Income Tax Slab Rate For Fy 2024 25 Image To U

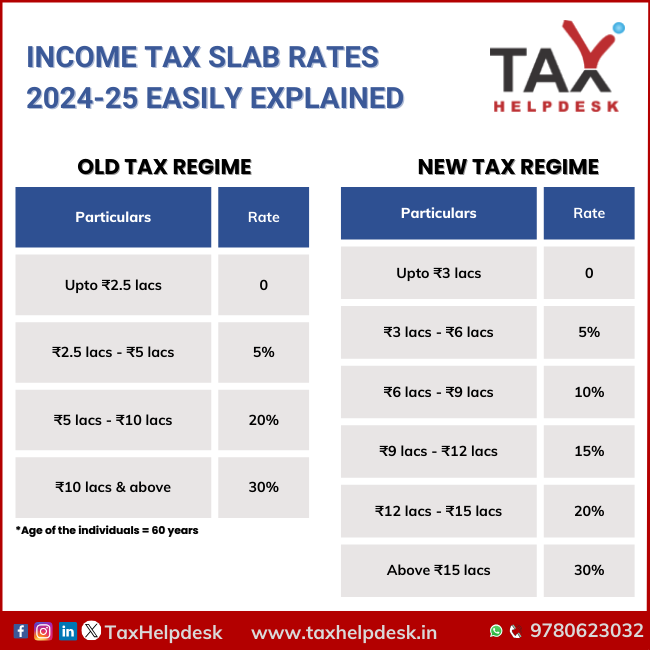

Income Tax Slab Rates 2024 25 Easily Explained Rs 5,00,001 to rs 10,00,000. 20%. rs 10,00,001 and above. 30%. the above income tax slabs table is applicable for individuals below 60 years of age. cess at 4% will be levied on the income tax amount payable. surcharge will be applicable on incomes above rs 50 lakh. Rs 12,50,001 rs 15,00,000. 25%. rs 15,00,001 and above. 30%. * tax rebate up to rs.12,500 is applicable if the total income does not exceed rs 5,00,000 (not applicable for nris) refer to the above image for the rates applicable to fy 2023 24 (ay 2024 25) for the upcoming tax filing season. b.

Income Tax Rates For Ay 2024 25 Huf Irita Sharron Budget update 2024 25. standard deduction for salaried employees increased from rs 50,000 to rs 75,000. family pension deduction increased from rs 15,000 to rs 25,000. tax rate on short term gains on certain financial assets will be 20% tax rate. other financial and all non financial assets will continue with the existing tax rate. Latest income tax slabs for fy 2024 25: here are the latest income tax slabs that will be effective for the current financial year after budget 2024. the budget was presented in july instead of february due to the lok sabha elections 2024 held in april, may, and june, as opposed to the usual february presentation. A surcharge of 7% of tax for total income between ₹1,00,00,000 and ₹10,00,00,000. a surcharge of 10% of tax if total income is more than ₹10,00,00,000. b) tax slab rates for domestic companies under new regime. as per the new regime, domestic companies have been given more leeway and concessions. For the financial year 2023 24 (assessment year 2024 25) under the new regime, the income tax slab rates are structured as follows: income slabs. income tax rates for fy 2023 24 (ay 2024 25) up to ₹3,00,000. nil. ₹3,00,000 to ₹6,00,000. 5% on income exceeding ₹3,00,000. ₹6,00,000 to ₹9,00,000.

Income Tax Slab Rates Fy 2024 25 Old Vs New Tax Regi A surcharge of 7% of tax for total income between ₹1,00,00,000 and ₹10,00,00,000. a surcharge of 10% of tax if total income is more than ₹10,00,00,000. b) tax slab rates for domestic companies under new regime. as per the new regime, domestic companies have been given more leeway and concessions. For the financial year 2023 24 (assessment year 2024 25) under the new regime, the income tax slab rates are structured as follows: income slabs. income tax rates for fy 2023 24 (ay 2024 25) up to ₹3,00,000. nil. ₹3,00,000 to ₹6,00,000. 5% on income exceeding ₹3,00,000. ₹6,00,000 to ₹9,00,000. 20%. ₹12,50,000 – ₹15,00,000. 25%. >₹15,00,000. 30%. refer to the above image for the rates applicable to fy 2023 24 (ay 2024 25) for the upcoming tax filing season. b. old tax regime. select your age group: less than 60 years old 60 80 years above 80 years. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2024: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with.

Comments are closed.