Inflation Is Set To Rise Here S What That Means For Your Finances

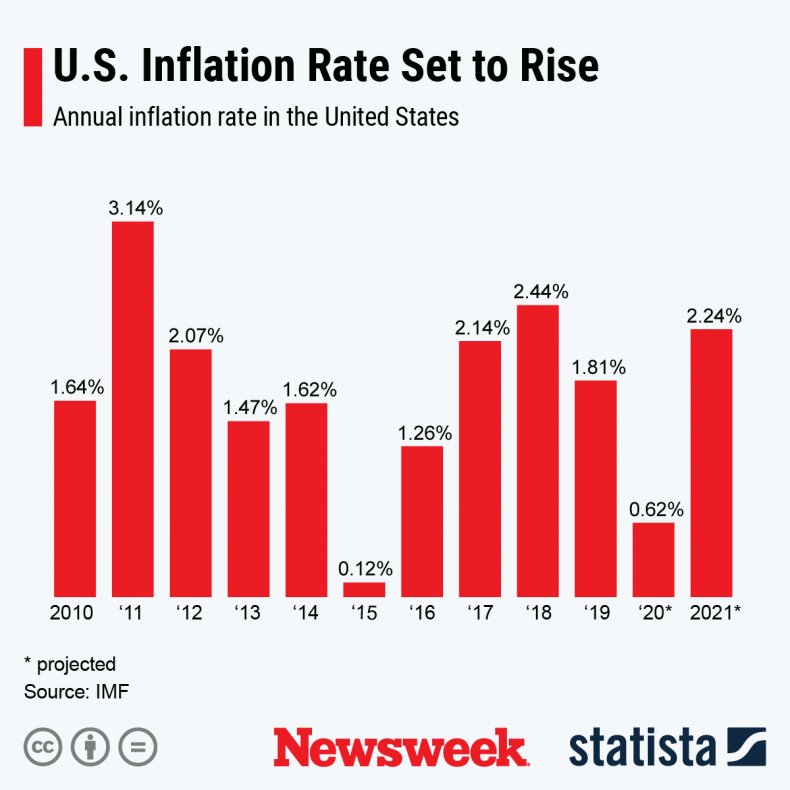

Inflation Is Set To Rise Here S What That Means For Your Finances The international monetary fund projects a 2.24 percent annual rise in the general level of prices in the u.s. until 2021, as shown in the graphic below provided by statista. this means that a. That means consumers could sock away some cash in a high interest savings account or cd and earn a rate that's 1.5 percentage point to 2 percentage point higher than the current inflation rate.

:max_bytes(150000):strip_icc()/inflation_color2-216537dd3aeb4365b991b67790765e4f.png)

