Guide To Mutual Funds Advantages And Types Of Mutual Funds

Guide To Mutual Funds Advantages And Types Of Mutual Funds Mutual funds come with many advantages, such as advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing. disadvantages include high fees, tax. Mutual funds offer diversification or access to a wider variety of investments than an individual investor could afford to buy. investing with a group offers economies of scale, decreasing your.

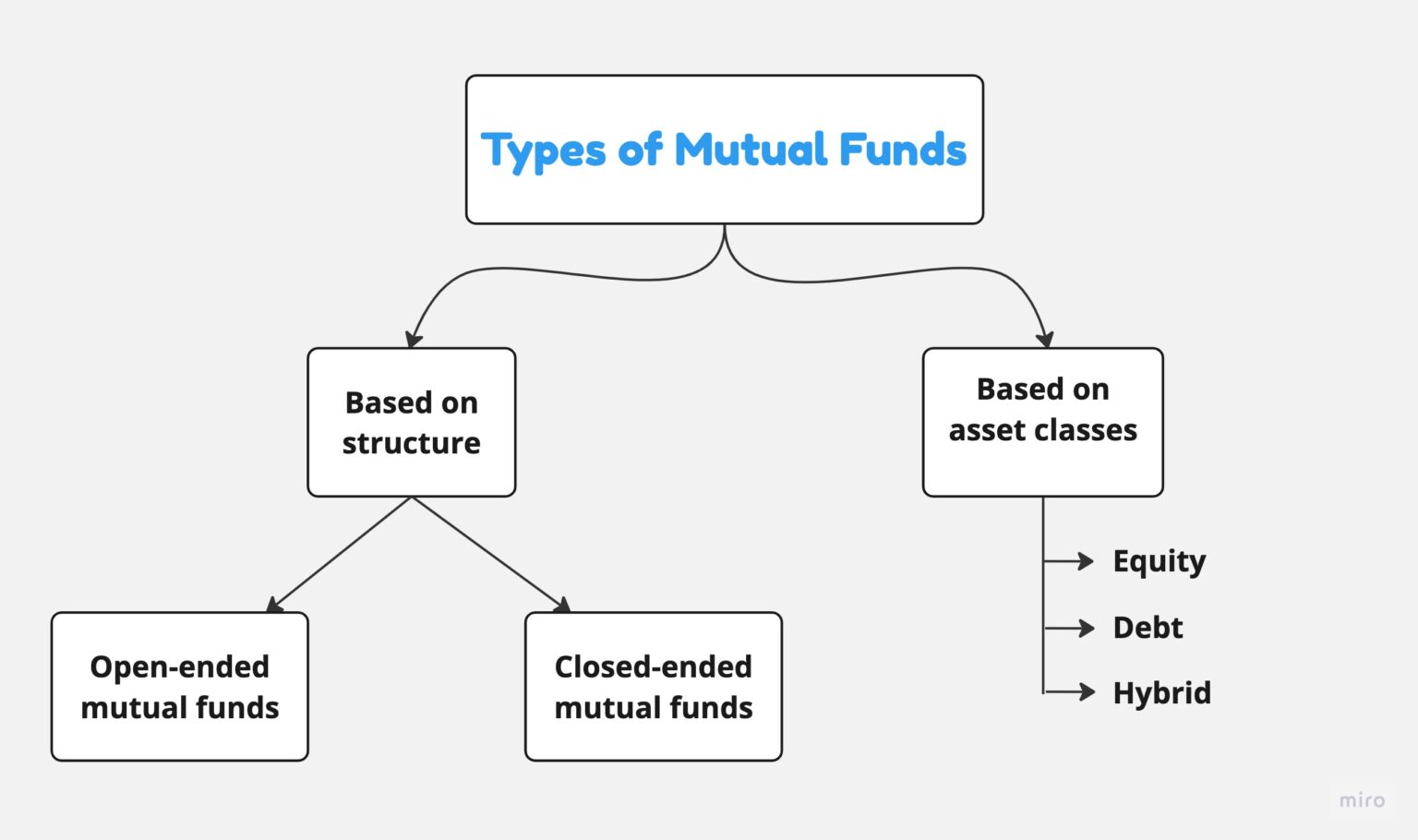

An Overview Of Mutual Fund Types Risks And Advantages A Guide To Mutual funds let you pool your money with other investors to purchase stocks, bonds, and other securities. mutual funds act as a basket of securities you buy all at once, which can be easier than. Guide to mutual funds; etfs tend to have certain tax advantages and are often more cost efficient. investors can choose from many types of mutual funds, such as stock, bond, money market. A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Mutual funds use money from investors to purchase stocks, bonds and other assets. you can think of them as ready made portfolios, and with their diverse holdings, mutual funds can help you diversify your own portfolio more easily. 1 as the fund's investments gain or lose value, you gain or lose as well, and when they pay dividends.

Guide To Mutual Funds Advantages And Types Of Mutual Funds A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Mutual funds use money from investors to purchase stocks, bonds and other assets. you can think of them as ready made portfolios, and with their diverse holdings, mutual funds can help you diversify your own portfolio more easily. 1 as the fund's investments gain or lose value, you gain or lose as well, and when they pay dividends. This brochure explains the basics of mutual fund and etf investing, how each investment option works, the potential costs associated with each option, and how to research a particular investment. u.s. securities and exchange commission. office of investor education and advocacy. 100 f street, ne. Each puts $10,000 into a mutual fund. one fund charges 0.25% in annual fees and the other charges 0.50%. say each fund earns 9% returns, before fees, each year for the next 30 years. after the 30 year period ends, the first investor will have $162,980.58 while the second will have $152,203.13.

Mutual Fund Meaning Types Advantages Key Terms And More This brochure explains the basics of mutual fund and etf investing, how each investment option works, the potential costs associated with each option, and how to research a particular investment. u.s. securities and exchange commission. office of investor education and advocacy. 100 f street, ne. Each puts $10,000 into a mutual fund. one fund charges 0.25% in annual fees and the other charges 0.50%. say each fund earns 9% returns, before fees, each year for the next 30 years. after the 30 year period ends, the first investor will have $162,980.58 while the second will have $152,203.13.

Types Of Mutual Funds In India And Their Benefits в Investify In

Comments are closed.