Medicare Supplement Plan N Vs Plan G

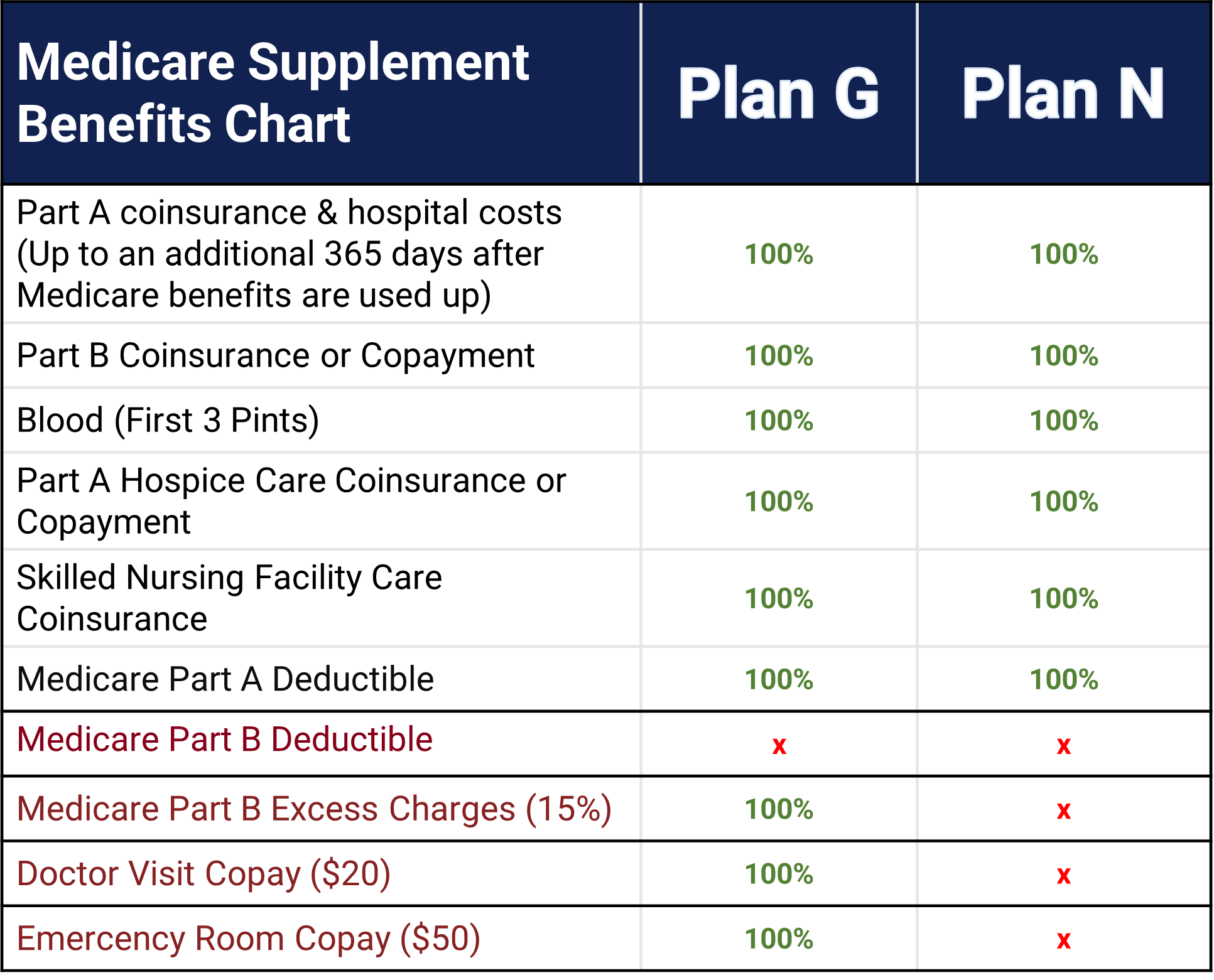

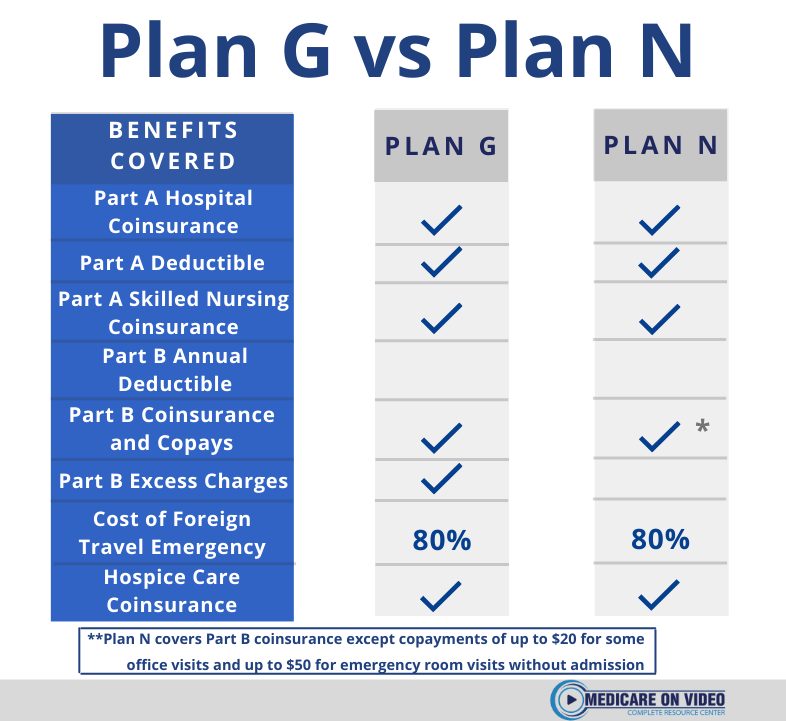

Medicare Plan G Vs Plan N Medicare Hero Medigap plans g and n are both supplemental insurance plans offered by private insurance companies to help cover medicare’s out of pocket costs. plan g is slightly more comprehensive than plan n. Compare the coverage, cost and benefits of medigap plan g and plan n, two popular medicare supplement insurance plans. learn how to choose the best plan for your needs based on your health care visits and budget.

Medicare Plan G Vs Plan N Which Is Right Plan For You In 2 This copay is relatively small for those who only visit the doctor occasionally. 2. emergency room copay: if you end up in the emergency room and are not admitted to the hospital, plan n requires up to a $50 copay. 3. part b deductible: similar to plan g, you must pay 100% of the annual medicare part b deductible. Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. Learn the differences and similarities between medicare supplement plan n and plan g, two of the most popular medigap plans. find out how to choose the best plan for your needs, budget and health status. Plan g vs plan n cost. the average monthly premium for plan g was $135 in 2023, while the average plan n premium was $110 per month. 2. typically, plan g has higher monthly premiums than plan n due to its more extensive coverage. but plan n may lead to more out of pocket expenses due to copayments and potential excess charges.

Comments are closed.