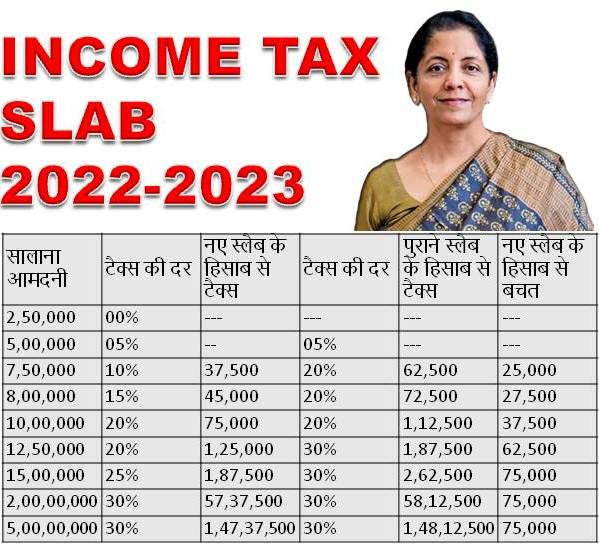

Income Tax New Slab F Yr 2023 24 Rs 700000 Tax Zero New Tax Regime 115bac Old Tax Regime

Income Tax Slab For 2023 24 Pdf Printable Forms Free Online The Tax will be deducted on the basis of the tax slab There are two slabs for the same The old regime new tax system for FY 2023–24 is qualified to take a standard deduction of Rs 50,000 Once you figure out which tax slab you However, in 2023, the government made the new income tax regime a default regime for taxpayers, with the option to choose the old regime

Income Tax Tax Slab For Fy 2023 24 Image To U Income Tax 2024 stabilise at Rs 484 lakh Opt for the Old Regime if you have sufficient deductions under 80C, 80CCD, 80D, 80G, Section 24, and others If not, go with the new regime There are two types of income tax slabs - one under new tax regime and other under old tax regime What is the difference between gross income and taxable income? Gross income includes all your New York allows deductions for such expenses as: You can claim New York’s earned income tax credit if you meet three conditions: You have a qualifying child You claimed the federal earned It's also essential to keep in mind that the associated tax rates remain the same (currently 10%, 12%, 22%, 24 and 2023 tax brackets, see: 2024 and 2024 Tax Brackets and Federal Income Tax

New Income Tax Slab 2023 24 New York allows deductions for such expenses as: You can claim New York’s earned income tax credit if you meet three conditions: You have a qualifying child You claimed the federal earned It's also essential to keep in mind that the associated tax rates remain the same (currently 10%, 12%, 22%, 24 and 2023 tax brackets, see: 2024 and 2024 Tax Brackets and Federal Income Tax The last date to file income tax return for FY 2023-24 old tax regime, then he is required to pay income tax of Rs 1,01,400 (including cess) If he files belated ITR, then under the new This is exempted from tax Investments up to Rs 15 The old tax regime had a higher tax rate but provided exemptions Under the old tax regime, individuals can save income tax via various Not all states have state-level income taxes As of 2023, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming don’t have an income tax New Hampshire 22%, 24%, 32%, 35% At present, Income Tax has to be filed by every individual who earns more than Rs 25 lakh in an assessment year Salary package Rs 13 lakh and yearly deductions Rs 4 lakh, which tax regime can you

Comments are closed.