Invesco Digital Assets Etfs Blockchain Technology Exposure Invesco Us

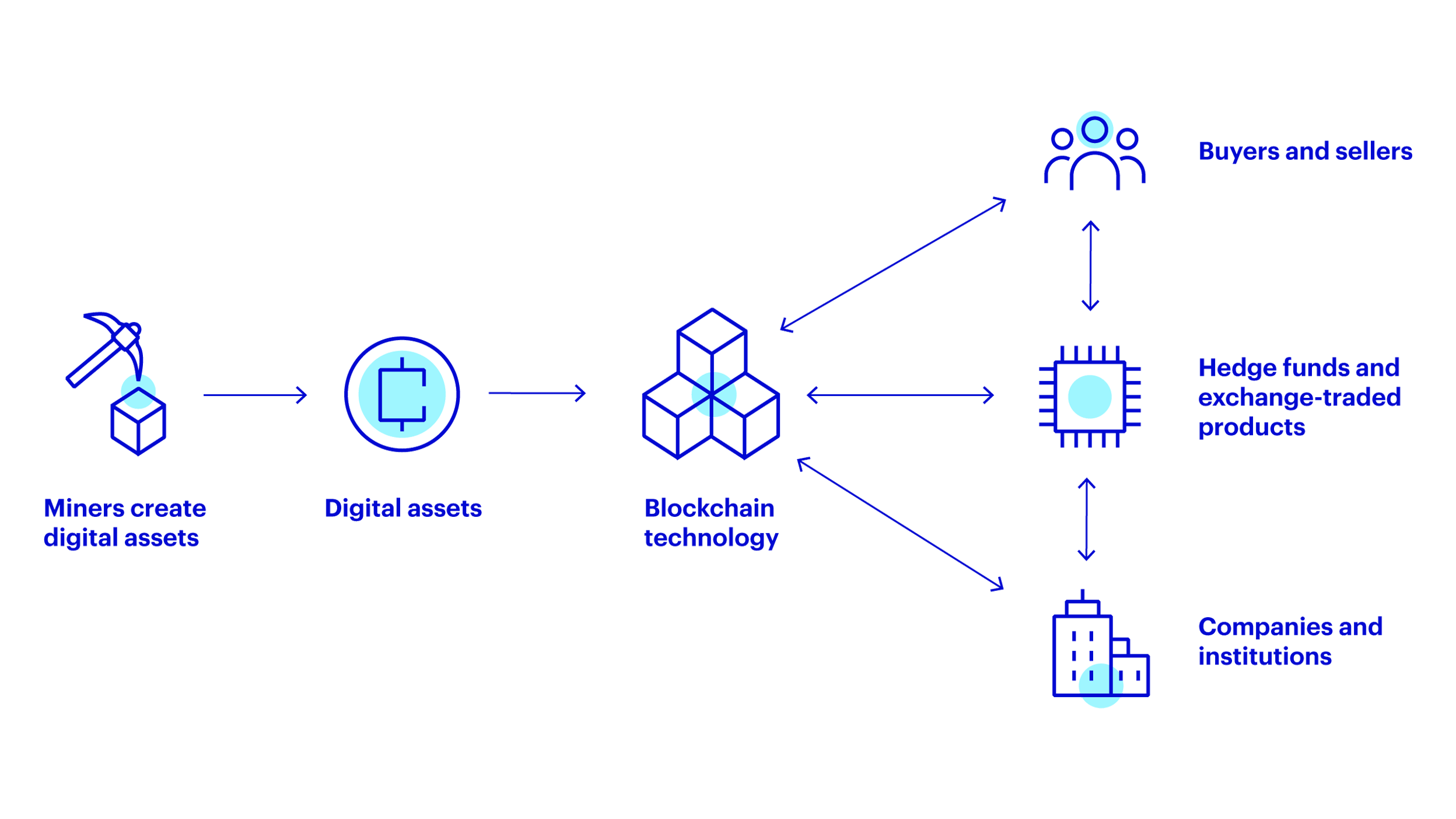

Digital Asset Etfs Easier Access To Blockchain And Crypto Invesco U "QETH joins Invesco Galaxy ETP's BTCO, SATO and BLKC in providing easier access and additional safeguards to US investors looking to create a varied digital assets portfolio with ETFs" The investment manager also had $299,900 in the ARK 21Shares Bitcoin ETF (5,000 shares), $561 million in the Invesco exposure to cryptocurrencies and digital assets Onyx is a blockchain

юааdigitalюаб юааassetsюаб The Investorтащs Guide To юааblockchainюаб And Crypto юааinvescoюаб юааus The fund is sponsored by Invesco It has amassed assets over $29739 million PSCT is a great option for investors seeking exposure to the Technology ETFs segment of the market Eight asset management firms, including Grayscale, Bitwise, Fidelity, BlackRock and Invesco ETFs may be suitable for long-term investors seeking diversification or exposure to blockchain Invesco, one of the biggest operators of ETFs in the US Blockchain Economy ETF and the Invesco Galaxy Crypto Economy ETF- that will invest in stocks focused on digital assets and technology A smart beta exchange traded fund, the Invesco S&P 500 Equal Weight Technology ETF (RSPT) debuted on 11/01/2006, and offers broad exposure assets over $323 billion, making it one of the

Comments are closed.