How Rba Will Raise Interest Rates What It Means For The Housing Market

How Rba Will Raise Interest Rates What It Means For The Housing Market Long term fixed rate mortgage rates are now at 6.2%, the lowest since february 2023. (it's worth noting, though, that other factors besides the federal reserve's benchmark interest rate influence. What the fed’s rate cutting plans mean for the housing market. published sep 20, 2024 6:00 a.m. pdt · 2 min read. with 30 year interest rates near 6%, roughly 4.7 million homeowners could.

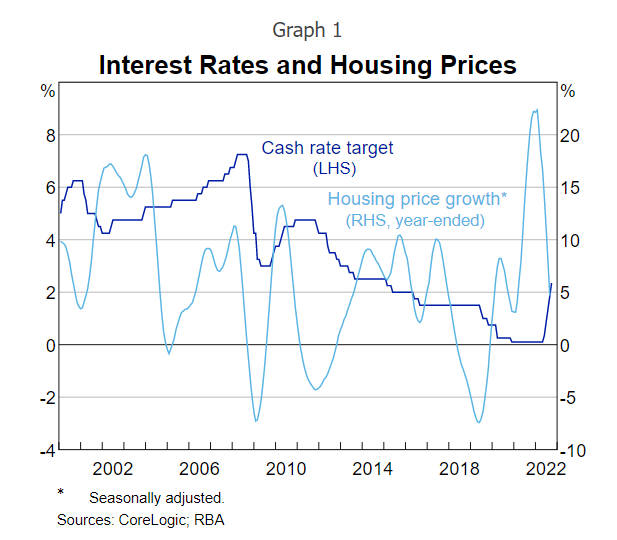

The юааrbaюаб Changed Its Tune On юааhousingюаб юааpricesюаб Hereтащs What That юааmeansюаб Aussie interest rate hikes will be precarious for housing market. world are expected to continue to raise interest rates. in the us, markets are currently pricing in a 65 per cent chance that. By. nicole friedman. , reporter. millions of would be homeowners have been priced out of the property market since early 2022, when the federal reserve started raising interest rates. the looming. September 18, 2024 at 6:00 a.m. edt. the federal reserve is poised to cut interest rates this week for the first time in four years, putting an end to its longest cycle of rate hikes in roughly a. The fed, after 5.25 percentage points of increases between march 2022 and july 2023, is seen deciding between a quarter percentage point cut in its key rate to the 5.00% 5.25% range, or a half.

Interest Rates Chart Pack Rba September 18, 2024 at 6:00 a.m. edt. the federal reserve is poised to cut interest rates this week for the first time in four years, putting an end to its longest cycle of rate hikes in roughly a. The fed, after 5.25 percentage points of increases between march 2022 and july 2023, is seen deciding between a quarter percentage point cut in its key rate to the 5.00% 5.25% range, or a half. Sept. 18, 2024, 2:00 am pdt updated sept. 18, 2024, 11:50 am pdt. by rob wile. the federal reserve said wednesday it was lowering its key interest rate by half a percentage point, an unusually. But if mortgage rates pull back, affordability will become less of a factor. for instance, borrowing $320,000 at the late july rate of 6.90 percent translates to a monthly principal and interest.

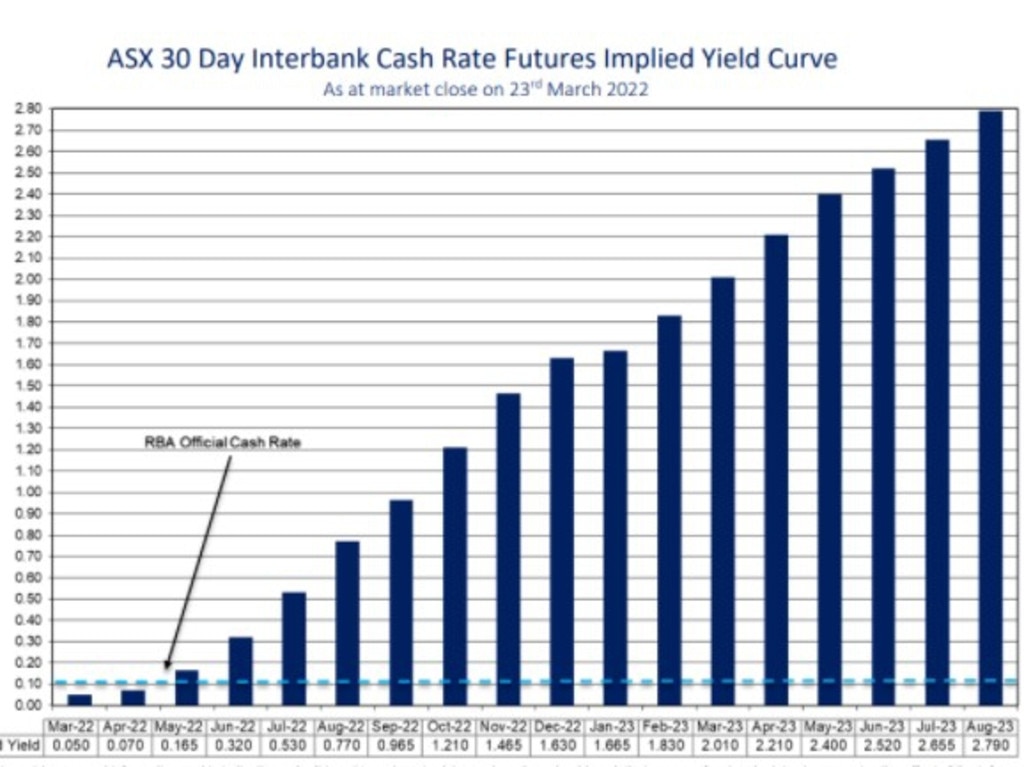

The Rba Will Raise Interest Rates вђ But Not To The Alarming Levels The Sept. 18, 2024, 2:00 am pdt updated sept. 18, 2024, 11:50 am pdt. by rob wile. the federal reserve said wednesday it was lowering its key interest rate by half a percentage point, an unusually. But if mortgage rates pull back, affordability will become less of a factor. for instance, borrowing $320,000 at the late july rate of 6.90 percent translates to a monthly principal and interest.

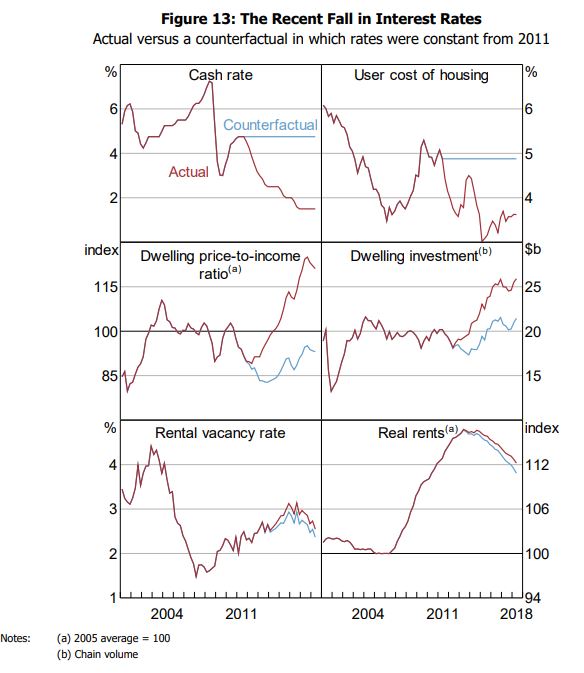

How Rba Rate Cuts May Have Affected Australia S Housing Market

Comments are closed.