at a 23 year high of 5.25% 5.50% – just as it has done at each of its previous six. The federal reserve cuts interest rates to help the economy get back to normal during tough times. the chief operating officer for ritholtz wealth management llc. maggiulli has graphed the.

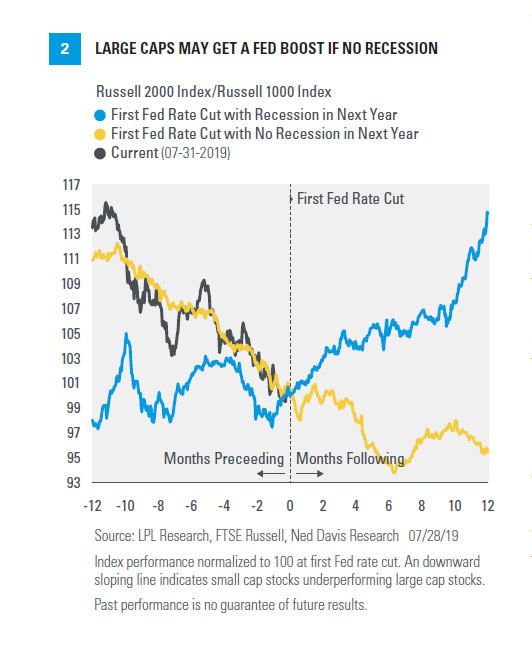

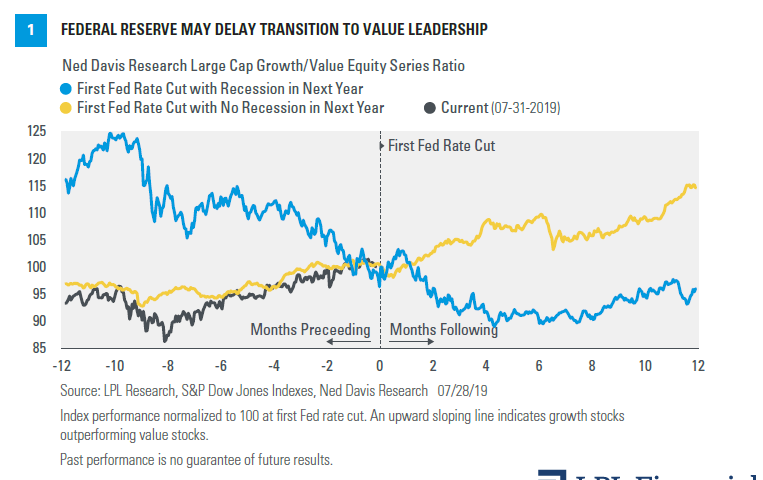

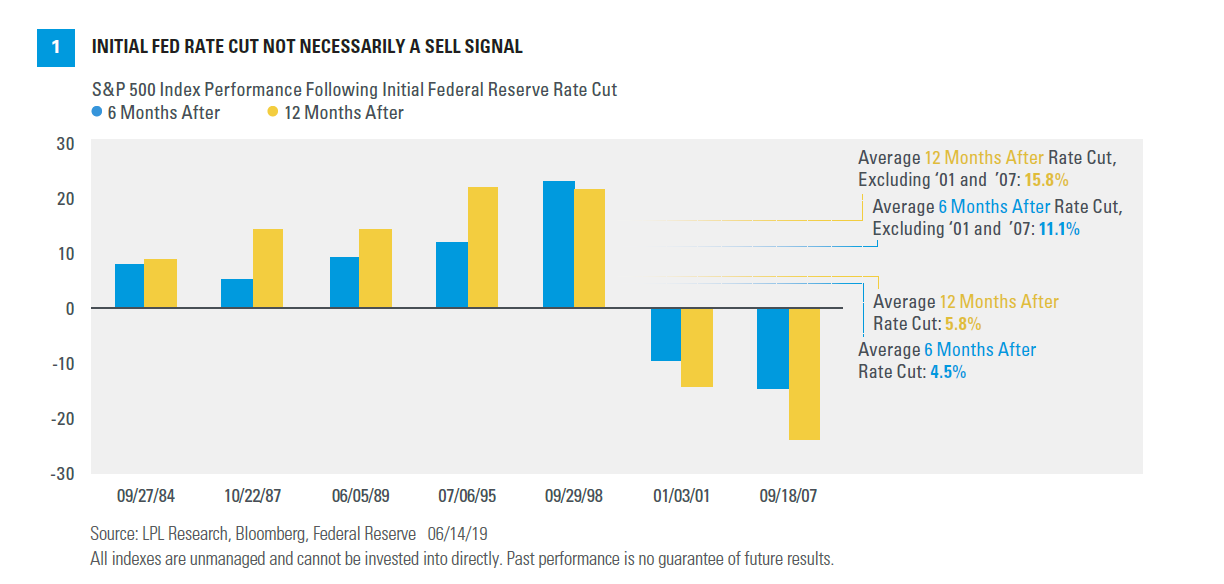

Stocks And Fed Rate Cuts Sjk Wealth Management At the latest u.s. federal reserve meeting on july 30 31, the central bank held its federal funds rate steady at a 23 year high of 5.25% 5.50% – just as it has done at each of its previous six. The federal reserve cuts interest rates to help the economy get back to normal during tough times. the chief operating officer for ritholtz wealth management llc. maggiulli has graphed the. Source rbc wealth management, bloomberg; data through 8 26 24; market interest rate expectations based on federal fund futures. equities after the first rate cut in the eleven instances of fed easing cycles that we identified since 1970, the s&p 500 has often delivered positive returns in the 12 months following the initial rate cut, with a. Of the 14 rate cycles since 1929, 12 of them saw positive s&p 500 returns for the 12 month period following the first rate cut. source: charles schwab, bloomberg, and the federal reserve. data from 08 09 1929 through 07 31 2020. indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

More On Fed Rate Cut Implications Sjk Wealth Management Source rbc wealth management, bloomberg; data through 8 26 24; market interest rate expectations based on federal fund futures. equities after the first rate cut in the eleven instances of fed easing cycles that we identified since 1970, the s&p 500 has often delivered positive returns in the 12 months following the initial rate cut, with a. Of the 14 rate cycles since 1929, 12 of them saw positive s&p 500 returns for the 12 month period following the first rate cut. source: charles schwab, bloomberg, and the federal reserve. data from 08 09 1929 through 07 31 2020. indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

Who Is Right Fed Or Markets Sjk Wealth Management

Comments are closed.