Making A Budget Consumer Gov

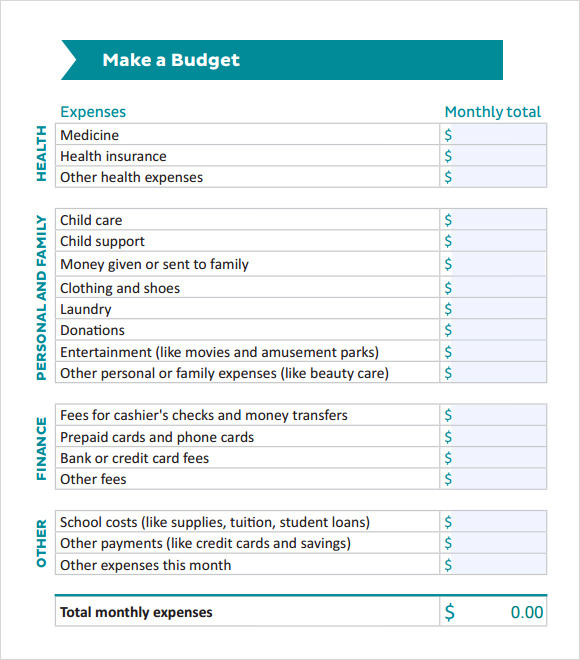

Making A Budget Consumer Gov A budget is a plan that shows you how you can spend your money every month. making a budget can help you make sure you do not run out of money each month. a budget also will help you save money for your goals or for emergencies. how do i make a budget? write down your expenses. expenses are what you spend money on. expenses include: bills:. Make a budget worksheet. use this worksheet to see how much money you spend this month. also, use the worksheet to plan for next month’s budget. pdf 1020 make budget worksheet form.pdf (507.72 kb) use this worksheet to see how much money you spend this month. also, use the worksheet to plan for next month’s budget.

Making A Budget Consumer Gov Making A Budget Budgeting Budgeting Make a budget use this worksheet to see how much money you spend this month. then, use this month’s . information to help you plan next month’s budget. some bills are monthly and some come less often. if you have an expense that does not occur . every month, put it in the “other expenses this month” category. month year. my income this. Making a budget can help you balance your income with your savings and expenses. it guides your spending to help you reach your financial goals. a budget is especially important if you: don't know where your money is going. don't save regularly. have problems paying off your debts. feel overwhelmed by your finances. Step 4: create your working budget. once you’ve identified all of your income sources and started tracking your spending and when your bills are due, our budget worksheet pulls everything together so you have a working and realistic budget. creating a budget will help you figure out if you have enough money to cover your expenses, while also. November 26, 2019. ottawa, ontario. today, the financial consumer agency of canada (fcac) launched its new budget planner tool, which will help canadians manage their financial goals. this evidence based tool uses behavioural insights, enabling users to tailor their budget to their needs. fcac’s budget planner offers instant personalized.

Make A Budget Consumer Govmy Monthly Budget Worksheet Sallie Step 4: create your working budget. once you’ve identified all of your income sources and started tracking your spending and when your bills are due, our budget worksheet pulls everything together so you have a working and realistic budget. creating a budget will help you figure out if you have enough money to cover your expenses, while also. November 26, 2019. ottawa, ontario. today, the financial consumer agency of canada (fcac) launched its new budget planner tool, which will help canadians manage their financial goals. this evidence based tool uses behavioural insights, enabling users to tailor their budget to their needs. fcac’s budget planner offers instant personalized. Personalize your budget. create a budget that suits your needs by selecting the answers that best reflect your situation. you’ll receive personalized tips, suggestions and will be able to compare your budget with those of other canadians like you. personalizing your budget will not clear previously entered data but certain fields may no. You can account for irregular expenses by budgeting a set amount, say fifty dollars every month, for unexpected costs. or by spreading a known expense, like tuition, over several months so you have the entire amount saved when you need it. step 3. subtract the expenses from your monthly income.

Consumer Gov Budget Worksheet Budgeting Worksheets Personalize your budget. create a budget that suits your needs by selecting the answers that best reflect your situation. you’ll receive personalized tips, suggestions and will be able to compare your budget with those of other canadians like you. personalizing your budget will not clear previously entered data but certain fields may no. You can account for irregular expenses by budgeting a set amount, say fifty dollars every month, for unexpected costs. or by spreading a known expense, like tuition, over several months so you have the entire amount saved when you need it. step 3. subtract the expenses from your monthly income.

Comments are closed.