Is Bank Overdraft Protection Worth It

What Is Overdraft Protection And Is It Worth It Lexington Law Overdraft protection ensures transactions still process even if there isn't enough money in your bank account. overdraft protection usually covers checks, atm, and debit card transactions. Overdraft protection is a set of measures put in place to ensure you have enough money in your bank account to conduct transactions such as debit purchases and bill payments. an overdraft on your account means the bank is attempting to make a withdrawal — like an electronic payment or atm withdrawal — and there aren’t enough funds to.

What Is Overdraft Protection Definition And Meaning Market Business News The bank may charge you for this service, but the price is usually considerably less than paying an overdraft fee. the average overdraft fee is $26.61 per transaction, according to bankrate’s. A typical overdraft fee is usually around $35, while annual overdraft protection can actually be free. in most cases, you need to link your checking account to another bank account, like a savings. Overdraft lines of credit. an overdraft line of credit functions like a credit card — but without the card. if you don’t have enough money in your account to cover a transaction, your bank. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. here’s how it works. updated thu, jan 25.

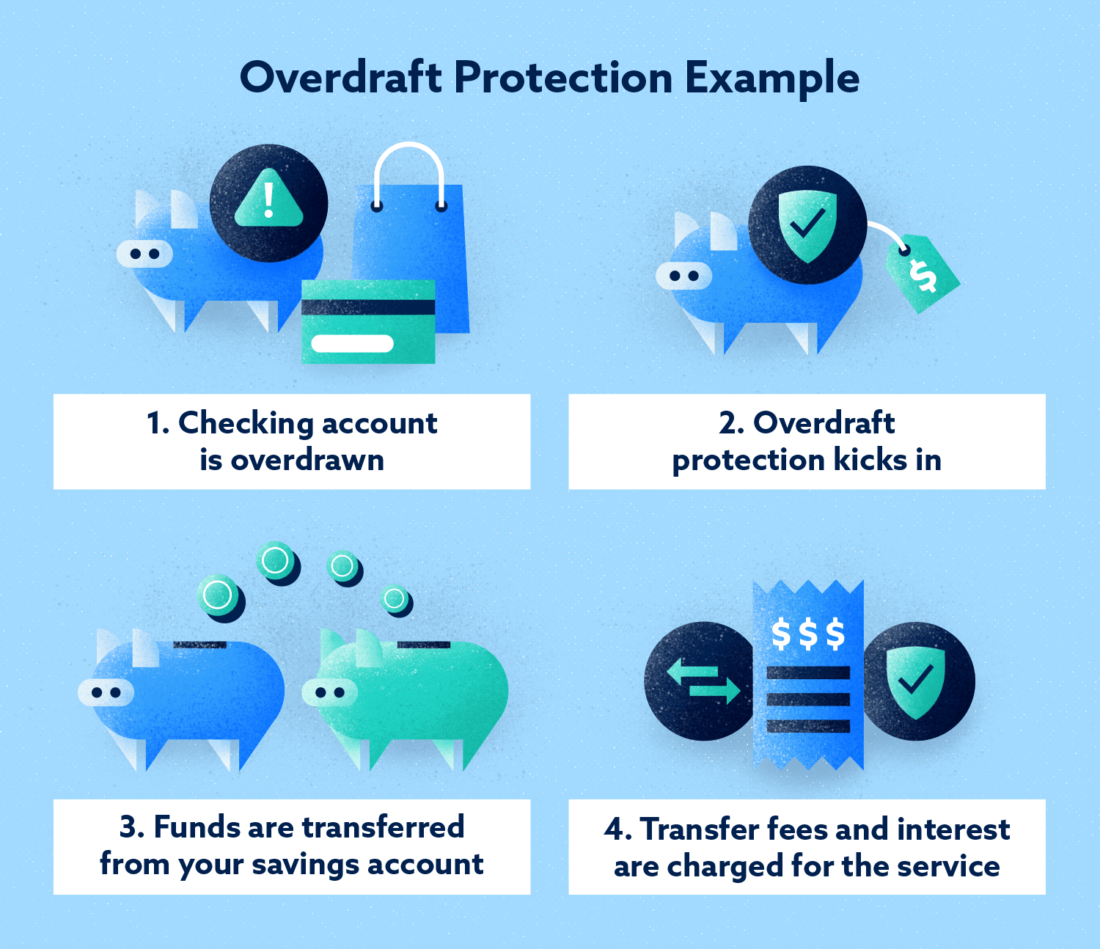

What Is Overdraft Protection And Is It Worth It Lexington Law Overdraft lines of credit. an overdraft line of credit functions like a credit card — but without the card. if you don’t have enough money in your account to cover a transaction, your bank. Overdraft protection typically allows transactions exceeding the balance in your checking account to be approved and can save you steep overdraft fees. here’s how it works. updated thu, jan 25. Banks charged $1.97 billion in overdraft fees in the second quarter of 2021 alone, according to data from s&p global market intelligence. according to forbes advisor’s 2021 checking account fees. Overdraft protection may help save you from paying overdraft and insufficient fund fees and ensure transactions are carried out as planned. the service is optional and works by designating a backup account to be drawn from if the primary account is too low to complete a payment or transaction. altogether, assessing your likelihood of.

What Is Overdraft Protection And How Does It Impact Your Credit Banks charged $1.97 billion in overdraft fees in the second quarter of 2021 alone, according to data from s&p global market intelligence. according to forbes advisor’s 2021 checking account fees. Overdraft protection may help save you from paying overdraft and insufficient fund fees and ensure transactions are carried out as planned. the service is optional and works by designating a backup account to be drawn from if the primary account is too low to complete a payment or transaction. altogether, assessing your likelihood of.

Overdraft Protection Meaning Types Fees Example What Is It

Comments are closed.