How To Calculate Income Tax On Salary With Examples

How To Calculate Income Tax On Salary With Example Below are the steps to calculate your federal taxes by hand followed by examples — or you can simply use the free paycheckcity calculators to do the math for you. steps to calculate federal income tax. before you begin, you will need: your paycheck, w 4 form, and a calculator. find the paycheck's gross pay (earnings before taxes). Step 3.2 – state income tax liability. some states have a flat rate, some don’t have income tax and some adopt progressive income tax rates. depending on the state, your tax bracket may be based on your filing status. the formula is: state taxable income × state income tax rate = state income tax liability. step 3.3 – state payroll tax.

How To Calculate Income Tax On Salary With Example Geeksforgeeks Annual gross income: in this calculator field, enter your total 2023 household income before taxes. include wages, tips, commission, income earned from interest, dividends, investments, rental. 37%. $609,351 or more. $731,201 or more. $365,601 or more. $690,351 or more. use our united states salary tax calculator to determine how much tax will be paid on your annual salary. federal tax, state tax, medicare, as well as social security tax allowances, are all taken into account and are kept up to date with 2024 25 rates. 1040 tax calculator. enter your filing status, income, deductions and credits and we will estimate your total taxes. based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april. change the information currently provided in the calculator to match your personal information. Updated on jul 23 2024. free paycheck calculator to estimate your federal, state & local income tax burden.

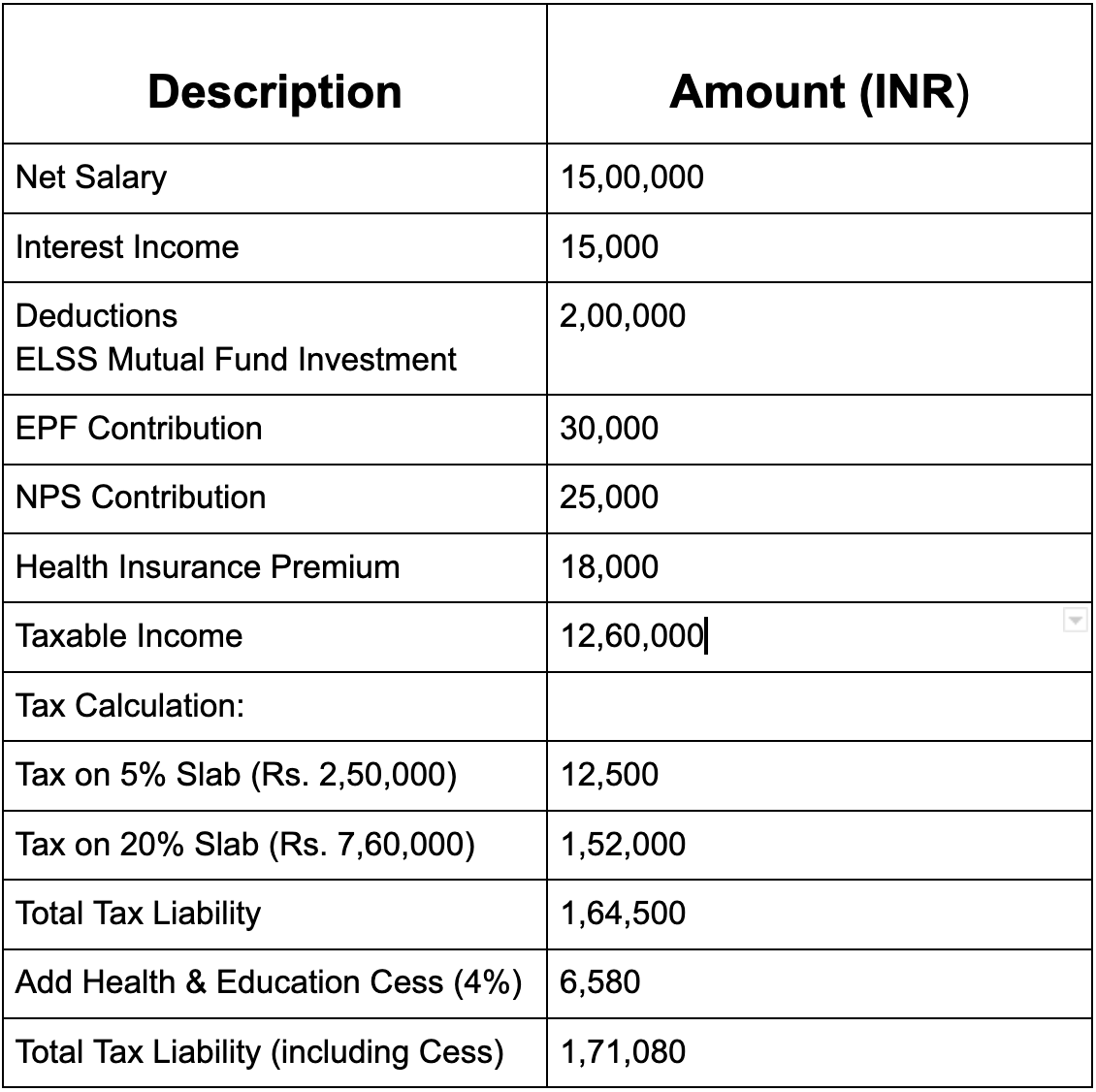

How To Calculate Income Tax On Salary With Example 1040 tax calculator. enter your filing status, income, deductions and credits and we will estimate your total taxes. based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the irs next april. change the information currently provided in the calculator to match your personal information. Updated on jul 23 2024. free paycheck calculator to estimate your federal, state & local income tax burden. Fica contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for social security taxes and your employer contributes a further 6.2%. however, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2023 is $160,200 ($168,600 for 2024). How to calculate income tax on your salary calculating income tax on your salary may seem straightforward, involving multiplying the tax rate by your taxable income. calculating taxes involves calculating your income, subtracting deductions, finding your tax owed, and considering past payments. we'll guide you on how tax is calculated.

How To Calculate Income Tax On Salary With Payslip Example Incomeођ Fica contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for social security taxes and your employer contributes a further 6.2%. however, the 6.2% that you pay only applies to income up to the social security tax cap, which for 2023 is $160,200 ($168,600 for 2024). How to calculate income tax on your salary calculating income tax on your salary may seem straightforward, involving multiplying the tax rate by your taxable income. calculating taxes involves calculating your income, subtracting deductions, finding your tax owed, and considering past payments. we'll guide you on how tax is calculated.

How To Calculate Income Tax On Salary With Examples

Comments are closed.