How Do Interest Rates Affect The Stock Market

What You Need To Know About How Stock And Bond Markets Interact Learn how the federal funds rate and the discount rate influence the economy and the stock market. find out how higher or lower interest rates impact earnings, cash flow, valuation, and investor sentiment. Here’s the thing about the u.s. stock market and interest rate hikes. if you try to find data showing a correlation between rising rates and falling markets, you might be disappointed.

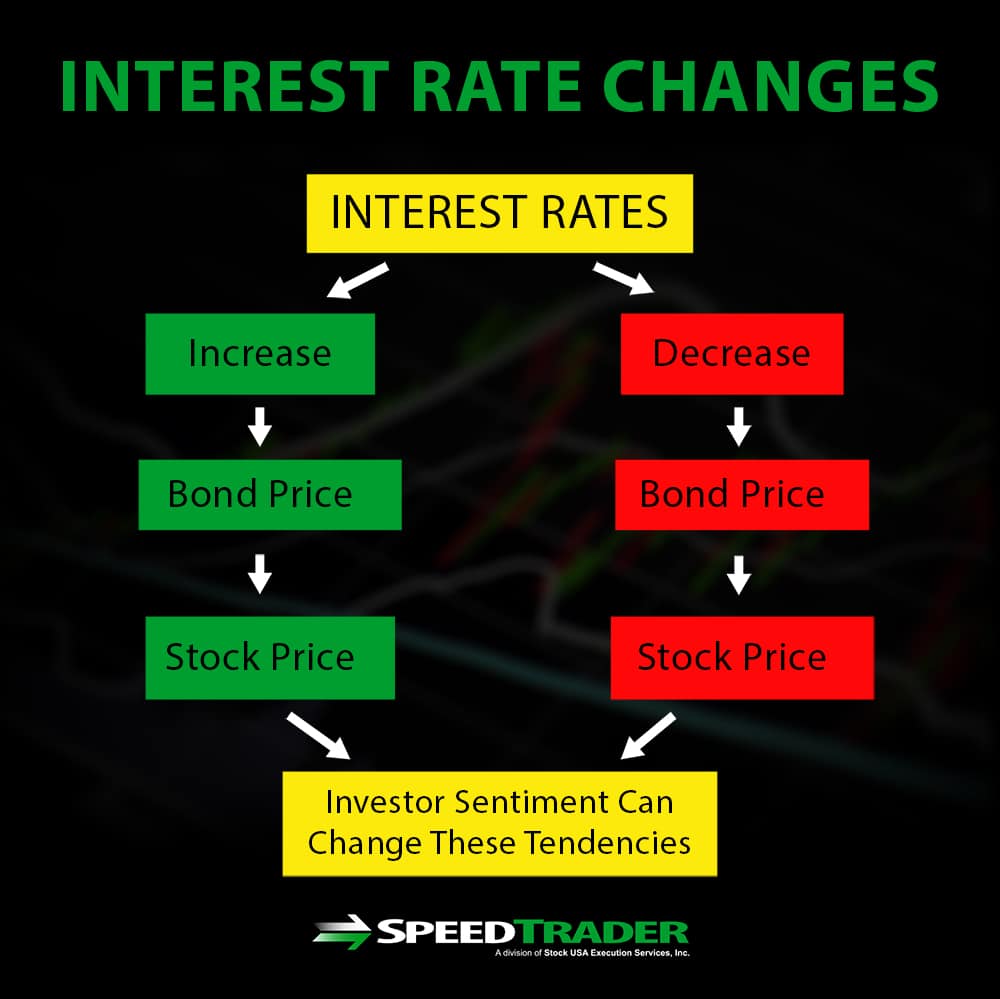

How Do Interest Rates Affect The Stock Market When the federal reserve changes interest rates, it has a ripple effect throughout the broader economy, affecting both stock and bond markets in different ways. lower rates make borrowing money. This decline in interest rates occurred even as the fed kept the federal funds rate at a range of 5.25% to 5.5%. moreover, gross domestic product (gdp) excelled in q4, growing at an annual rate of. Moreover, rising rates dim the economic growth prospects and can impact future returns for companies. secondly, rising rates decrease the present value of any business. as already outlined. The fed tweaks interest rates as part of its monetary policy to keep the economy stable – lowering them to stimulate growth or raising them to curb inflation. these rate changes send waves through the economy, influencing how much businesses invest, consumers spend and how the stock market performs. when central banks adjust interest rates.

How Interest Rates Affect The Stock Market Youtube Moreover, rising rates dim the economic growth prospects and can impact future returns for companies. secondly, rising rates decrease the present value of any business. as already outlined. The fed tweaks interest rates as part of its monetary policy to keep the economy stable – lowering them to stimulate growth or raising them to curb inflation. these rate changes send waves through the economy, influencing how much businesses invest, consumers spend and how the stock market performs. when central banks adjust interest rates. The stock market’s sharp downward trend began after the federal reserve (fed) initiated a series of increases in the short term federal funds target rate it controls. that resulted in the rate moving from near 0% in early 2022 to a range of 5.25% to 5.50% following the fed’s last rate hike in july 2023. however, the fed has held rates. Interest rates can have a significant impact on the economy as a whole and your personal financial life. when tracking changes to interest rates, the stock market is often a major focal point, as rates can affect investors directly and indirectly. the impact of interest rate changes can also be felt more immediately in the markets while it may.

How Do Interest Rates Impact The Usa Stock Market Youtube The stock market’s sharp downward trend began after the federal reserve (fed) initiated a series of increases in the short term federal funds target rate it controls. that resulted in the rate moving from near 0% in early 2022 to a range of 5.25% to 5.50% following the fed’s last rate hike in july 2023. however, the fed has held rates. Interest rates can have a significant impact on the economy as a whole and your personal financial life. when tracking changes to interest rates, the stock market is often a major focal point, as rates can affect investors directly and indirectly. the impact of interest rate changes can also be felt more immediately in the markets while it may.

Comments are closed.