How The Inflation Reduction Act Changes Tax And Healthcare Laws

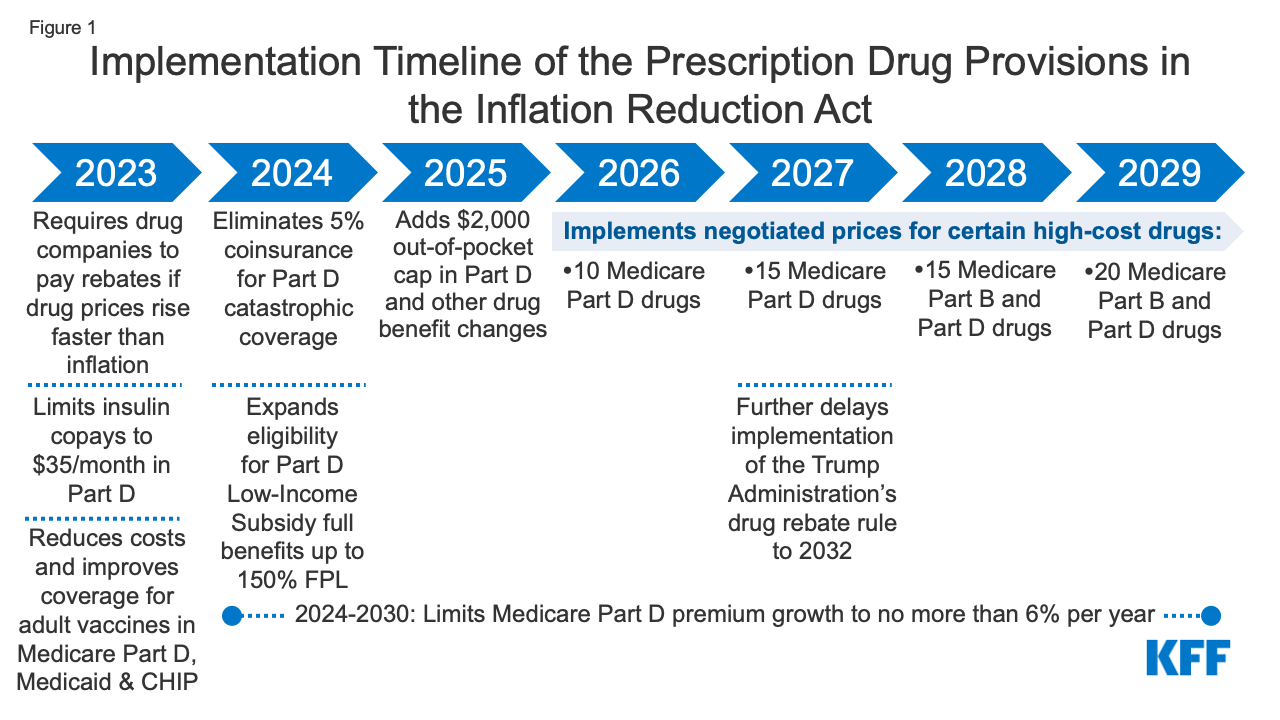

How The Inflation Reduction Act Changes Tax And Healthcare Laws The cost of insulin will be capped at $35 a month for patients on medicare under the new law. however, the law does not cap the cost of insulin for the millions of people with private health. The united states a year ago passed a 730 page piece of legislation that almost single handedly paved the way for some of the world’s biggest manufacturing companies to change their supply chain systems. signed into law on aug. 16 by president joe biden, the inflation reduction act (ira), contrary to its title, wasn’t just about bringing.

Inflation Reduction Act Healthcare Provisions Just to make it clear here, we are talking about a 15 percent minimum tax that passed as part of the inflation reduction act that is entirely different than the other 15 percent minimum tax that. The inflation reduction act becomes law: an overview of the tax law changes. this alert, originally published on august 12, 2022, was updated on august 17, 2022. president biden signed the inflation reduction act, hr 5376 (ira) into law on august 16, 2022. budget reconciliation procedures permitted senate democrats to pass the legislation in. On health care, the bill enables the federal health secretary to negotiate the prices of some drugs for medicare. it also caps out of pocket prescription drug costs for people on medicare at. Insights and analysis on the tax law provisions in the "ira". on august 16, 2022, president biden signed into law h.r. 5376 (commonly referred to as the inflation reduction act of 2022 or ira)—the budget reconciliation legislation that includes significant law changes related to tax, climate change, energy, and healthcare.

How The Inflation Reduction Act Changes Tax And Healthcare Laws On health care, the bill enables the federal health secretary to negotiate the prices of some drugs for medicare. it also caps out of pocket prescription drug costs for people on medicare at. Insights and analysis on the tax law provisions in the "ira". on august 16, 2022, president biden signed into law h.r. 5376 (commonly referred to as the inflation reduction act of 2022 or ira)—the budget reconciliation legislation that includes significant law changes related to tax, climate change, energy, and healthcare. Released legislative text for budget reconciliation legislation, also known as the “inflation reduction act of 2022.”1 on august 7, 2022, the senate passed a modified version of the inflation reduction act of 2022.2 this text will replace the legislative text of the house passed build back better act (bbba; h.r. 5376) as a substitute. The law is bringing down health care costs and thanks to president biden, vice president harris, and the inflation reduction act’s continuation of important improvements on the affordable care.

How The Inflation Reduction Act Changes Healthcare Planning Articles Released legislative text for budget reconciliation legislation, also known as the “inflation reduction act of 2022.”1 on august 7, 2022, the senate passed a modified version of the inflation reduction act of 2022.2 this text will replace the legislative text of the house passed build back better act (bbba; h.r. 5376) as a substitute. The law is bringing down health care costs and thanks to president biden, vice president harris, and the inflation reduction act’s continuation of important improvements on the affordable care.

Comments are closed.