How To Fix Credit In 8 Easy Steps

How To Fix Credit In 8 Easy Steps 3. always pay your bills on time. your payment history makes up 35% of your credit score. so if you want to fix your credit, you should focus on ironing out your monthly payments. while it may. Getting your credit utilization rate below 10% has the biggest positive impact on credit scores. 6. pay off debt. create a budget that frees up money to pay off credit card debt and other high interest debt. the debt snowball or debt avalanche methods can be effective ways of tackling debt.

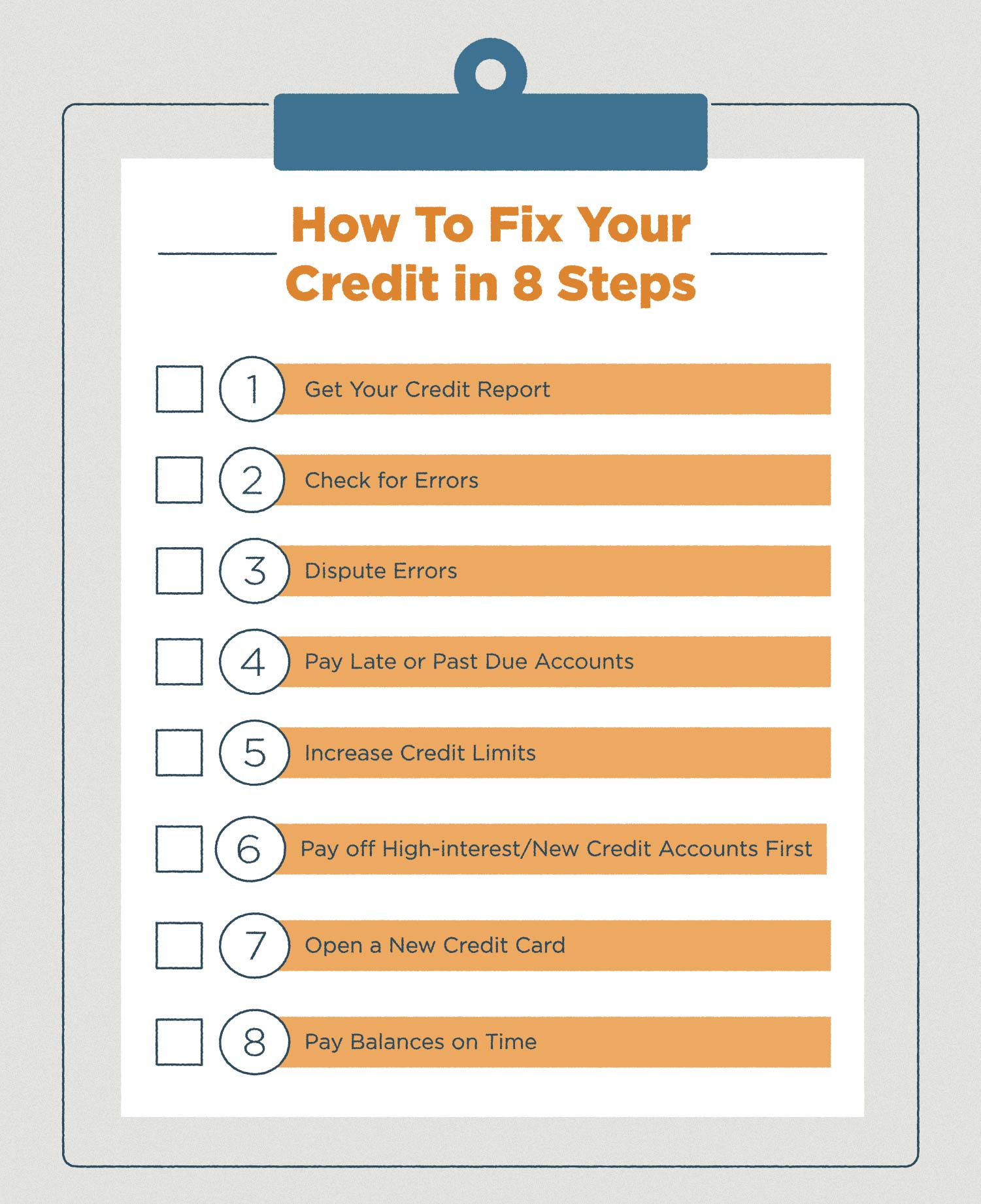

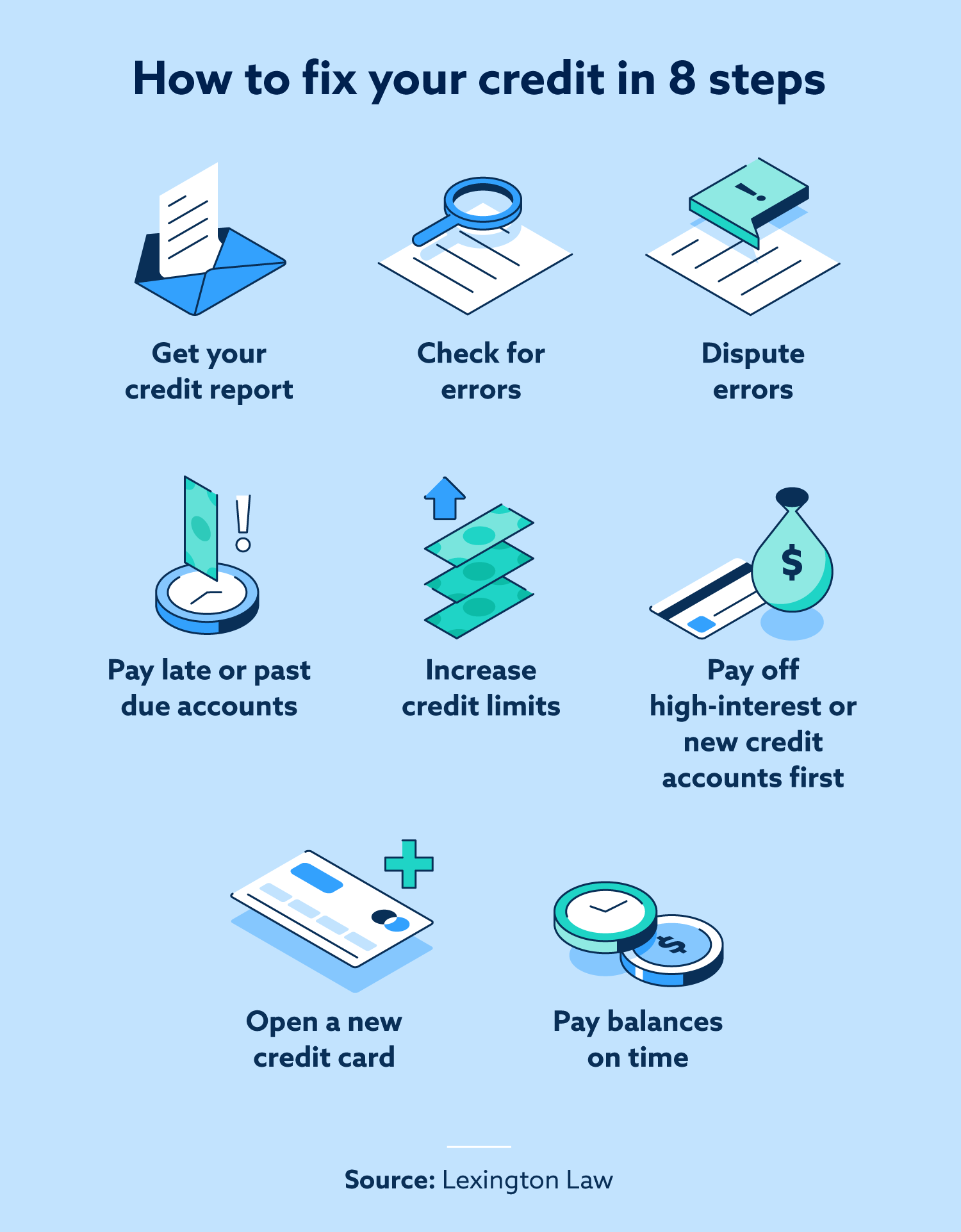

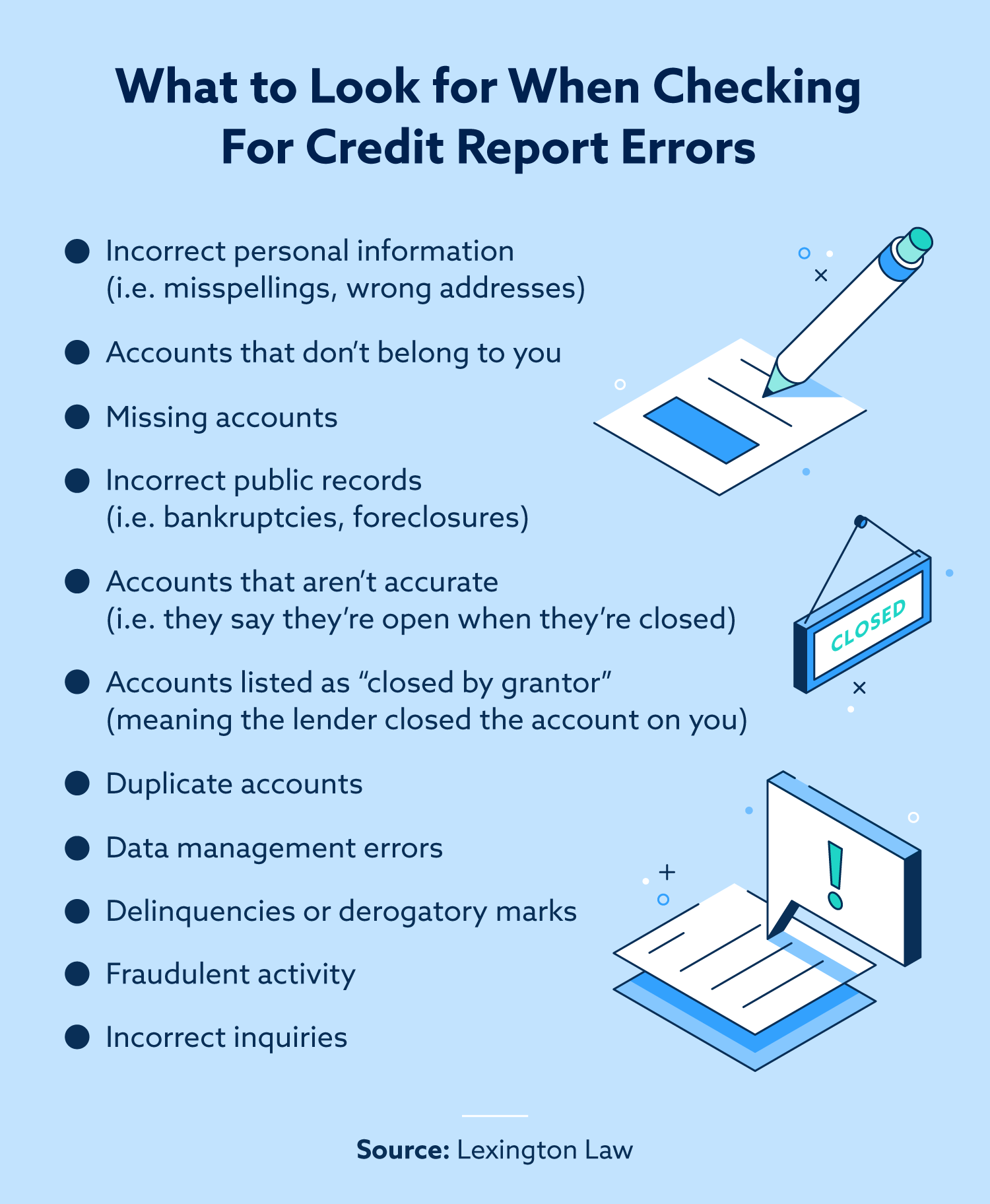

How To Fix Credit In 8 Easy Steps Lexington Law 2. catch up on past due bills. the more time that passes after you miss a due date on a credit card or loan, the worse it is for your credit score, so catching up on missed payments will help your score stop sliding and lay the foundation for your rebuild. you don’t necessarily have to pay the full amount that you owe. Here is a step by step guide to help you understand and improve your credit score. 