How to Use Currency Exchange Apps to Save Money While Traveling

How to Use Currency Exchange Apps to Save Money While Traveling

Traveling is an incredible experience, but it can also be expensive. One major cost often overlooked is currency exchange. However, thanks to the rise of currency exchange apps, you can now avoid exorbitant fees and exchange rates at airports and banks. Here’s how to use these apps to your advantage and save money while traveling:

1. Choose the Right App:

Not all currency exchange apps are created equal. Research different options and consider factors like:

- Fees: Look for apps with low or transparent fees. Some apps charge a percentage of the transaction, while others have fixed fees per transaction.

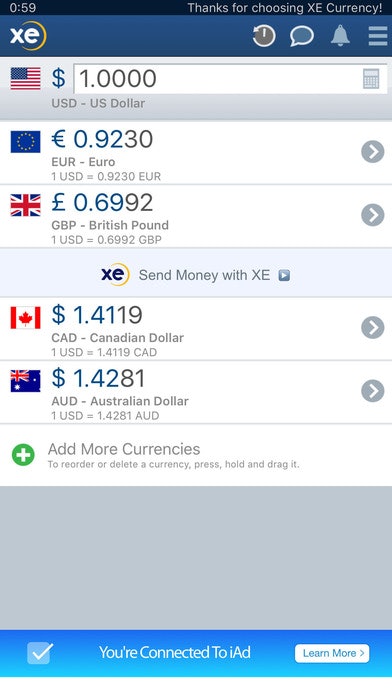

- Exchange Rates: Compare the offered exchange rates with those of banks and airport kiosks. Ideally, aim for apps offering rates close to the mid-market rate (the average of buy and sell rates).

- Availability: Ensure the app is available in your destination country and supports the currencies you need.

- Features: Some apps offer additional features like sending money abroad, tracking your spending, and accessing local ATMs.

2. Download and Register:

Once you’ve chosen an app, download it on your smartphone and create an account. Most apps require basic personal information and may ask for your bank details to link your account for transactions.

3. Load Funds:

You can typically fund your app account in two ways:

- Direct Bank Transfer: Transfer funds from your bank account to your app account. This usually takes 1-3 business days.

- Debit/Credit Card: Load funds using your debit or credit card. This is faster but may incur additional fees.

4. Exchange Currency:

Once you have funds in your account, you can exchange them into the desired currency. Most apps offer real-time exchange rates, allowing you to lock in a favorable rate before you travel.

5. Spend Wisely:

You can use your app-loaded funds to:

- Make Purchases: Use your app’s virtual card or QR code to make purchases at stores and restaurants.

- Withdraw Cash: Access local ATMs using your app’s debit card.

- Send Money: Transfer funds to other app users or to bank accounts in your destination country.

6. Monitor your Spending:

Many apps provide detailed transaction histories and spending summaries. Keep track of your expenses to stay within your budget and avoid overspending.

Tips for Getting the Best Rates:

- Exchange in Advance: Exchange currency before you leave to secure better rates and avoid rush fees at the airport.

- Check for Promotions: Some apps offer promotional periods with lower fees or better exchange rates.

- Compare Rates: Compare rates from different apps and banks before making a decision.

- Consider Sending Money: If you’re staying for a longer period, consider sending money to your destination bank account for cheaper transactions.

By using currency exchange apps, you can save money, avoid hidden fees, and enjoy your travels without the hassle of traditional exchange methods. So, do your research, choose the right app, and start saving on your next trip!