Income Tax Rates 2023 Individual Tax Rates Pelajaran

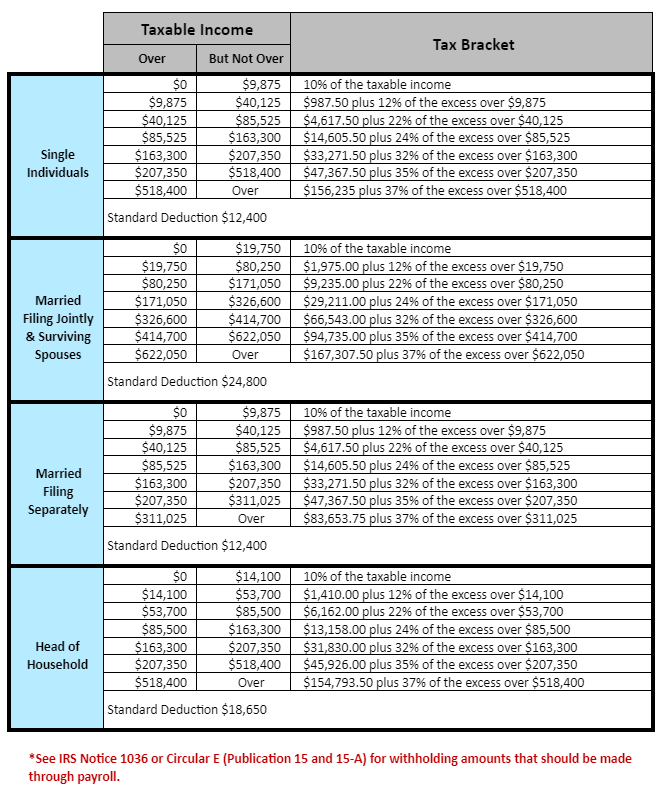

Federal Individual Income Tax Rates 2023 24 Pelajaran 2024 federal income tax rates. these rates apply to your taxable income. your taxable income is your income after various deductions, credits, and exemptions have been applied. there are also various tax credits, deductions and benefits available to you to reduce your total tax payable. see how amounts are adjusted for inflation. For 2024, the marginal rate for $173,205 to $246,752 is 29.32% because of the above noted personal amount reduction through this tax bracket. the additional 0.32% is calculated as 15% x ($15,705 $14,156) ($246,752 $173,205). for 2023, the marginal rate for $165,430 to $235,675 is 29.32% because of the above noted personal amount reduction.

Income Tax Rates 2023 Individual Standard Pelajaran Tax rates > current marginal tax rates > ontario personal income tax rates ontario 2024 and 2023 tax rates & tax brackets. the ontario tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1.045 (4.5% increase), except for the $150,000 and $220,000 bracket amounts, which are not indexed for inflation. That means you will pay 15% in federal tax on your $50,000 of income—that’s $7,500, not including deductions and claims of course. to give an another example, in november 2023, the average. Temporary flat rate method for home office expenses. the temporary flat rate method does not apply to 2023. therefore, taxpayers looking to claim home office expenses for 2023 will be required to use the detailed method and get a completed form t2200, declaration of conditions of employment, from their employer. 2023 federal income tax brackets. here are the tax brackets for canada based on your taxable income. federal tax bracket. federal tax rates. $53,359 or less. 15.00%. $53,360 to $106,717. 20.50%. $106,718 to $165,430.

Income Tax Rates 2023 Individual Tax Exemption Pelajaran Temporary flat rate method for home office expenses. the temporary flat rate method does not apply to 2023. therefore, taxpayers looking to claim home office expenses for 2023 will be required to use the detailed method and get a completed form t2200, declaration of conditions of employment, from their employer. 2023 federal income tax brackets. here are the tax brackets for canada based on your taxable income. federal tax bracket. federal tax rates. $53,359 or less. 15.00%. $53,360 to $106,717. 20.50%. $106,718 to $165,430. Tax rates > current marginal tax rates > alberta personal income tax rates alberta 2024 and 2023 tax rates & tax brackets alberta personal income tax act s. 6.1, 8, 21, 44. the alberta tax brackets and personal tax credit amounts are increased for 2024 by an indexation factor of 1.042 (4.2% increase). the federal tax brackets and personal tax. The low income tax reduction ($274 of ontario tax) is clawed back for income in excess of $17,291 until the reduction is eliminated, resulting in an additional 5.05% of provincial tax on income between $17,292 and $22,716. the federal basic personal amount comprises two elements: the base amount ($13,521 for 2023) and an additional amount.

Comments are closed.