1. check your credit score and credit reports. a successful credit repair journey begins with understanding your. Step 1: obtain and review your credit reports. you'll want to check all credit reports from the three major credit bureaus to get the full scope of your financial history. you're entitled to a. Whatever the reason, here are seven things you can do to bring that score up—and keep it there. 1. pay your bills on time. late payments or missing payments can lower your score more than any other factor. making regular, on time payments is one of the best ways to bring it back up.

How To Fix Credit In 8 Easy Steps Lexington Law Step 1: obtain and review your credit reports. you'll want to check all credit reports from the three major credit bureaus to get the full scope of your financial history. you're entitled to a. Whatever the reason, here are seven things you can do to bring that score up—and keep it there. 1. pay your bills on time. late payments or missing payments can lower your score more than any other factor. making regular, on time payments is one of the best ways to bring it back up. 8 steps to rebuild your credit. there's no silver bullet for rebuilding a less than stellar credit profile. but regardless of the reasons for your current situation, here are some tried and true guidelines you can follow to get your credit score back where you want it to be. 1. review your credit reports. Get a personal loan to pay off credit card debt. you can improve your credit score by paying off your credit card debt by taking out a personal loan. the interest rate on the loan is also likely.

Repair Your Credit In 8 Steps A How To Guide 8 steps to rebuild your credit. there's no silver bullet for rebuilding a less than stellar credit profile. but regardless of the reasons for your current situation, here are some tried and true guidelines you can follow to get your credit score back where you want it to be. 1. review your credit reports. Get a personal loan to pay off credit card debt. you can improve your credit score by paying off your credit card debt by taking out a personal loan. the interest rate on the loan is also likely.

Comments are closed.