Hedge Fund Analysis 4 Performance Metrics To Consider

Hedge Fund Analysis 4 Performance Metrics To Consider Pdf Beta Here’s a primer on four of the most common performance measures for hedge fund analysis. 1. beta. beta (β) is the measure of an asset or portfolio’s risk compared to the market’s risk. if an asset has a beta of one, its risk profile is the same as the market’s. there’s no “good” or “bad” beta—it’s all about you or your. Analyzing the performance of specific hedge funds using metrics. consider analyzing the performance of two contrasting hedge funds to illustrate the significance of metrics: fund a: utilizing a long short equity strategy, showcase how annualized returns, alpha, and beta metrics offer insights into its performance vis a vis market movements.

Hedge Fund Analysis 4 Performance Metrics To Consider As hedge funds navigate an increasingly complex financial landscape, future trends in hedge fund performance metrics are anticipated to become more sophisticated and data driven. emerging technologies, such as artificial intelligence and machine learning, will likely enable more accurate and timely analysis of performance indicators. Discover key quantitative metrics for evaluating hedge funds, including performance, risk, and risk adjusted return metrics. learn about volatility, maximum drawdown, beta, sharpe ratio, sortino ratio, and additional measures like alpha and correlation for comprehensive fund analysis. 8 min read | jun 25, 2024. Understanding the performance and risk characteristics of hedge funds can often be quite a bit more complex than a mutual fund or standard portfolio of stocks and bonds. many hedge funds seek. Two key metrics for quantifying consistency include: rolling window returns – performance is measured over set intervals (e.g. 36 months) as the window rolls forward in time. analyzes return consistency over long periods. up down capture – calculates manager return during benchmark up periods vs down periods.

Analysis Of Hedge Fund Performance Powerpoint Presentation Slides Understanding the performance and risk characteristics of hedge funds can often be quite a bit more complex than a mutual fund or standard portfolio of stocks and bonds. many hedge funds seek. Two key metrics for quantifying consistency include: rolling window returns – performance is measured over set intervals (e.g. 36 months) as the window rolls forward in time. analyzes return consistency over long periods. up down capture – calculates manager return during benchmark up periods vs down periods. February 17, 2023. key metrics used in hedge fund performance analysis include alpha, sharpe ratio, beta, drawdown, and volatility. they measure the performance of a hedge fund relative to its benchmark and provide an assessment of its risk profile. with these metrics, investors can track the fund's performance over time and compare it to other. Hedge funds have surpassed $4 trillion in assets and use complex strategies to earn returns. this document discusses 4 key performance metrics for analyzing hedge funds: beta, which measures risk compared to the market; alpha, which measures returns above the market after adjusting for risk; the sharpe ratio, which compares risk adjusted returns of different investments; and the information.

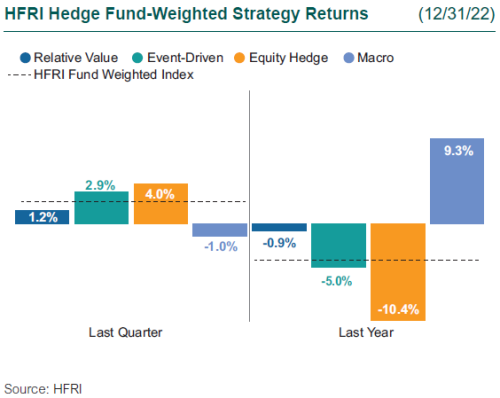

4q22 Hedge Fund Performance Highlights And Analysis February 17, 2023. key metrics used in hedge fund performance analysis include alpha, sharpe ratio, beta, drawdown, and volatility. they measure the performance of a hedge fund relative to its benchmark and provide an assessment of its risk profile. with these metrics, investors can track the fund's performance over time and compare it to other. Hedge funds have surpassed $4 trillion in assets and use complex strategies to earn returns. this document discusses 4 key performance metrics for analyzing hedge funds: beta, which measures risk compared to the market; alpha, which measures returns above the market after adjusting for risk; the sharpe ratio, which compares risk adjusted returns of different investments; and the information.

Comments are closed.