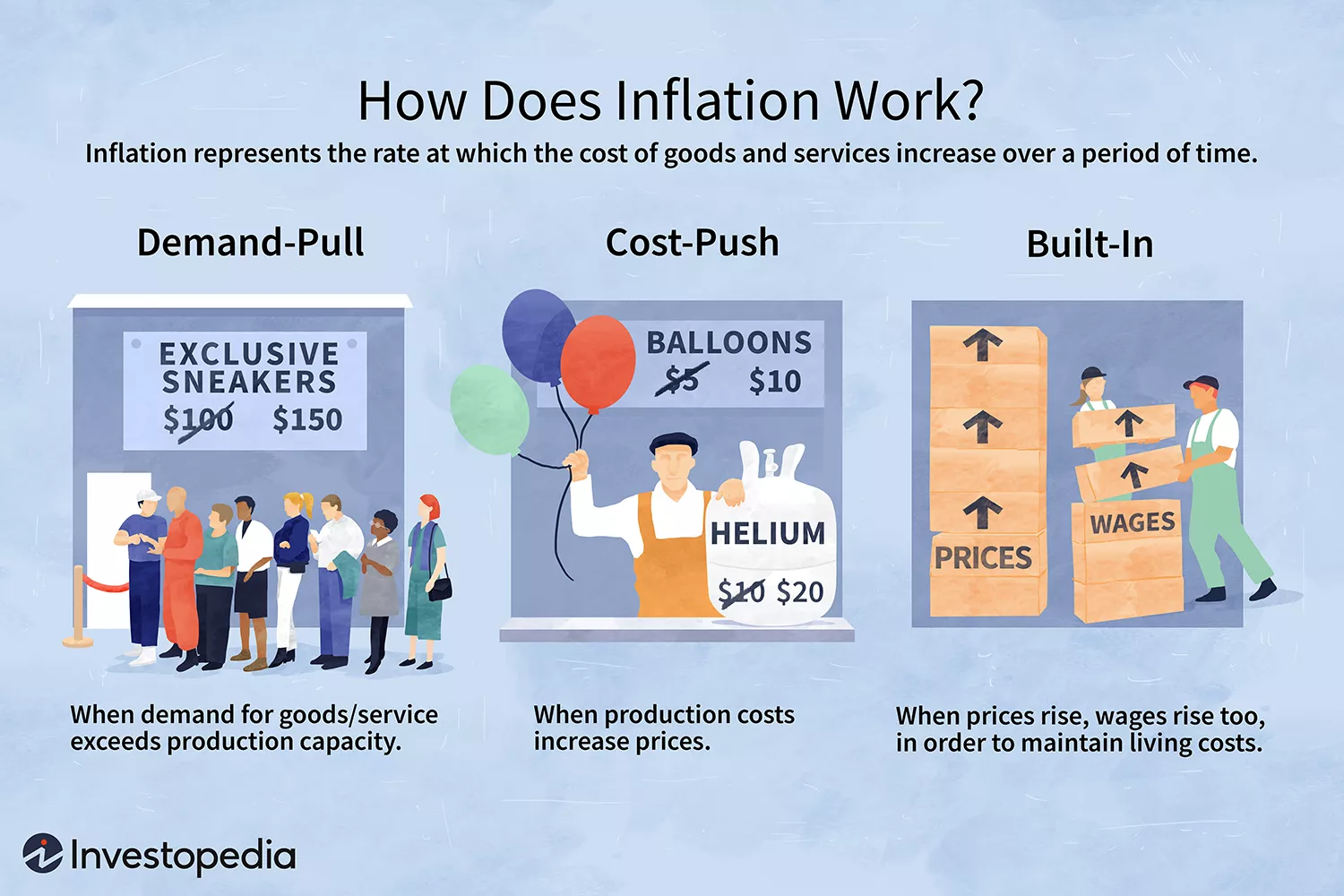

Inflation Definition Formula How To Calculate Between march 2022 and july 2023, the boc raised its key lending rate from 0.25% to 5%, with the goal of slowing price growth and reaching its 2% inflation target. with the rate of inflation. Inflation slows to 4.6% as government says pledge met. the key factor is a reduction in financial support from the government. over the course of six months last winter, almost everyone received a. The bank of canada has two tools at its disposal to maintain its target inflation rate. during an economic downturn, the bank can buy government bonds and other financial assets to drive up the. The impact of inflation on your budget and financial plan. for many canadians, wages have not kept pace with inflation. by may of 2022, average wage increases for permanent workers rose by 4.5%, at a time when inflation was at 7.7%. when your expenses increase more than your income, something has to give.

What Is Inflation And What Causes It The bank of canada has two tools at its disposal to maintain its target inflation rate. during an economic downturn, the bank can buy government bonds and other financial assets to drive up the. The impact of inflation on your budget and financial plan. for many canadians, wages have not kept pace with inflation. by may of 2022, average wage increases for permanent workers rose by 4.5%, at a time when inflation was at 7.7%. when your expenses increase more than your income, something has to give. Because rising interest rates mean a rise in the cost of borrowing, you have to pay more to borrow against your existing investments. inflation: many factors impact interest rates; inflation is one of the more important. when inflation is high, a central bank, like the bank of canada may raise interest rates to help control how people spend money. Here are some ways to counter the impact of rising policy interest rates and inflation on your finances: if you find that the price of food and gas has increased in the last year, it could be a good time to re evaluate your projects, and priorities, and update your budget. → create a simple and balanced budget in six steps.

Comments are closed.