Fraud Trends Your Questions Answered Faq Equifax Canada

Fraud Trends Your Questions Answered Faq Equifax Canada Fraud trends: your questions answered. view product sheet. key questions from the h1 2023 fraud trends and insights webinar. learn more about our products or sign up for service by contacting our sales team. Contact an equifax fraud consulting team member to learn more about how we can help you reduce risk and loss due to fraud cherolle prince director,fraudconsulting cherolle.prince@equifax hussein ezzat fraudconsultant(greatertorontoarea) hussein.ezzat@equifax david paquette bilingualfraudconsultant(quebec) david.paquette@equifax.

Equifax Canada Canadians Fighting Back Against Fraud And Identity Our #fraud experts answered some top questions around fraud trends, identity theft, insider risk, cybersecurity and more in our recent webinar. missed the…. Reducing risk pre transaction can optimize authorization rates and reduce false positives. q: do you have any data or best practices on synthetic fraud prevention in the car lending industry? scott przybyla: according to equifax data and analytics, within one year’s time, 456,000 accounts were identified as potential synthetic identity fraud. Toronto, feb. 27, 2024 (globe newswire) — a new survey* by equifax canada sheds light on a public increasingly worried about the potential rise in fraudulent activity across industries. in addition, equifax canada data shows mortgage fraud and identity fraud continuing to escalate across the country as economic pressure continue. Equifax canada quarterly data** also shows fraud rates in mortgage applications continue to rise, up by 9.9 per cent in q4 compared to q4 2022, with ontario having the highest mortgage fraud rate.

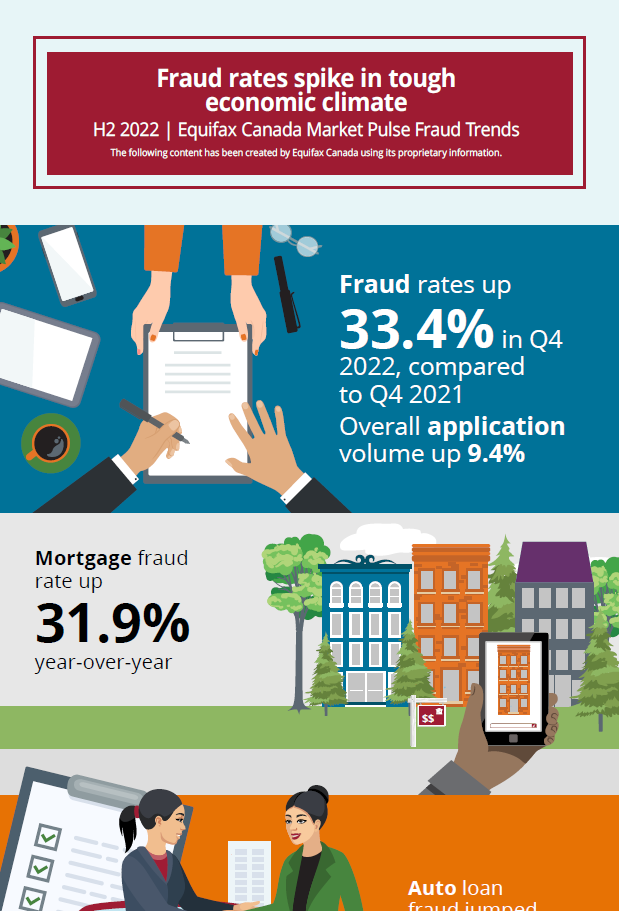

H2 2022 Equifax Canada Market Pulse Fraud Trends Infographic Toronto, feb. 27, 2024 (globe newswire) — a new survey* by equifax canada sheds light on a public increasingly worried about the potential rise in fraudulent activity across industries. in addition, equifax canada data shows mortgage fraud and identity fraud continuing to escalate across the country as economic pressure continue. Equifax canada quarterly data** also shows fraud rates in mortgage applications continue to rise, up by 9.9 per cent in q4 compared to q4 2022, with ontario having the highest mortgage fraud rate. Have you been a victim of identity theft or fraud? to place an identity alert on your equifax credit report, call 1 800 465 7166. after you select your language, say "fraud" or press 3. to report that your wallet or id was stolen, call 1 800 465 7166. after you select your language, say "lost id" or press 2. New fraud types roared onto the scene, with the federal trade commission fielding more than 325,000 pandemic related reports of fraud and identity theft from january 2020 through april 2021.1 at the same time, existing fraud types — think: synthetic identity fraud, authorized user abuse and credit piggybacking —.

Q2 2021 Fraud Trends Insights Infographic Infographic Equifax Have you been a victim of identity theft or fraud? to place an identity alert on your equifax credit report, call 1 800 465 7166. after you select your language, say "fraud" or press 3. to report that your wallet or id was stolen, call 1 800 465 7166. after you select your language, say "lost id" or press 2. New fraud types roared onto the scene, with the federal trade commission fielding more than 325,000 pandemic related reports of fraud and identity theft from january 2020 through april 2021.1 at the same time, existing fraud types — think: synthetic identity fraud, authorized user abuse and credit piggybacking —.

Comments are closed.