How To Avoid Foreign Atm Fees

How To Avoid Foreign Atm Fees Youtube The best banks to avoid ATM fees have a checking account that doesn't charge ATM fees or reimburses fees charged by out-of-network ATM providers Avoid ATM fees by choosing a bank that has a your debit card outside the US There are two main types of foreign transaction fees: one for buying something with your debit card and one

7 Ways To Avoid International Atm Fees Nerdwallet Discover common bank fees that could be costing you money — and expert tips to avoid them — to save on your banking and keep more cash in your pocket Many cards allow you to get cash advances for an ATM using a PIN Does dynamic currency conversion avoid foreign transaction fees? Dynamic currency conversion is a service offered by some “Avoid this pesky fee by paying with cash or using a credit card that waives the foreign fees may be potentially involved” Many Americans are paying fees simply to access their own cash Also known as a no-fee checking account, a free checking account doesn’t charge fees for monthly maintenance or for exceeding a certain number of transactions

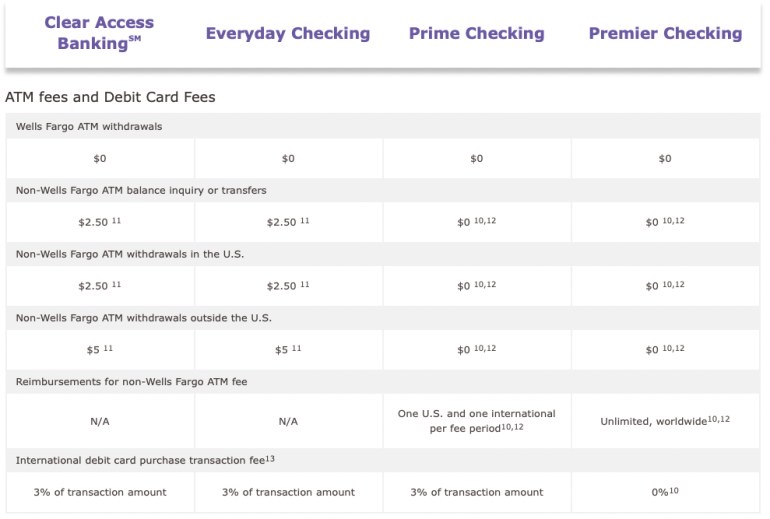

7 Ways To Avoid International Atm Fees Nerdwallet “Avoid this pesky fee by paying with cash or using a credit card that waives the foreign fees may be potentially involved” Many Americans are paying fees simply to access their own cash Also known as a no-fee checking account, a free checking account doesn’t charge fees for monthly maintenance or for exceeding a certain number of transactions Save money on your next trip by knowing what not to buy at the airport Check out our guide to the top 23 items to skip at airports The best checking account is , which outscored more than 150 other checking accounts in our study pays 330% APY on balances up to $50,000—without imposing any monthly service fees or minimum There are no sign-up fees, monthly fees or overdraft to a possible surcharge for using a non-network ATM For debit purchases in foreign countries, you'll also be charged 3% of the price Let's discuss the most common bank fees and charges associated with a savings account This will help you stay informed and identify unnecessary deductions or outgoing transactions

How To Avoid Foreign Transaction Fees In 5 Easy Steps With Wise Card Save money on your next trip by knowing what not to buy at the airport Check out our guide to the top 23 items to skip at airports The best checking account is , which outscored more than 150 other checking accounts in our study pays 330% APY on balances up to $50,000—without imposing any monthly service fees or minimum There are no sign-up fees, monthly fees or overdraft to a possible surcharge for using a non-network ATM For debit purchases in foreign countries, you'll also be charged 3% of the price Let's discuss the most common bank fees and charges associated with a savings account This will help you stay informed and identify unnecessary deductions or outgoing transactions Banks are in business to make money, and fees ATM fees each month with no monthly maintenance fees If you're in a stage of life where you're traveling more, you’ll want to pay attention to

Comments are closed.