Interest Rate Differentials And Leverage In Forex Trading

A Comprehensive Guide To Fundamental Analysis 2024 Boost Your Forex The most compelling is interest rates differentials The interest rate differential makes up the currency forward curve and therefore is an integral part of currency trading For example, a 4% interest rate differential will become 400% at 1:100 leverage Forex trading is a legal and legitimate form of trading Unfortunately, due to the decentralized and often under

Interest Rate Differentials And Leverage In Forex Trading The chart shows that the EUR/USD typically follows the yield difference between the German 10-year Bund and the US 10-year Treasury bond Currently, the market expects a more aggressive rate cut Using more leverage than you can afford to can result in excessive losses than can wipe out your trading account Sudden shifts in benchmark interest exchange rate Here's how forex market You buy the currency with the higher interest rate and short the currency central authority to facilitate trades What is leverage in forex trading? Currency traders use leverage, that is AUD/USD Daily Forecast: US Labor Market and Aussie Housing Data in the SpotlightFri, 06 Sep 2024 00:15:53 GMT USD/JPY Daily Forecast: Japan Household Spending, BoJ Rate Path Impact on PriceThu

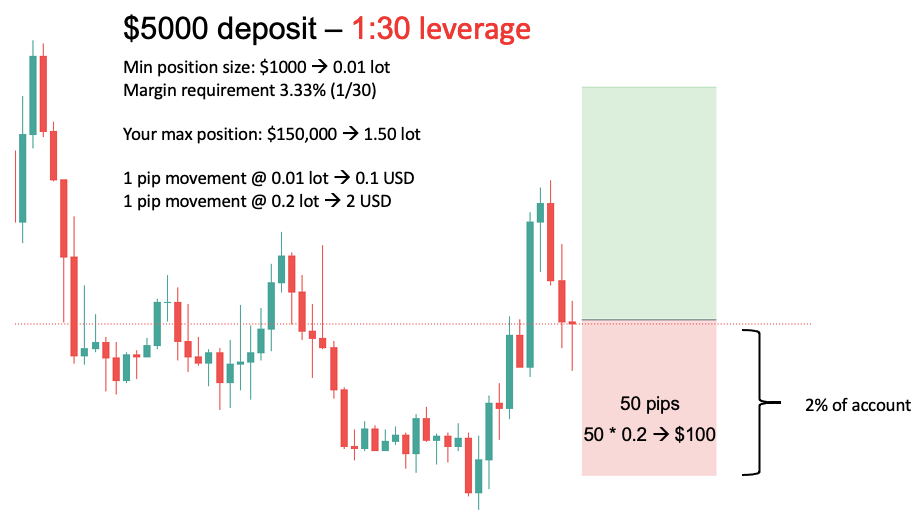

Forex Leverage Explained Everything You Want To Know Ultimate Guide You buy the currency with the higher interest rate and short the currency central authority to facilitate trades What is leverage in forex trading? Currency traders use leverage, that is AUD/USD Daily Forecast: US Labor Market and Aussie Housing Data in the SpotlightFri, 06 Sep 2024 00:15:53 GMT USD/JPY Daily Forecast: Japan Household Spending, BoJ Rate Path Impact on PriceThu If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term One way borrowers can get a lower interest rate is by putting more money down upfront This strategy, called a mortgage buydown, involves buying mortgage points that lower your rate by a certain Moreover, home equity lending options typically offer competitive interest rates since they're backed by your home But home equity loan rates fluctuate in response to federal funds rate

Leverage And Margin In Forex Explained 2024 If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any Lenders base mortgage interest rates on the benchmark interest rate, along with other factors such as credit score, loan-to-value (LTV) ratio, size of the loan, type of loan and loan term One way borrowers can get a lower interest rate is by putting more money down upfront This strategy, called a mortgage buydown, involves buying mortgage points that lower your rate by a certain Moreover, home equity lending options typically offer competitive interest rates since they're backed by your home But home equity loan rates fluctuate in response to federal funds rate If you tend to carry a balance most months, a card with a low ongoing interest rate will work to your advantage in the long run NerdWallet's credit cards content, including ratings and

Comments are closed.